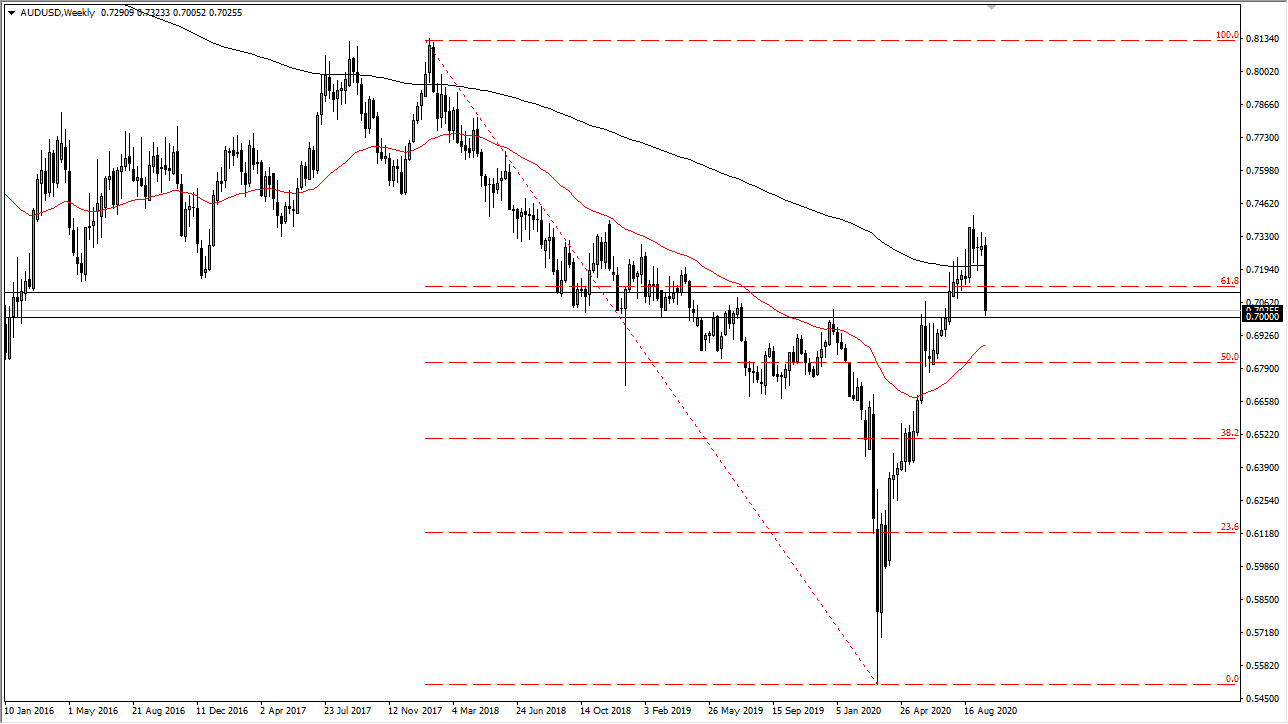

AUD/USD

The Australian dollar fell rather hard during the course of the week, slamming into the 0.70 level. This is a significant area on the chart, so we should be paying attention to it. I think that if we can turn around and bounce from here, a break above the 0.71 level will probably have momentum chasers try to push this market higher. On the other hand, if the market was to break down below the 0.70 level, then it is likely to go looking towards the 0.69 level. More likely than not, the market is going to rally before fading again.

