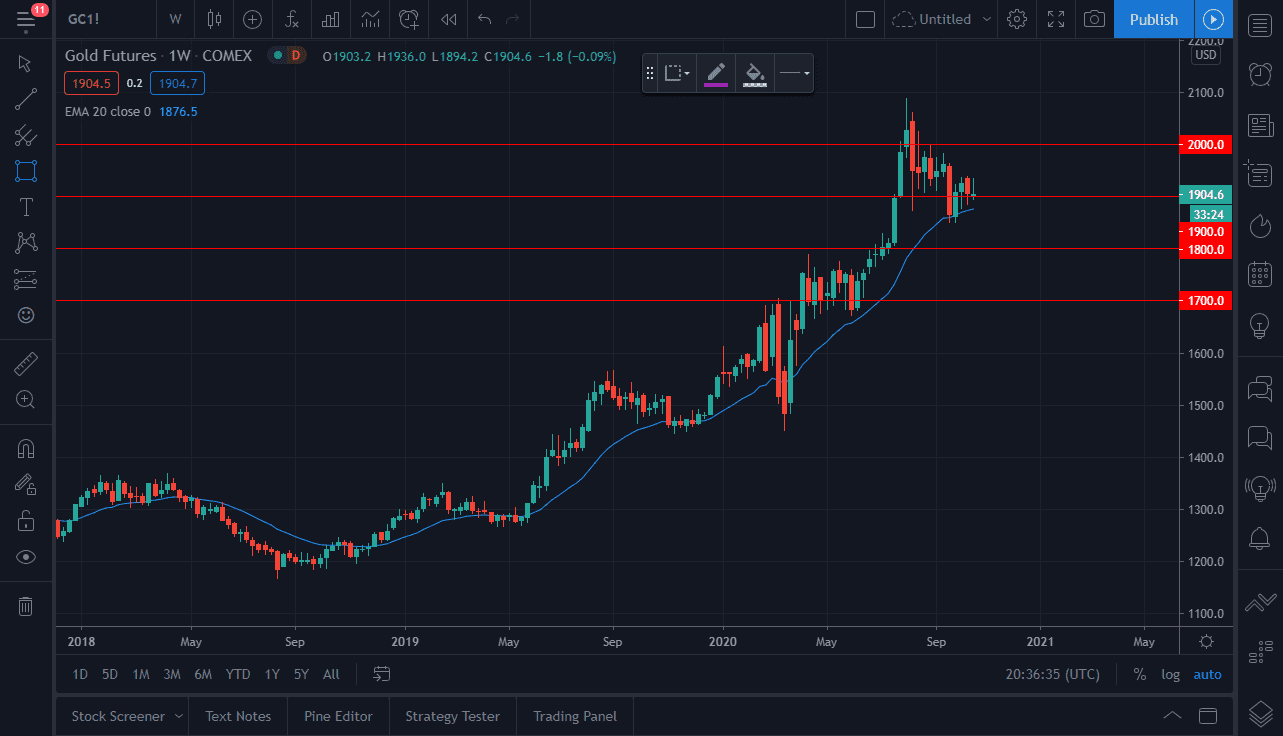

Gold markets have gone back and forth during the course of the month of October, and at this point it seems like the $1900 level should continue to be a bit of a magnet for price. Having said that, the 20 week EMA sits just below. With this being the case, if we break down below there it is likely that we go looking towards the $1850 level, perhaps even down to the $1800 level. I do think that if we break down below there it is likely that the buyers would come back into the marketplace and start buying.

The $1850 level has been interesting for buyers recently, but if we break down below there then the $1800 level is even more importantly due to the fact that it was the scene of a major breakout. A lot of traders will be looking to get involved in the market if that happens, and I do believe that it would be essentially be the bottom of the market.

Having said that, pay attention to the US Dollar Index as it will have a major influence on what happens with gold, as gold of course is considered to be the “anti-dollar play” by a lot of traders. However, there is also the possibility that both go higher by the end of the month if there is a massive “risk off” type of attitude. It is because of this that we need to pay very close attention to what is driving the US dollar either higher or lower. If there is a bit of a freak out in general, both of these markets will rally but at the same time if the US dollar starts to fall apart, that could drive gold higher as well. In other words, I do think that eventually we go to the upside. Keep in mind also that the central bank in multiple countries will be doing massive stimulus and therefore it dries down the value of fiat currencies in general. That has people looking for hard assets to take advantage of, and as of this is the case, gold is the ultimate trade. If we can break above the candlestick for the last week of the month, the market could very well go looking towards the $2000 level. Either way, it is only a matter of time before gold goes higher.