The USD/PKR may prove enticing to short-term speculators who are looking for a forex pair which may not be affected too much by the outcome of the US elections. Certainly in the long term, the results for the US presidential vote will create impetus for Pakistan economically, but short-term government and financial transactions are unlikely to feel an immediate shift in momentum because of the questions lingering about the US outcome.

The USD/PKR has established a strong bearish trend since late August and incrementally has been able to puncture support levels below. The Pakistani rupee was trading near a high of 168.5000 during a significant portion of August, but since then has found a solid trend emerge which has established a downward path for the USD/PKR.

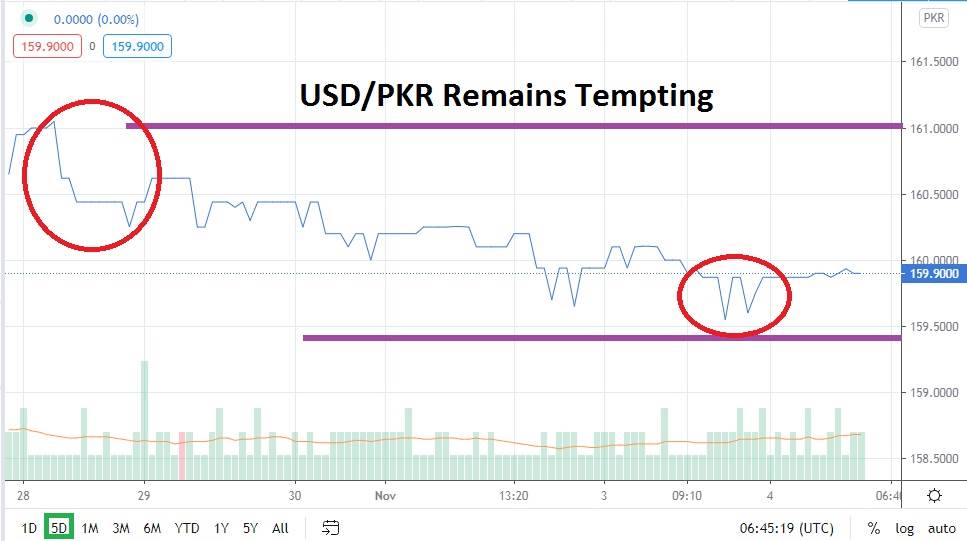

The USD/PKR has sustained its value within a crucial lower price range which was last tested in late May and if further downside pressure is found the forex pair may prove that additional bearish strength can be generated. As of this morning the Pakistan rupee is near vital support and if the 159.8000 juncture can be punctured lower speculators may want to target the 159.6000 level. Breaking the 159.6000 level below could prove a critical inflection level.

If support continues to prove vulnerable it could set up a very interesting test of the 158.0000 to 159.0000 junctures. This price band was last traded in early May and also in early March. This range would put the USD/PKR within values that were produced as coronavirus concerns became loud and had an impact.

The USD/PKR remains a volatile forex pair and one which should be treated carefully by speculators because of its lack of transparency. However, humorously enough, the psychological lack of transparent transactions within the USD/PKR could help it be less volatile short term, as other global financial assets react to the still unclear results of the US election.

Speculators may continue to pursue selling positions of the USD/PKR and attempt to capture a downward trend. Traders should use limit orders when taking positions within the forex pair to guard against price fills which may be questionable and hard to argue. The Pakistani rupee has seen a solid bearish trend the past two months and it has accomplished this without a great amount of fanfare, which means its selling momentum may not be finished.

Pakistani rupee short-term outlook:

Current Resistance: 160.1500

Current Support: 159.6000

High Target: 160.6000

Low Target: 158.9000