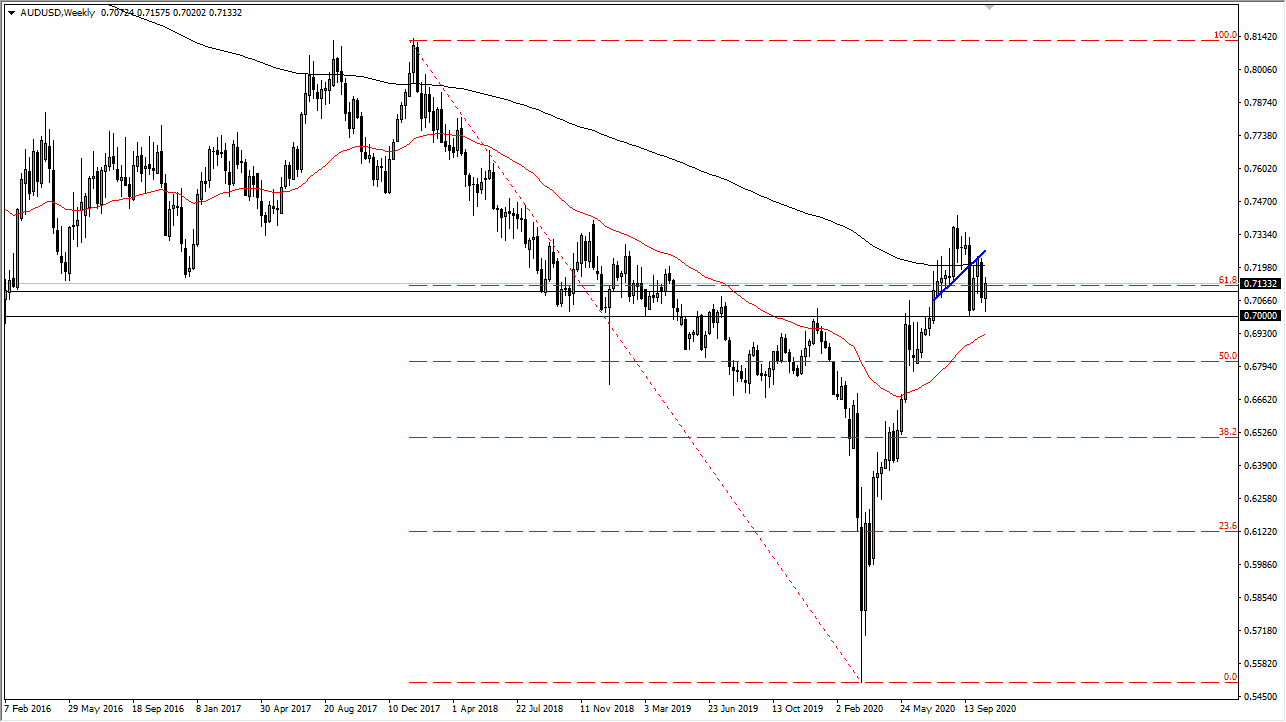

AUD/USD

The Australian dollar initially saw a lot of selling pressure during the course of the week, but then recovered a bit to get above the 0.71 handle. At this point, we are continuing to move based upon the idea of whether or not the Americans are going to do stimulus and the Reserve Bank of Australia is likely to cut interest rates as well, so this causes a lot of chaos. At this point, I still prefer to fade short-term rallies.

