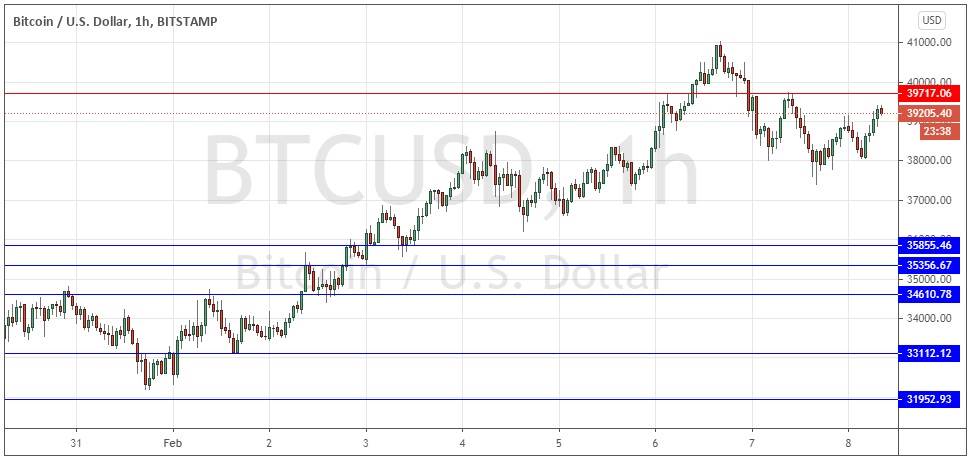

Last Wednesday’s signals produced an extremely profitable long trade entry from the bullish candlestick structure which rejected the support level identified at $35,855 that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Tuesday.

Long Trade Idea

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $35,855.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Idea

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $39,717.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that the environment had become more bullish but that the price was undergoing a short-term bearish retracement from the $37K area. It remained a buy at the cluster of support levels close below. I thought that if we had gotten two consecutive hourly closes above $37K then the price would be likely to at least hit the nearest resistance level at $38,742 and possibly get higher than that.

This was a good call, as I was correct to see the $35K area as a zone that bulls had to hold the price above to maintain a bullish outlook. A support level there gave a great long trade entry opportunity.

Crypto has been in favour in markets lately due to ongoing fallout from the Reddit r/WallStreetBets group buying of various assets which in recent days has included Dogecoin and cryptocurrencies generally by implication. We are also seeing a strengthening of general risk-on sentiment which always helps cryptocurrencies such as Bitcoin.

After peaking just below $41K on Saturday, the price has printed new lower resistance at $39,717 and is currently consolidating below there. This level looks very likely to be today’s pivotal point, so if we get two consecutive hourly closes above it, I will take a bullish bias on Bitcoin today.

On the other hand, there are no key support levels for quite a way down, with the nearest support sitting at $35,855. This means that if the price does continue to reject the nearby resistance and begins to fall from there, it could fall quite sharply with little to hold it up.

There is nothing of high importance scheduled today concerning the USD.