With seemingly no more than a push of a few buttons, the DAX Index has made swift gains the past week and is challenging high water marks. However, as trading opened this morning, slight headwinds have created some bearish movement for the German index. Global risk appetite has surged in a strong fashion in the afterglow of the US elections; financial institutions cherish the clarity they believe they have and are certainly pursuing their positive short-term outlooks on the belief the Biden administration may provide stability.

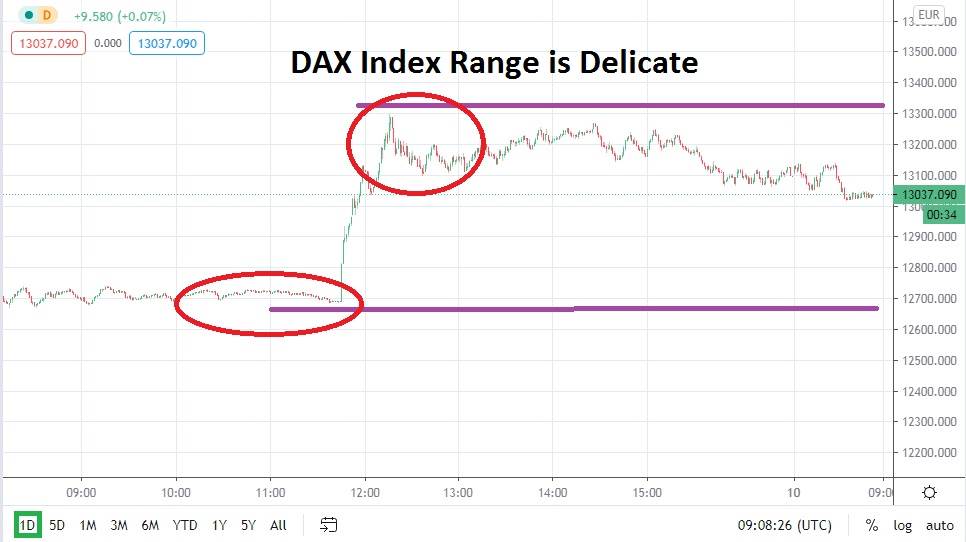

The current range of the DAX Index does look delicate in early trading today. As the German index has reestablished its highs, investors may be asking if the gains were a little too much in too short a time. However, this actually may not be the case at all; investors may merely be waiting for additional impetus to come from the US equity markets.

Future calls from the US were indicating a slightly negative opening about an hour ago, but this has reversed and the markets seem to be ready to move upwards again. This comes on the heels of yesterday’s trading which took major indices on Wall Street to high water marks, and financial institutions may be ready to push US indices to loftier heights.

Speculators have faced plenty of volatile pratfalls recently with the DAX Index. Last week’s reversal higher erupted on positive sentiment creating a cascade of buying action. Technically, the DAX Index has seen its current levels hit with resistance before, taking the market lower this summer and early fall. However, now may be the time to practice risk taking and pursue a trend which may continue to build as risk appetite shows its teeth near term.

Yes, there are economic shadows hovering over Germany and the European Union as coronavirus once again stalks. However, equity markets have shown little long-term inclination to be disturbed by the worries of the pandemic and continue to attract the money of financial institutions, because indices remain a ‘safe’ place for money managers to seek risk. Speculators should buy the German Index on slight dips and pursue the bullish trend which may continue to be demonstrated near term.

DAX Index Short Term Outlook:

Current Resistance: 13125.000

Current Support: 13025.000

High Target: 13293.000

Low Target: 12928.000