Gold futures fluctuated during recent trading sessions as the yellow metal struggled to find a tangible trend during a quiet trading week. Since the beginning of this week's trading, the price of gold was in a range between $1900 and $1872 before settling around the $1882 level. So far, gold prices are looking to re-test the psychological peak at $1900 with the beginning of the year 2021, amid the weakness of the US dollar and the coronavirus stimulus package from Washington. In general, market analysts are still optimistic about the gold performance next year. Despite the halting of gold's gains, it is still winning by 21% for the year 2020. As for silver, the sister commodity to gold, futures fell to $26,285 an ounce. Silver rose in December, advancing more than 15%.

Global financial markets are watching current events in Washington after President Donald Trump signed the $908 billion Coronavirus Stimulus and Relief Act that raises income support payments from $600 to $2,000. While the Democrat-controlled House of Representatives overwhelmingly voted in favour of the increase, Senate Republicans blocked the independent measure.

Senate Majority Leader Mitch McConnell has identified three priorities that President Trump has called on lawmakers to address: greater stimulus checks, a Section 230 repeal, and massive election fraud. Since there is no specific plan in the works, Senator McConnell has indicated that "the Senate will begin a process to highlight these three priorities."

Republican officials differ on the stimulus. Senator Marco Rubio expressed concern about the ballooning deficit but indicated that Americans are struggling and need relief. Senator Josh Hawley was persistently defending these payments, even working with Senator Bernie Sanders to pass the measure. Senator Ron Johnson has gone as far as to refuse the $1,200 checks.

The US Treasury Department confirmed that the $600 payments will be distributed this week, and if Congress approves the increase to $2000, it will add money to the amount already distributed.

In general, precious metals focused on the USD drop, as the US Dollar Index (DXY) fell to a psychological support level at 90.00, dropping by 1.4% over the past month, which increased its decline in 2020 by about 7%. The lower exchange rate is good for dollar-linked commodities because it makes them cheaper for foreign investors to purchase. As for other metals markets, copper futures fell to $3,552 a pound. Platinum futures rose to $1059.50 an ounce. February palladium futures fell to $2,336.00 an ounce.

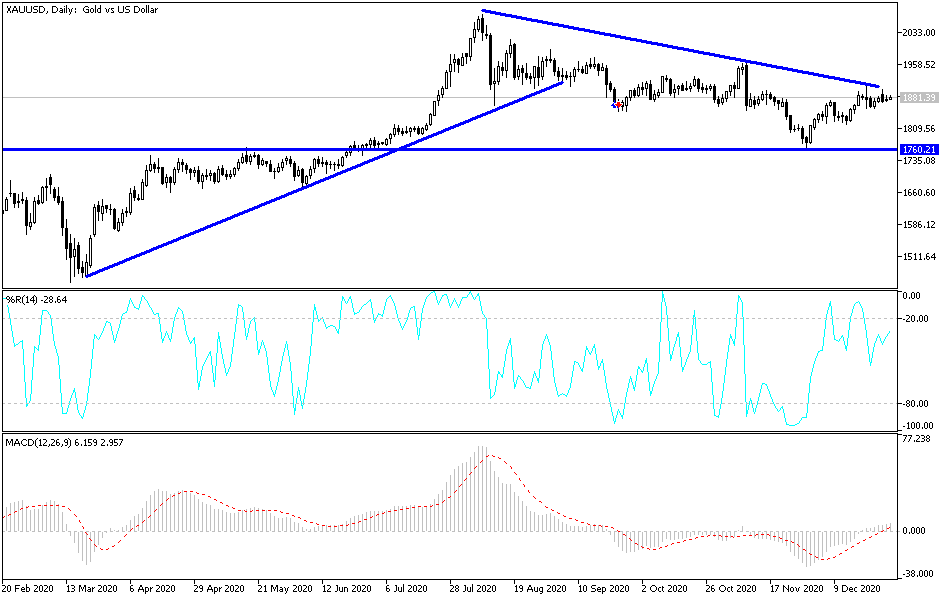

Technical analysis of gold:

According to the performance on the daily chart, the price of gold is still moving in the range of an upward channel that was formed at the end of November's trading when the price started from the support level at $1765 per ounce. Stability above the $1800 psychological resistance motivates gold investors to maintain purchases in preparation of a breakout through the next psychological resistance at $1900. I still prefer to buy gold from every downside level and the closest support levels are currently 1872, 1860 and 1835, respectively. The movements are limited in the markets in light of a short week due to the holidays, and thus weak liquidity.