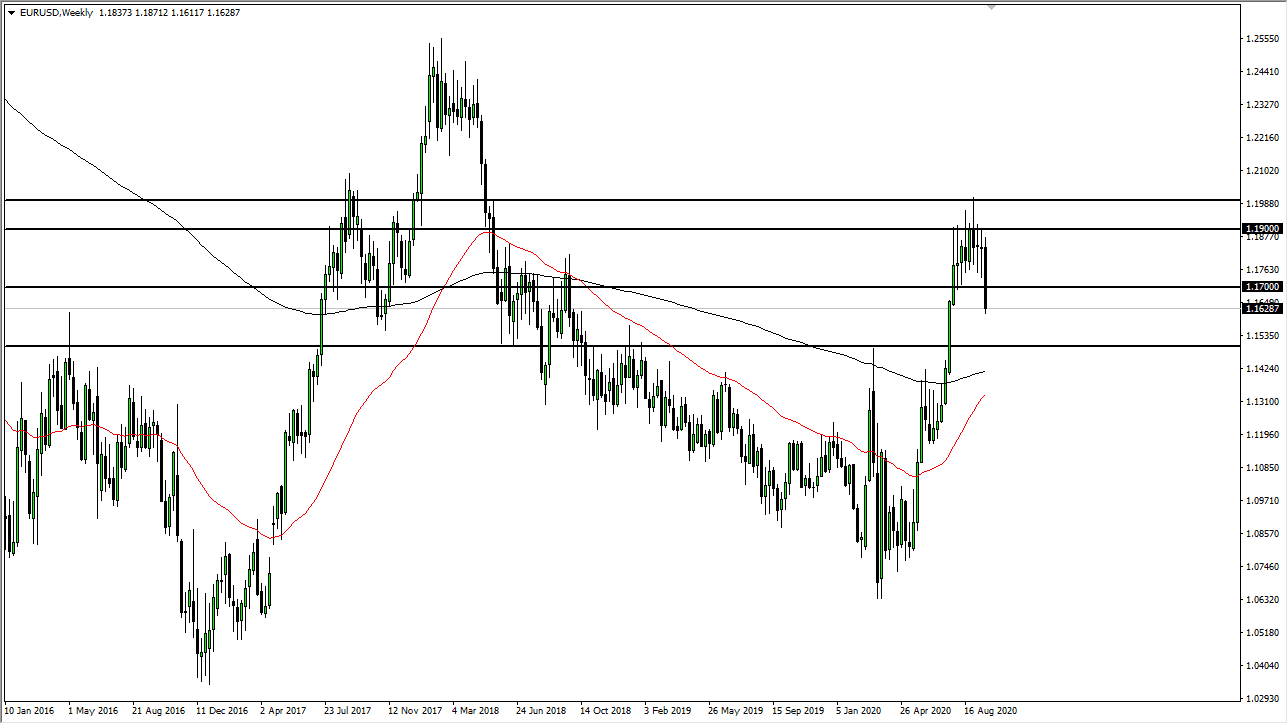

EUR/USD

The Euro of course sold off quite drastically as well, which should not be a huge surprise at all, considering how many of the negative candlesticks we have seen on the weekly timeframe. All things being equal and looks likely that the market is probably to go looking towards 1.15 level underneath. That does not mean we cannot bounce, and I do expect the market to do so. Somewhere near the 1.17 level I will be looking to short this market on signs of exhaustion. If we break above the 1.18 level, then I could believe the uptrend but until then I do not see that happening.

