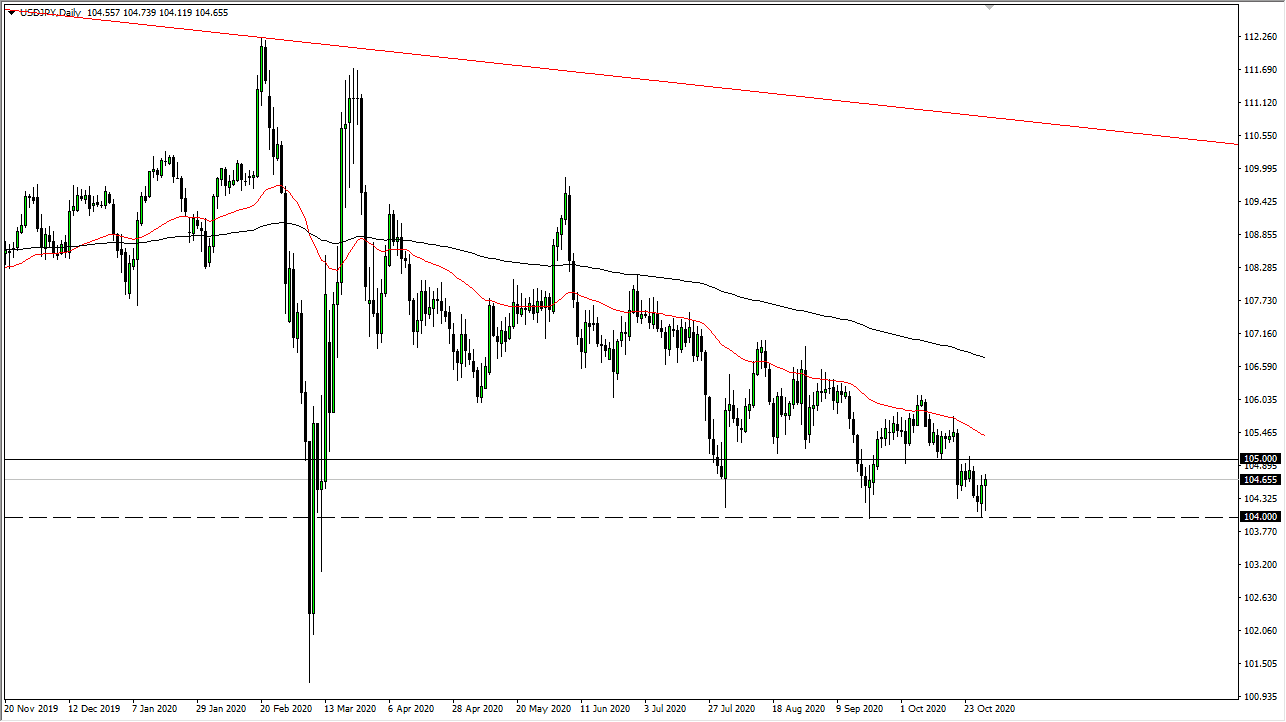

The US dollar went higher initially during the trading session on Thursday but continues to struggle near the ¥106 level. In fact, we are forming a very small “rounded top” that we can start looking at shorting. I think at this point in time it is likely that the markets will continue to be attracted to the 50 day EMA as resistance, because you can see over the last several months it has been so reliable. Furthermore, by the 50 day EMA you can see that there is a huge gap all the way to the 200 day EMA that has been essentially “no man’s land.”

Underneath, I see the ¥105 level as a significant marker that is worth paying attention to, as it is not only a large, round, psychologically significant figure, but it is also an area that we have seen a lot of action in recently. That is not to say that we cannot break down below it, quite frankly I think we can, and it is likely that we could go looking towards the ¥104 level. A breakdown below that level should open up the possibility of a move down towards the ¥102 level, possibly even the ¥100 level given enough time. All of that being said, this is been more of a grind lower than anything else, so I like fading short-term rallies.

One thing that you should probably keep in mind is that this pair does tend to move quite rapidly and drastically during the Non-Farm Payroll numbers at the beginning of the month, as it has a massive effect on interest rates and their expectations. At this point, I think that any rally should be thought of as a potential selling opportunity, and I have no interest in buying, at least not anytime soon. I think we would have to break above the 200 day EMA to start thinking along those lines, and that is closer to the ¥107 level. In other words, I am not buying this pair anytime soon. I believe that rallies are to be sold into, and that has worked out quite well for several months now as not only do we have the Federal Reserve printing as many US dollars as possible, there seems to be a lot of underlying concern out there around the world that has people buying Japanese yen.