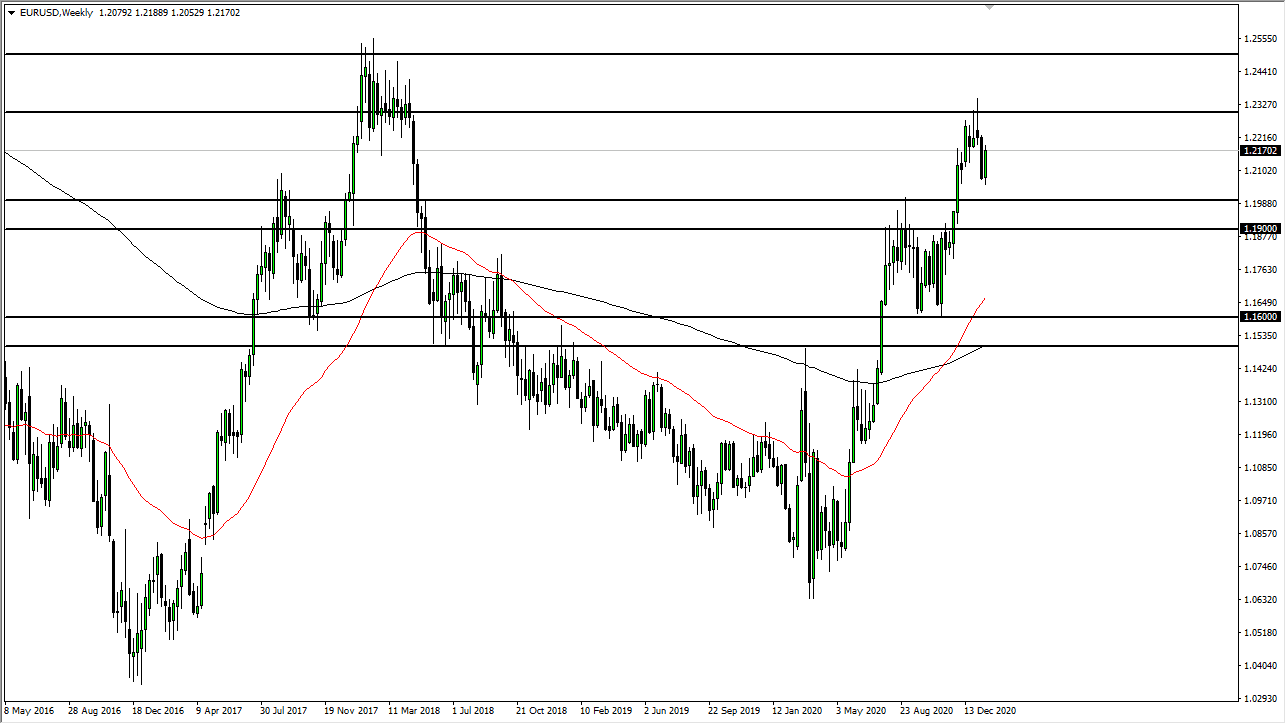

EUR/USD

The euro had a strong week, as we have recovered quite nicely after selling off drastically over the last several weeks. The market is essentially in the middle of two major areas of support and resistance, and we are eventually going to reach one of the two. At this point, the 1.23 level is the top, just as the 1.20 level underneath is the bottom. At this point, I think simple range-bound trading is what we will continue to see, perhaps with results hinging on the latest talk of stimulus in the United States and the possibility of tightening lockdowns in the European Union.

