Silver markets pulled back during the trading session on Friday as we continue to see the move out of precious metals. This is due to a “risk on trade” going on around the world. People are starting to bank on the idea of a “post-vaccine world”, meaning that they got out of some of the safety trades, including precious metals. Granted, silver is not as big of a safety trade as gold, but it does have a certain amount of that influence as well.

However, silver will eventually go higher for exactly the same reason why the stock markets and other markets are rising: because silver has a certain amount of industrial demand attached to it, so it is a play on explosion in growth. Beyond that, if the US dollar continues to drift lower, it could lift precious metals eventually, including silver. It is worth paying attention to the US Dollar Index, as the negative correlation is rather important. The negative correlation is not always perfect, as we have seen the last couple of days, but as soon as we get more of a “risk on” attitude with silver, you will see that come back into play.

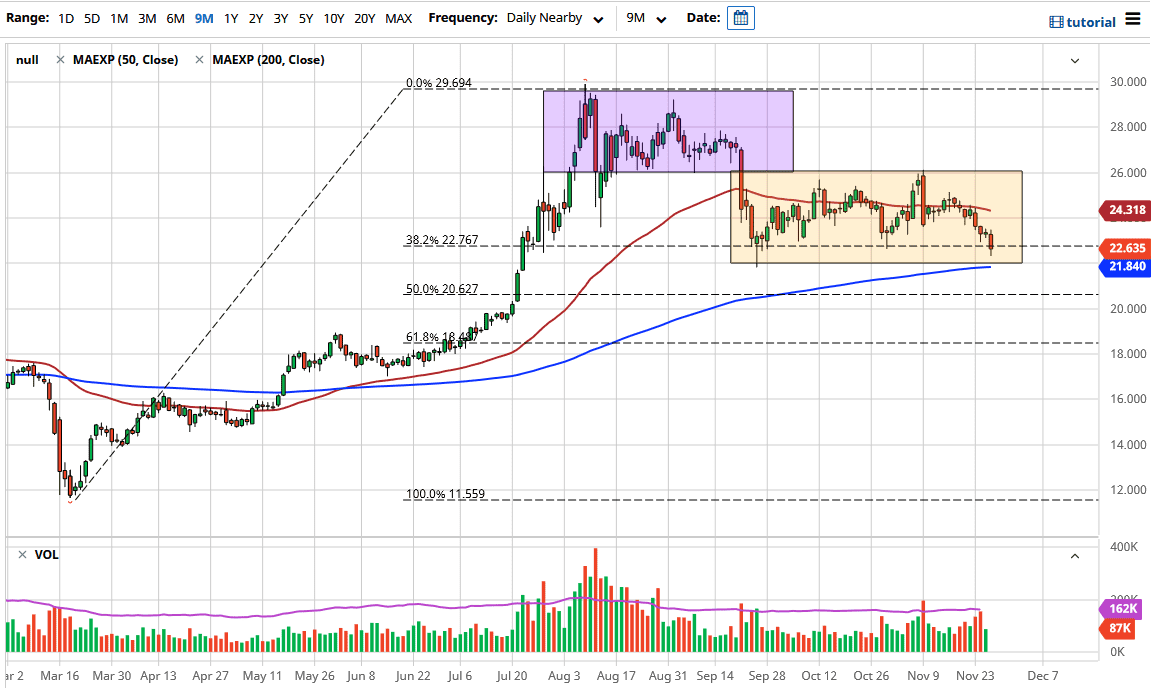

We are looking at the 38.2% Fibonacci retracement level, which we have pierced, but it looks like it is trying to hold up. We also have the 200-day EMA near the $21.84 level, so there is enough here in this general vicinity to keep the market somewhat stable. Furthermore, you can see that we had formed a hammer in the middle of September right at the same level. This is not to say that I am willing to jump in and start buying blindly; only that I am looking for a bounce to suggest that it is time to start buying. At that point, I would anticipate a move towards the 50-day EMA, which is colored in red on the chart.

If we can break above that 50-day EMA, then we could go looking towards the $26 level, which was the top of that overall range. I do like the idea of buying silver eventually, and central bank liquidity will continue to push the market higher in general. Because of this, I am a buyer of dips, but I would do so slowly.