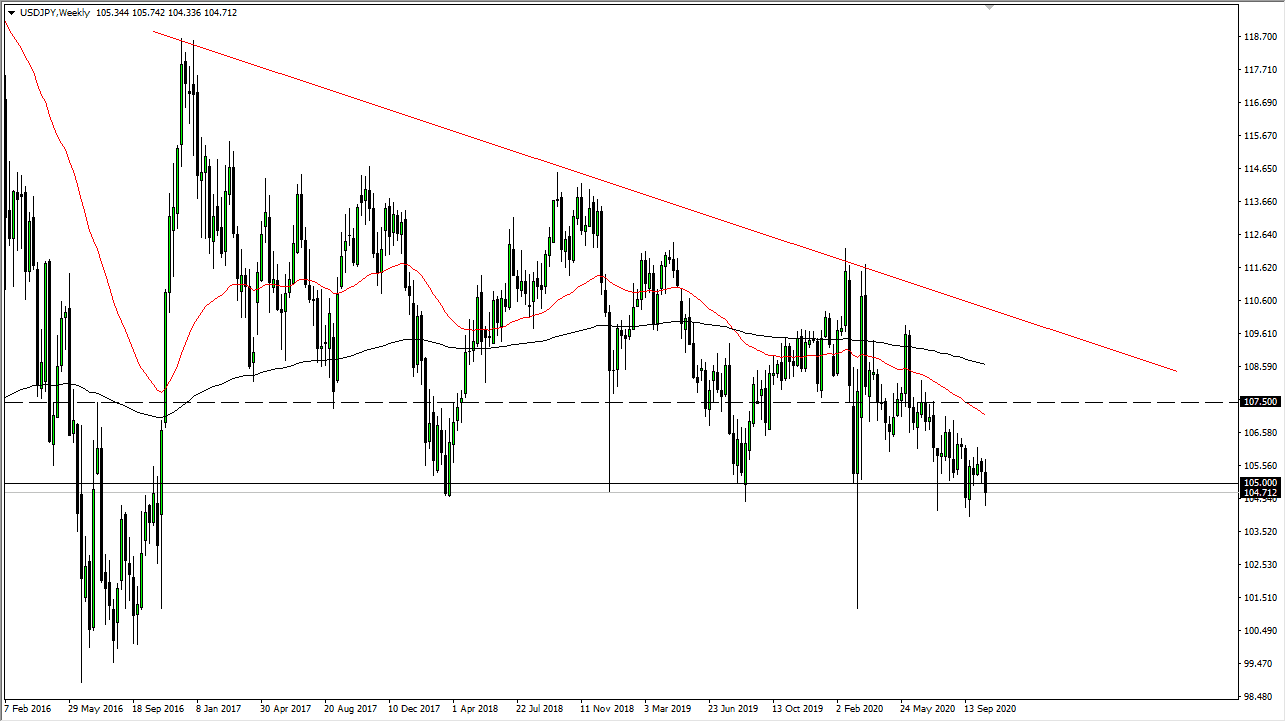

USD/JPY

The US dollar initially tried to rally during the trading week, but then broke down rather significantly on Wednesday. At this point, more negative pressure is probably coming towards as a pair, and I think that short-term rallies are going to be faded. If we break down below the ¥104 level, then it is likely that we go down to the ¥102 level. At this point in time, the market is likely to see a descending triangle with a measured move down towards the ¥102 level. That was the most recent low, and where we had seen a lot of buying. I continue to fade rallies and I think that eventually, we could break down.