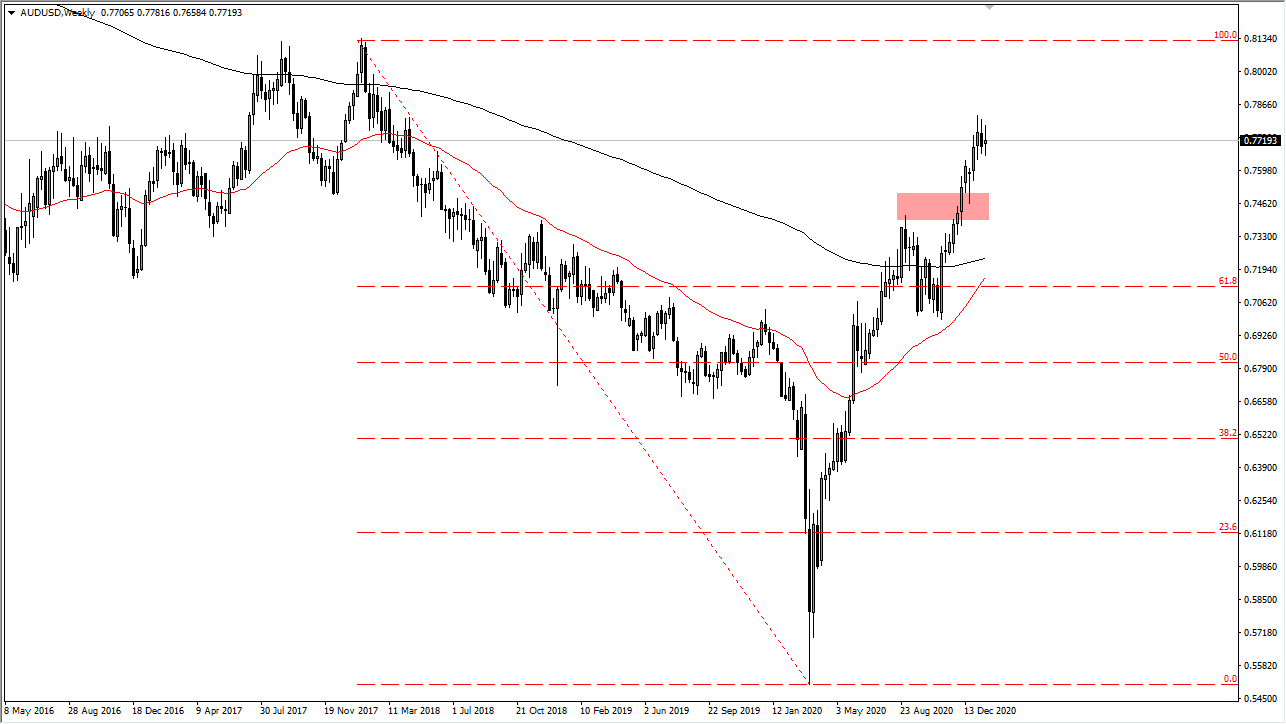

AUD/USD

The Australian dollar fluctuated during the course of the week, as we have formed a rather choppy candlestick yet again. We formed a couple of candlesticks that show exhaustion, so I think a pullback is very likely to be the case. To the downside, the 0.75 level is a large, round, psychologically significant figure, and an area where I think value hunters will return if we pull back to that region. Otherwise, breaking above the last couple of candlesticks on the weekly chart could send this market looking towards the 0.80 level.

