The USD/PKR bullish trend remains strong and traders who are brave enough to speculate on this forex pair will need to practice persistence and the art of using limit orders to have a chance for successful outcomes. The value of the Pakistani Rupee continues to trade at record low values against the US Dollar. Interestingly, even as risk appetite has flourished globally and many other emerging market currencies have found some positive traction versus the USD, the Pakistani Rupee remains an outlier.

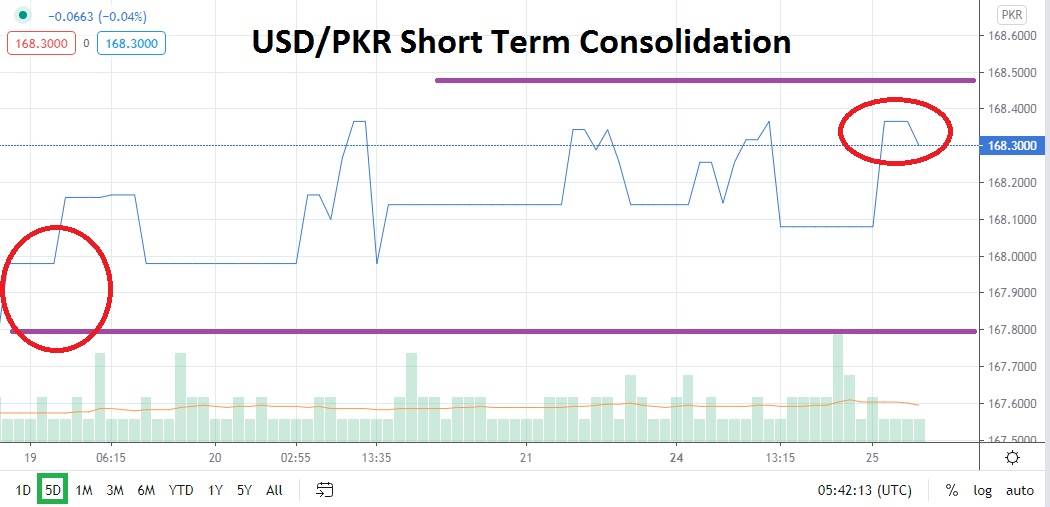

The USD/PKR continues to challenge high water marks regularly and test resistance levels as support junctures incrementally raise over the long term. Support near the 168.0000 mark appears to be solid. However, because we are talking about the USD/PKR we must also acknowledge the extremely thin volume which this forex pair languishes in and is the reason for sudden spikes which can develop quickly.

The USD/PKR is challenging important higher values near the 168.3000 level in early trading today, but its price action is always vulnerable. If a traders wishes to open a position within this forex pair they must use limit orders to guard against market fills which could leave them perplexed and angry if they are not prepared for sudden volatility. While resistance is written here as 168.5000 this is an abstract notion. First, the USD/PKR would have to break its current cycle of bouncing towards and reversing lower from the 168.4000 level which it has been tagging and then reacting to with sudden downward thrusts since the 5th of August.

Good traders know there is a difference between short term trading goals and long term expectations, meaning you can speculate on a trade which has very limited goals regarding timeframe and value targets. Speculative short term traders have two opportunities with the USD/PKR. One is to actually sell the USD/PKR around the level of 168.3000 and aim for support levels below using strict limit orders and stop loss protection.

The second possibility is to allow the USD/PKR to traverse lower and place a buying position near the 168.2000 level and use proper risk management. The long term trend of the USD/PKR continues to indicate technical weakness will develop, but to take advantage of this bullish movement a trader needs patience and the ability to absorb carrying charges if they hold the position overnight.

Pakistani Rupee Short Term Outlook:

Current Resistance: 168.5000

Current Support: 167.9800

High Target: 169.0000

Low Target: 167.5000