Long trade ideas

Buy the AUD/USD after the relatively strong PMI data.

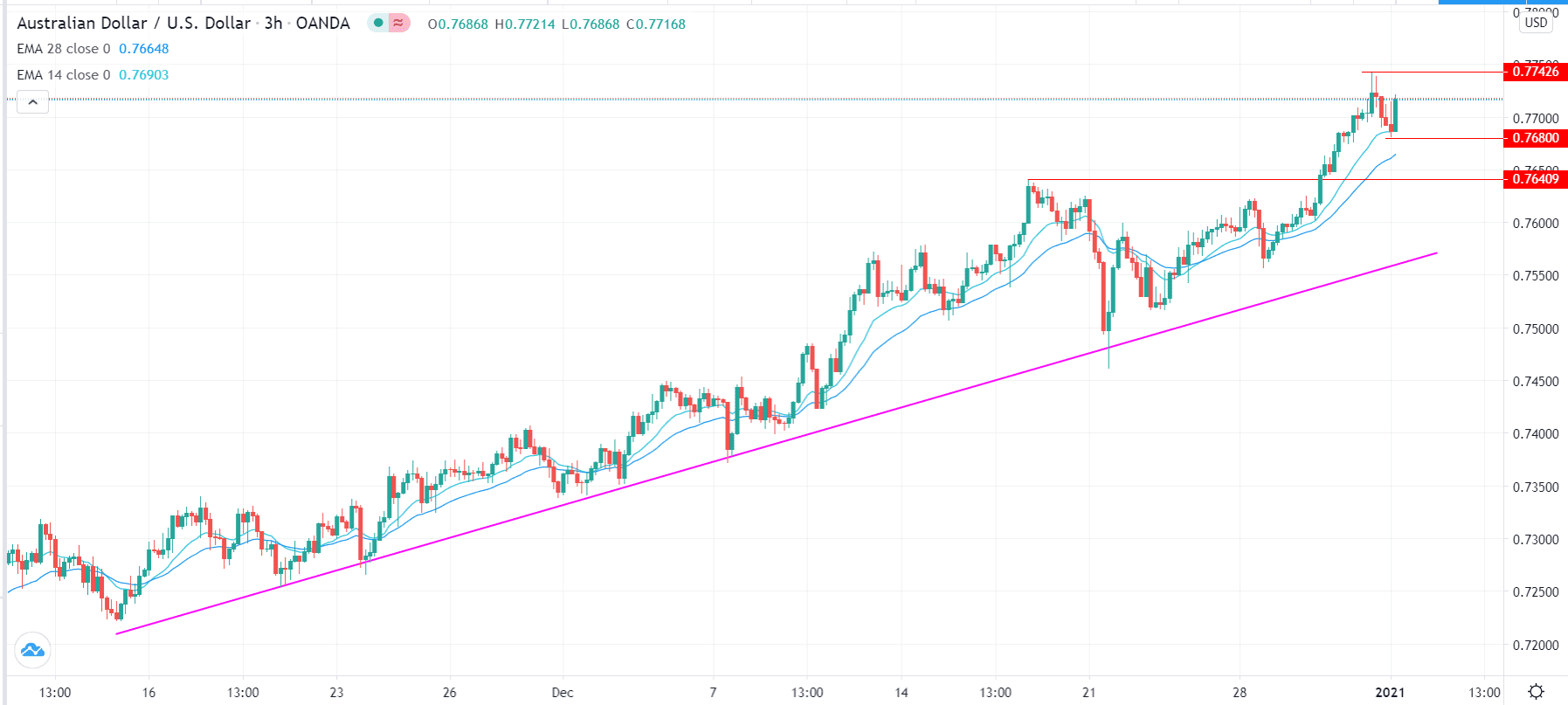

The initial target should be Friday’s high of 0.7742.

Put a stop loss at today’s low at 0.7640

Short trade ideas

Short the AUD/USD if the price falls below today’s low of 0.7640.

Target the psychological level at 0.7600.

Put a stop loss at 0.7742 the highest point on Friday.

The AUD/USD price started the year on a high note, continuing the 9.60% gains it made in 2020. It is trading at 0.7718, which is the highest it has been since April 2018.

Strong Manufacturing PMI

The Australian dollar is rising as traders react to the relatively strong Manufacturing PMI data from China and Australia.

In a report, data from Markit showed that the Australian manufacturing sector continued to expand in December, helped by robust internal demand. In total, the PMI declined from the 35-year high of 55.8 to 55.7. Still, this was an overall strong number since it was above the expansionary zone of 50.0.

Similarly, in China, the Manufacturing PMI data by Caixin declined slightly from 54.9 in November to 53.0 in December. That was the eighth straight month that the PMI has been above 50, which is a sign of the strength of the Chinese manufacturing sector.

The Australian dollar is often viewed as a proxy for China because of the vast amount of business the country does there. China buys more than a third of Australia’s goods like copper and iron ore. It also buys most of the country’s services like education and tourism.

Meanwhile, the AUD/USD pair is rising today because of the overall weaker US dollar. The US Dollar Index, which measures the strength of the greenback, is down by 0.25%. It has continued the 9%+ decline that it suffered last year.

This performance is partly because of the rising number of coronavirus cases in the United States. Over the weekend, the number of cases and hospitalizations continued to soar even as the country rolled-out vaccinations.

Also, the decline is because of the overall risk-on sentiment in the financial market. This sentiment has seen more investors embracing relatively riskier assets at the expense of the US dollar because of the incoming Biden administration and the COVID-19 vaccine.

AUD/USD Technical Outlook

The three-hour chart shows that the AUD/USD pair has been in an overall upward trend. It is slightly above the 28-period and 14-period exponential moving averages. It is also a few pips above the important support at 0.7640, which is the highest point on December 17. It is also slightly above the ascending pink trendline.

Therefore, the path of least resistance is higher, with the next primary target being Friday’s high at 0.7742. The invalidation point for this forecast is today’s low at 0.7680.