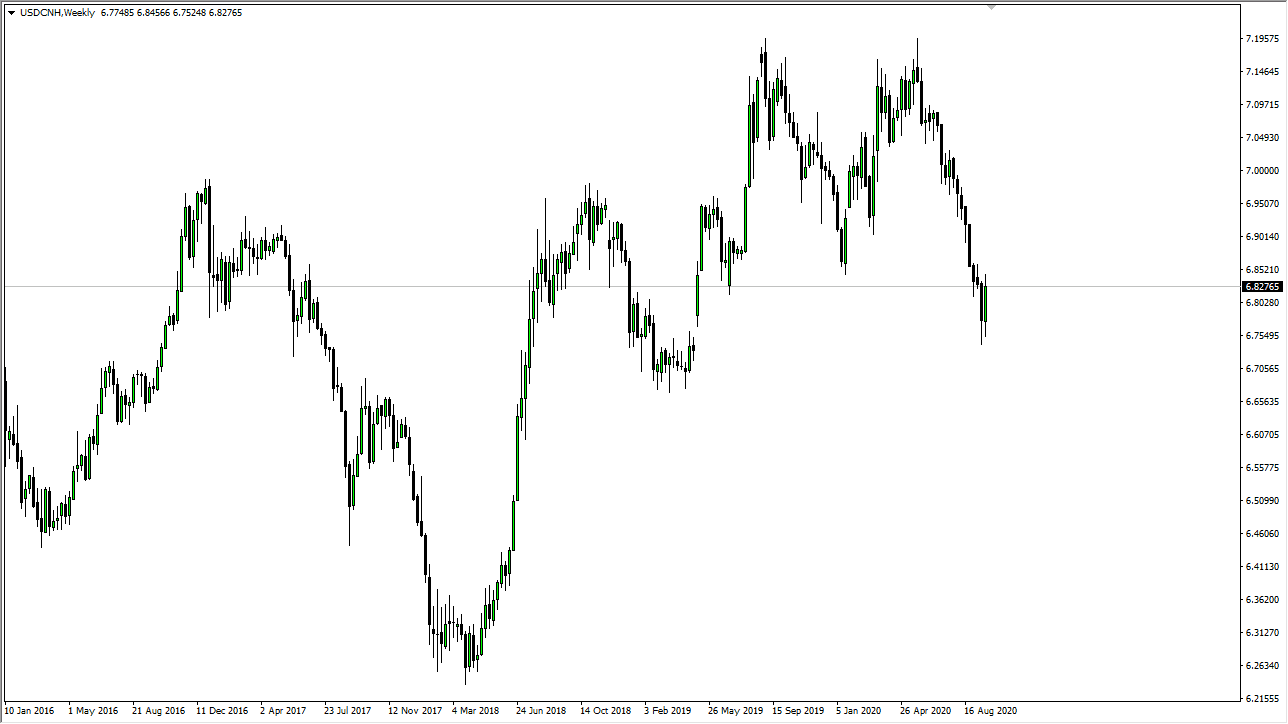

USD/CNH

The US dollar rallied significantly during the trading week, reaching towards the 6.85 level against the Chinese Yuan. However, this is where we broke down from the large “M pattern”, and therefore there could be sellers waiting to get involved. However, on the other side of the coin you can see that we fill the gap that I talked about the previous week so it will be interesting to see how this plays out. I think if you watch this pair, you can get a good idea as to where risk appetite is going, and right now we could see a bit of choppiness. If that is going to be the case, you can probably see it in every other pair. I do not necessarily trade this market very often, but I do use it as a gauge as to where risk appetite is going.

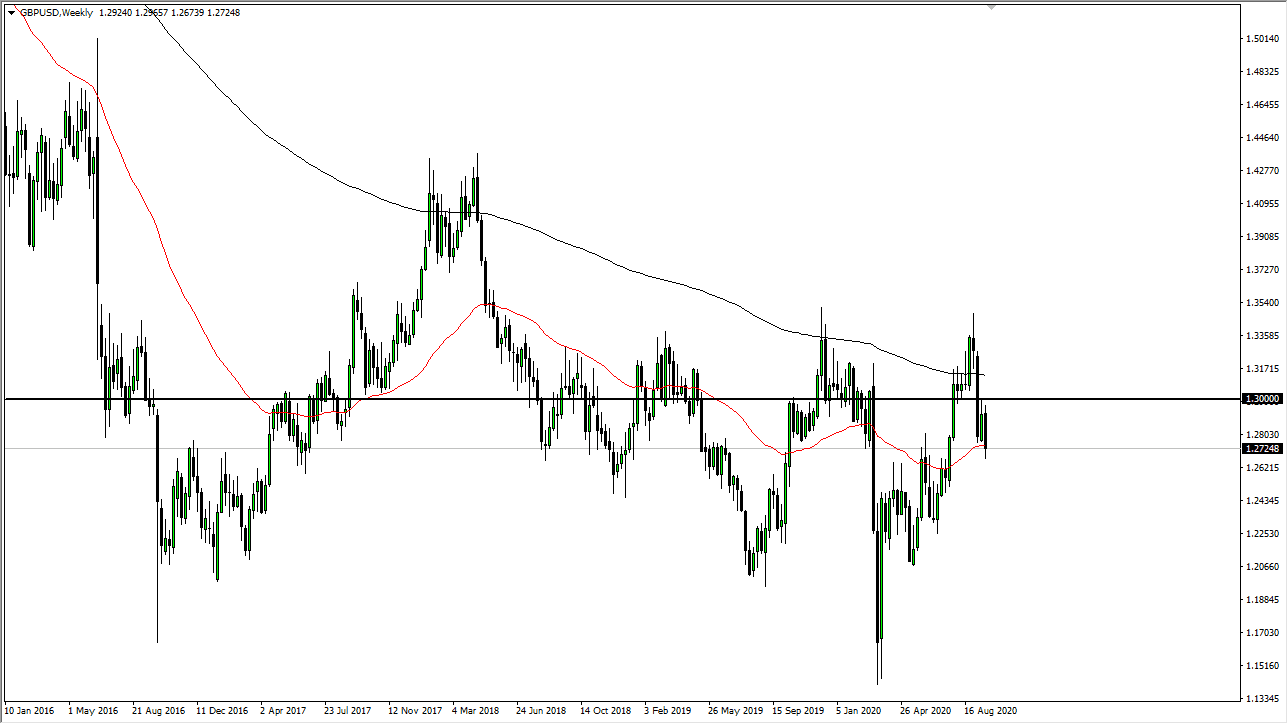

GBP/USD

The British pound initially tried to rally during the week but then sliced through the 50 week EMA. The 1.27 level is significant support underneath, and at this point I think we are going to continue to grind back and forth. Overall, this is a market that I think continues to be noisy and will be moving around based upon the latest Brexit headline. I think we are going to stay in the same range that we formed during this past candlestick. I do not look for clarity in this pair anytime soon.