The Bitcoin market has been bullish during the trading session on Wednesday, as the Federal Reserve continues to keep its monetary policy very loose. If that is going to be the case, then the US dollar will lose a bit of value over the longer term, and that should drive money into various other assets, Bitcoin included. In fact, this market is starting to act more and more like a Forex pair, which essentially what it is if you think about it.

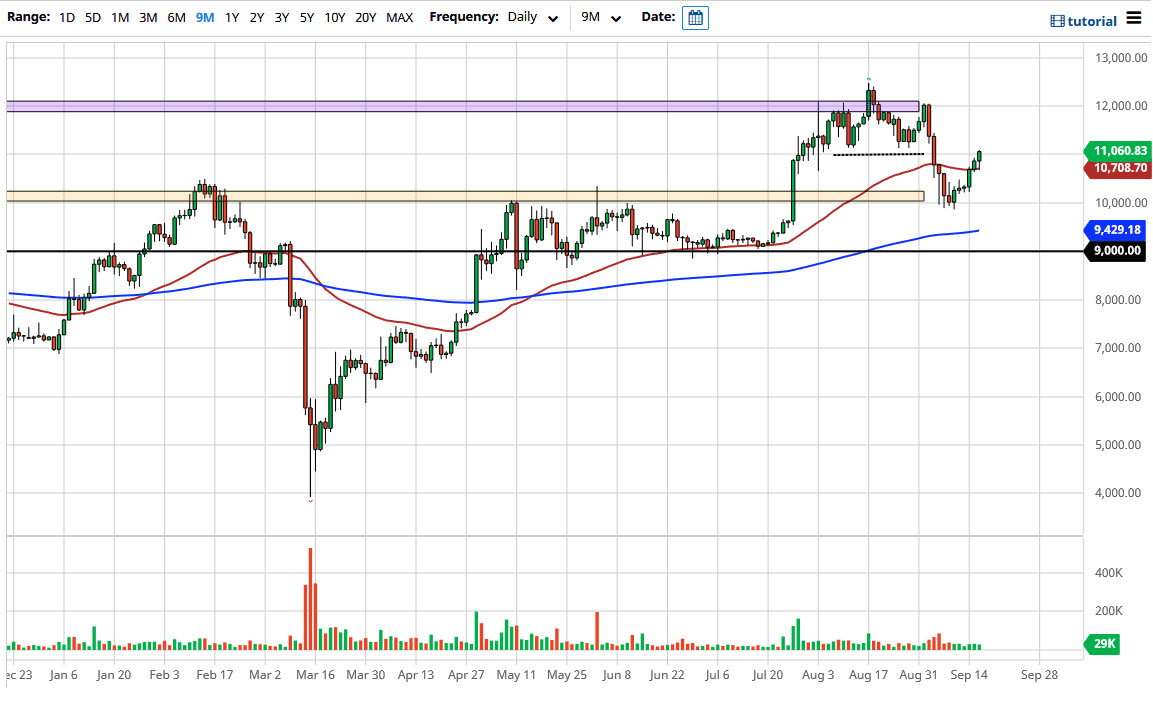

The $11,000 level seems to be an area of interest by the market, as it was previous support, and it is now short-term resistance. If we can break significantly above there on a daily close, then we will go looking towards the $11,500 level, and then possibly even the $12,000 level after that. Alternately, if we roll over from here, it is likely that we will then go towards the 50 day EMA underneath, possibly in short order. After that, we would more than likely be looking at $10,500 and then eventually the $10,000 level. This is a market that will continue to be very choppy overall, but it is worth noting that the $11,000 level is essentially the “halfway point” between the massive support at the $10,000 level and the massive resistance at the $12,000 level.

Underneath the $10,000 level, we have the 200 day EMA which is sitting at the $9429 level, and the structural support at the $9000 level. I think given enough time we will more than likely see a lot of volatility and essentially a larger move that we can follow, but until then you have to look at this from the short term. If we break out of this $2000 range, then it could be rather indicative of where we go next. A break above the $12,000 level opens up the possibility of a move all the way to the $15,000 level, which a lot of the bullish bitcoin traders are currently looking at. At this point, if we break down below the $9000 level, then that would open up the “trapdoor” for much lower pricing and will be toxic for the uptrend that we have been in. Pay attention to the US dollar, because this market should move in the opposite direction. If you see the US dollar strengthening everywhere else, it is likely that it is only a matter of time before it does so against bitcoin.