The Australian dollar initially shot higher during the trading session on Wednesday as the complete “risk on" trade was in full effect. I am not exactly sure what would kick this off, because there is a whole slew of things out there that could have caused it. The two most obvious things are the meeting between the UK and the EU later on in the evening, and the stimulus talks in the United States. So far, both of those have looked rather lackluster in what can get done, and perhaps that is what we are starting to see price itself in the currency markets.

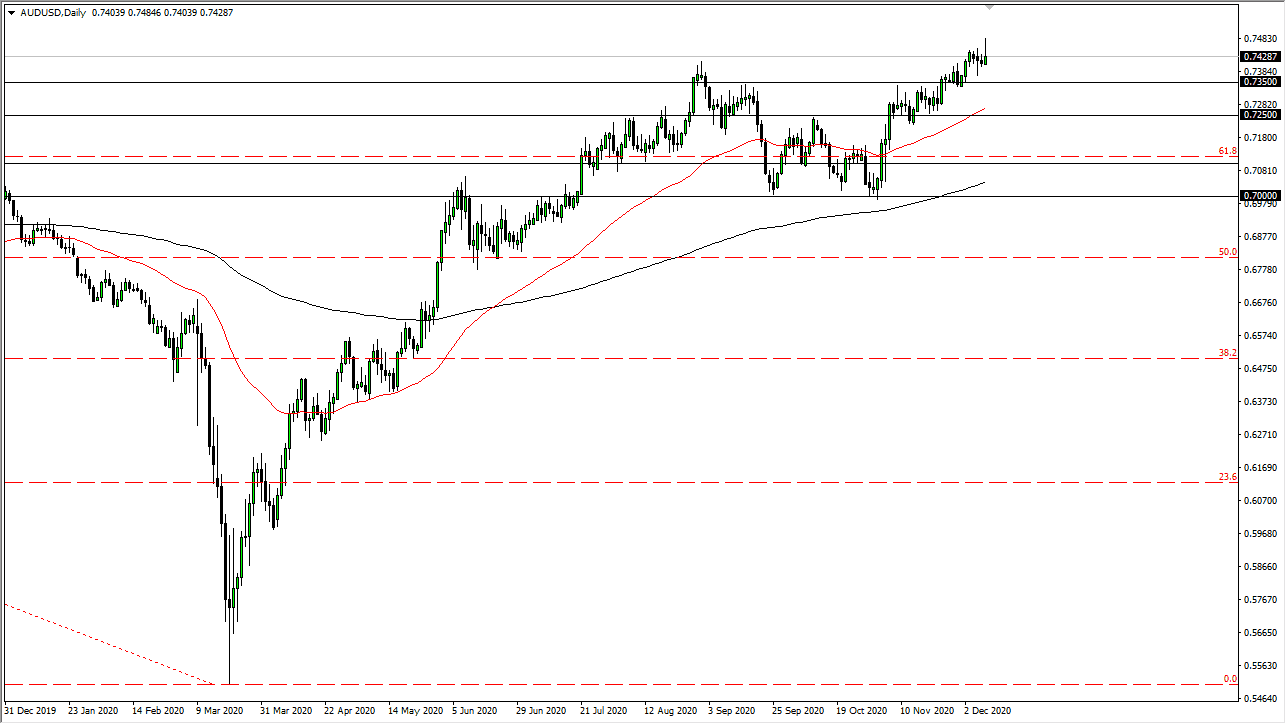

At the end of the day, you ended up seeing a very ugly candlestick for the Aussie dollar, but we are still very much in an uptrend. I think what this means is we will see a pullback, but I think that will only be bought into. The Australian dollar has been stubbornly resilient, and I do not see any reason why that would change in the short term. This market will eventually find its way higher and break above the 0.75 handle. If that happens, especially on a daily close, then it opens up the possibility of a move to the 0.7750 level, followed by the 0.80 level. The 0.80 level is an area that been important historically multiple times, so it is certainly something worth aiming for and watching.

To the downside, we should see plenty of buyers somewhere around the 50-day EMA, currently parked just above the 0.7250 level. The one thing that we know people want to do is sell the US dollar on the whole. This gives the opportunity for traders to do so, and at better rates. I expect a lot of choppy behavior between now and the eventual breakout, but eventually it will happen, and we should see some continuation. It is hard to tell whether or not Wednesday was an anomaly, or if it was the beginning of a more significant pullback, but at the end of the day the greenback is still on its back foot. I have no interest in shorting this pair anytime soon.