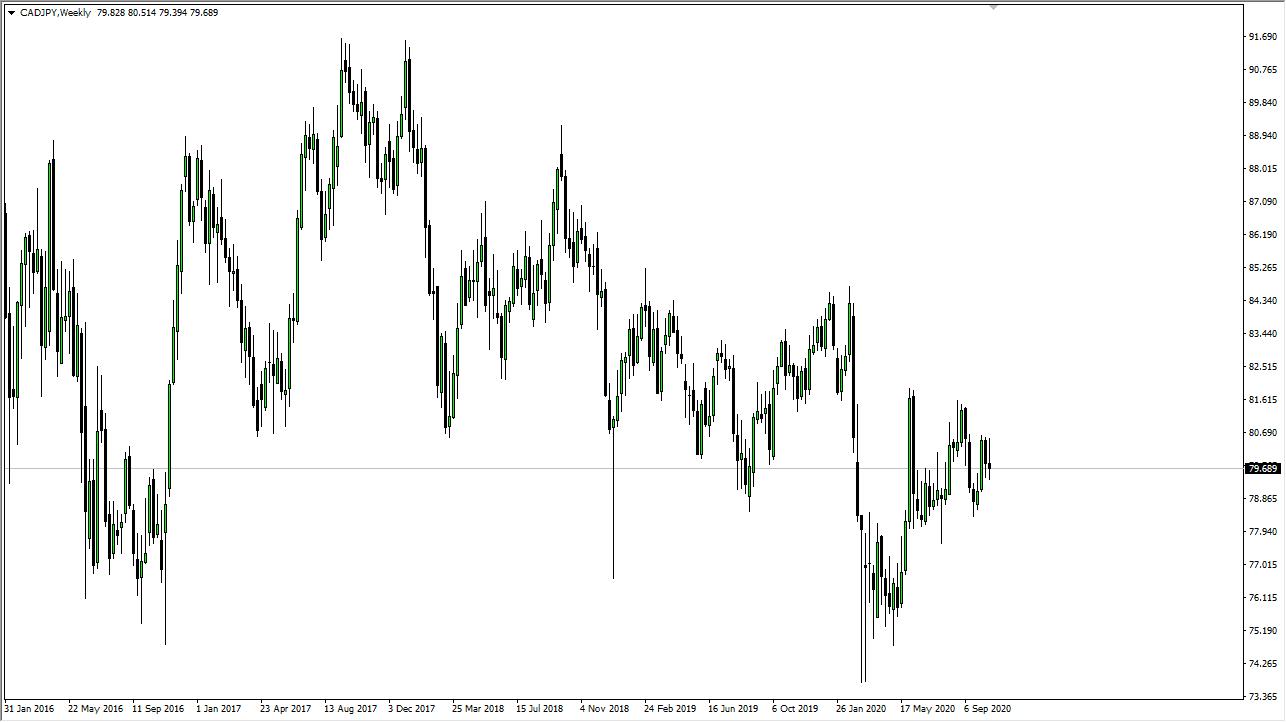

CAD/JPY

The Canadian dollar has been all over the place during the week, forming a bit of a negative candlestick by the time we will finish. At this point, I think we do see negative pressure going forward and there are a lot of concerns when it comes to crude oil. If crude oil gets hammered, or if we get a “risk-off” type of attitude, the CAD/JPY pair could very well find itself reaching towards the ¥78 level during the week. If we break out to the upside, I think there is a bit of a lid on this market near the ¥81.50 level.

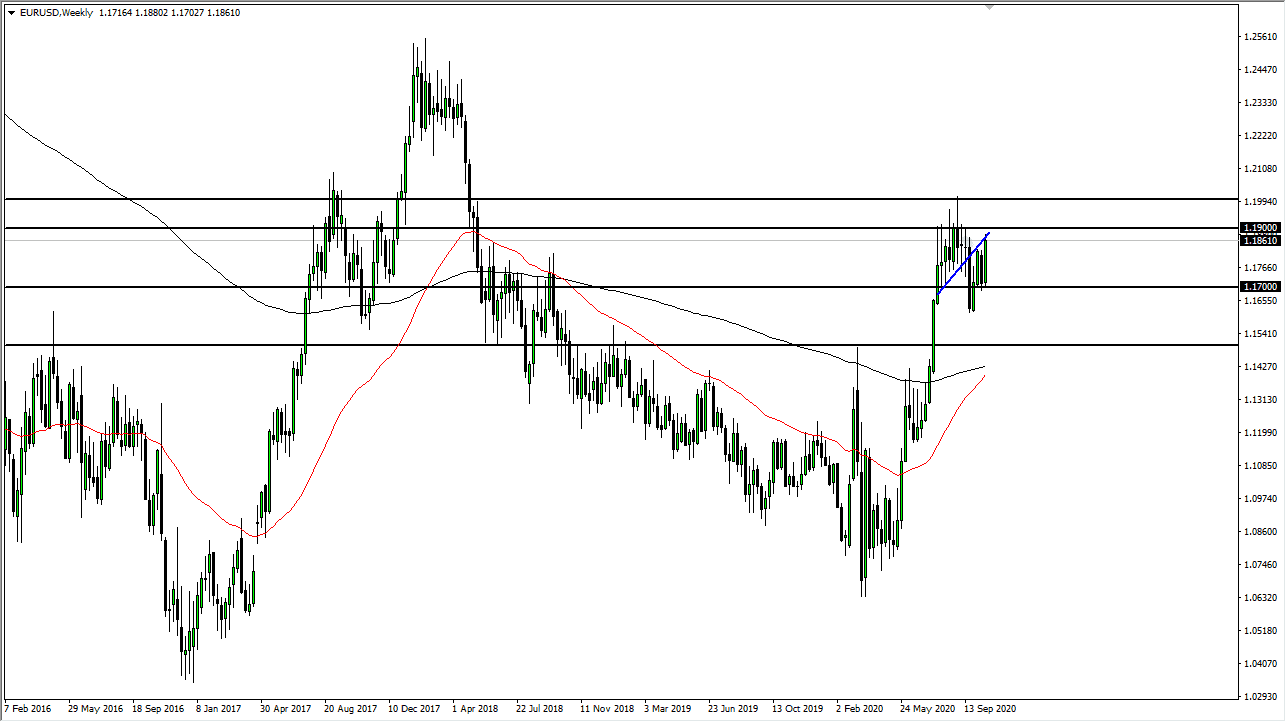

EUR/USD

The Euro rallied significantly during the week, and even though the candlestick for the weekly timeframe looks very bullish, the reality is that it was a very noisy ride indeed. We are testing the top of significant selling pressure and have a massive amount of resistance extending from the 1.19 level to the 1.20 level. With that being said, I think that this is a market that continues to see a lot of volatility in choppiness, and I think that on the shorter-term charts we will probably see exhaustion near the area just above that we could start fading.