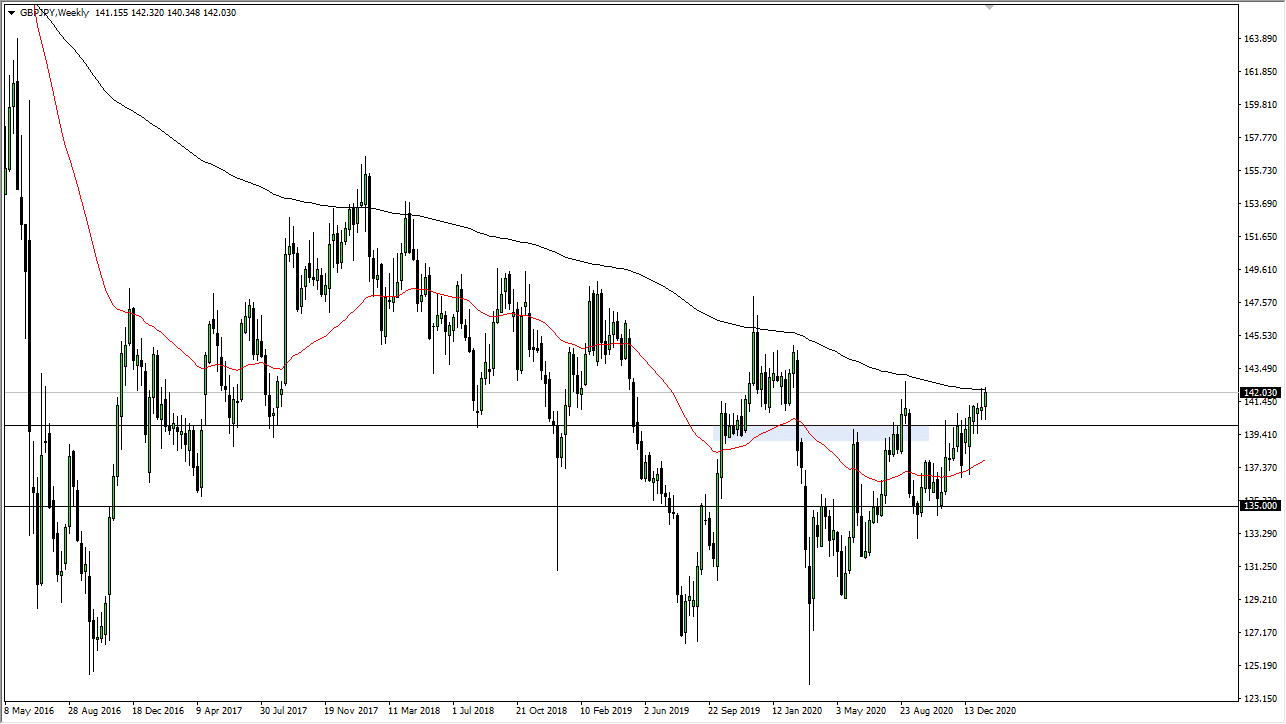

GBP/JPY

The British pound initially tried to break down against the Japanese yen for the week, but then turned around to show signs of strength again. The 200-week EMA was tested, and if we can break above the candlestick from the last couple weeks, the market is likely to go looking towards the ¥145 level. It certainly looks as if the “risk on trade” could continue to propel this market higher. The ¥140 level underneath should continue to offer significant support based upon what we have seen over the last couple of months.

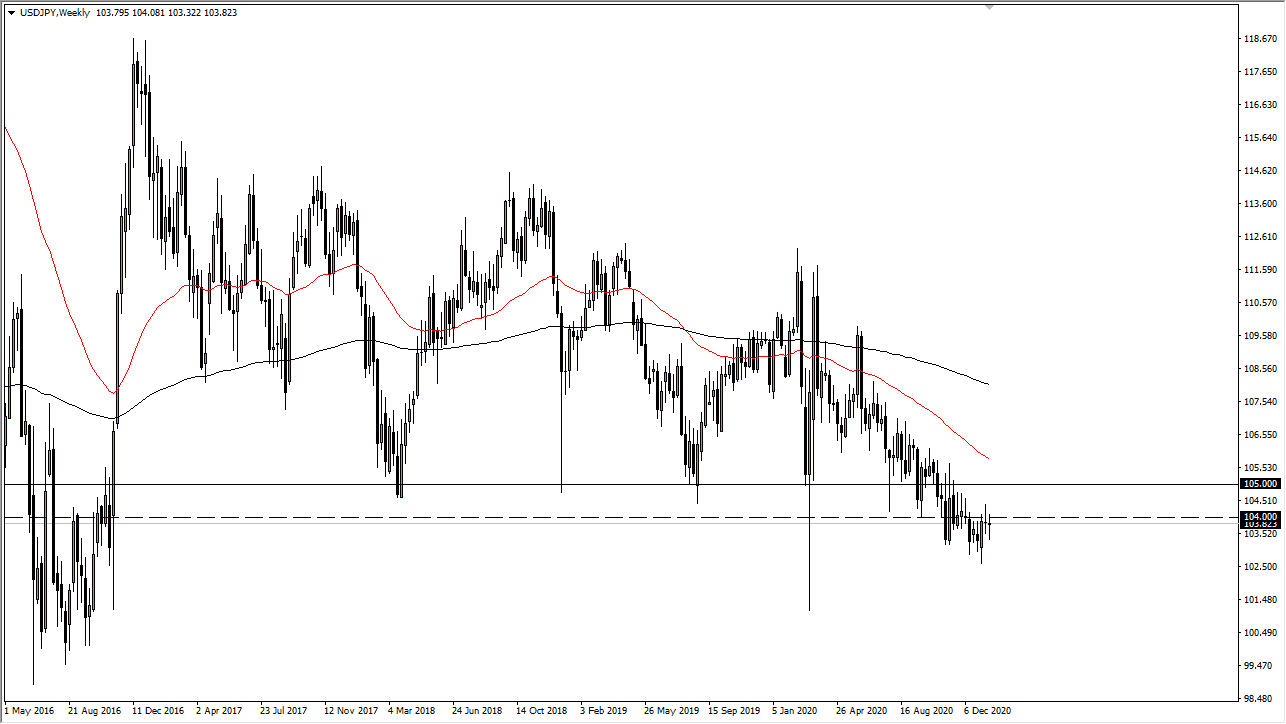

USD/JPY

The US dollar fluctuated during the course of the week against the Japanese yen as we are sitting just below the ¥104 level. The ¥104 level is important, as it has offered resistance for the last month or so. It previously had been supported, so I think we are going to continue to fluctuate going forward until we get a significant decision on stimulus and risk appetite based upon that. At best, we are looking at choppiness that is to be traded on short-term charts only.