The West Texas Intermediate Crude Oil market fell a bit during the trading session on Thursday as the inventory numbers were not necessarily overly bullish, but at the end of the day it is more important to pay attention to the fact that the macroeconomic situation does not bode well for crude oil over the longer term.

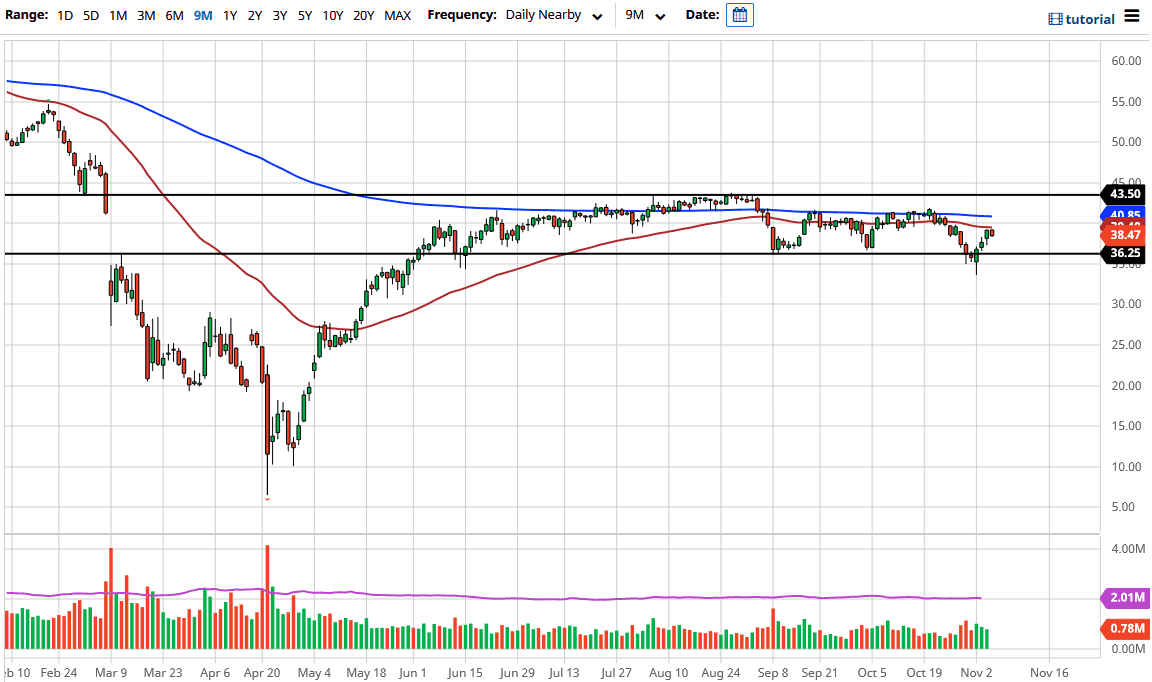

I understand that people out there are hoping for stimulus, and they assume that the potential stimulus package should bring quite a bit of demand in for crude oil. However, we have had three other ones before this, so any short-term rally is to be looked at with suspicion to say the least. From a technical analysis standpoint, we are sitting just below the 50 day EMA and we are already starting to see a little bit of selling pressure right here. Beyond that, we have the jobs number coming out on Friday and that of course will cause a bit of volatility in the markets as it typically will do. However, this week might be a little bit different because we are more or less paying more attention to the idea of getting the election finalized.

If we do not have the election finalized by the end of the day, it is very likely that we will see traders covering anything related to risk at the end of the session, and this will almost certainly weigh upon crude oil. After all, if we get some type of contested election it could take a couple of weeks before we get a finalized decision. While traders have dealt fairly well with the idea of waiting on the election results, it is an entirely different animal altogether to start talking about waiting until Monday, with the markets closed.

All that being said, there is no real demand for crude oil and any short-term sugar high based upon stimulus will more than likely be sold into. The 50 day EMA above offers resistance, just as the 200 day EMA does. With that, I think that we will more than test the lows again from the recent break down, and perhaps even go below there. If we do, then it is likely the market goes looking towards the $30 level. If we break above the 200 day EMA on a daily close, then I will start to pay close attention to the $43.50 level.