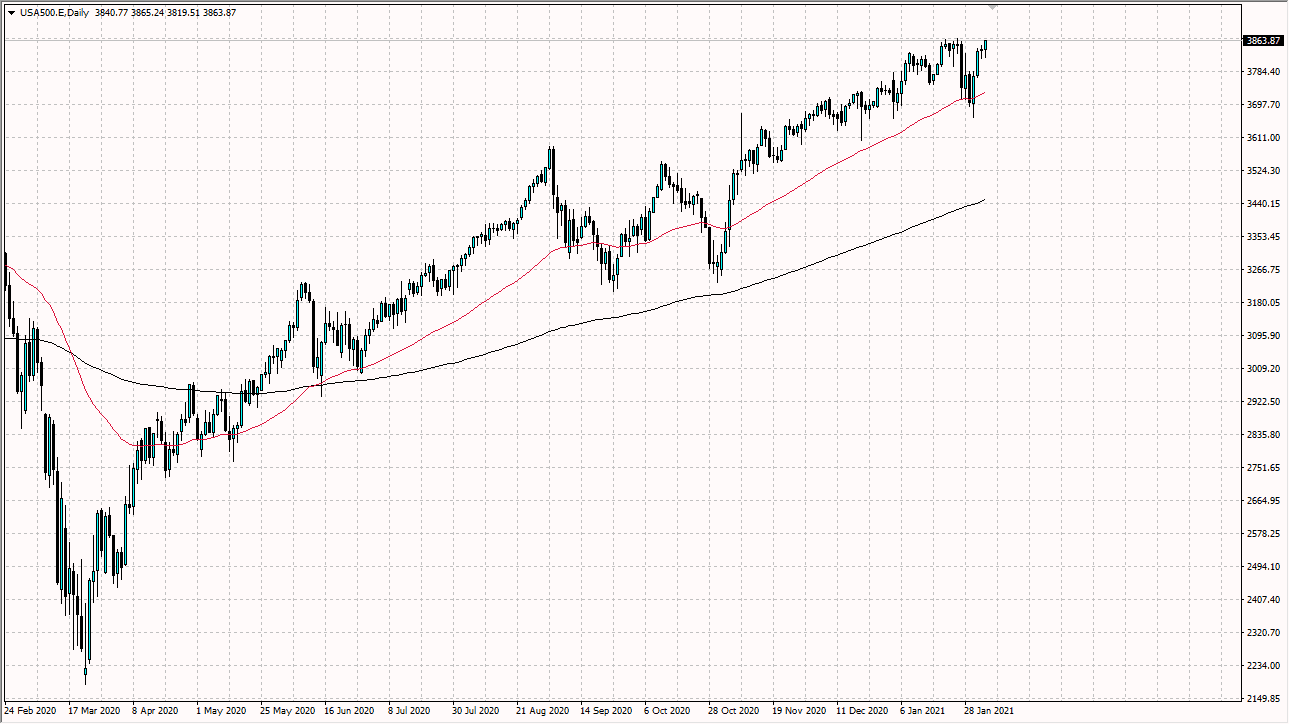

The S&P 500 initially pulled back just a bit during the trading session on Thursday but continues to push higher. In fact, the market is now making an all-time high yet again and it looks like we are going to see a huge push to continue going even higher. The S&P 500 has been like a freight train, and you clearly cannot short it. I think that a pullback could very well happen due to the fact that we are seeing the jobs numbers come out on Friday, but that pullback will almost certainly be bought into, because sooner or later the dips get picked up. Furthermore, the Federal Reserve will continue to flood the markets with liquidity so it is difficult to imagine a scenario where anything will change anytime soon.

As for support, I think that the 3800 level would be, just as the 50 day EMA will be. Nonetheless, I highly doubt we even get down to that area so as the market closed at the absolute highs of the day, this shows that we will more than likely have continuation and ultimately break to the upside. When you look at the longer-term chart, it does not take much imagination to see that this market could go looking towards the 4000 handle, if for no other reason than the fact that we had broken out of a massive rectangle that measured from 3200 on the bottom of it, reaching all the way to the 3600 level. That 400 point break out measures for that move to 4000 which of course is a large, round, psychologically significant figure, and a popular target of pundits on Wall Street.

Keep in mind that the jobs number may cause volatility, but we are still stuck in a “good news is good news and bad news is good news scenario. As long as the Federal Reserve is willing to pump money into the economy, it is very likely that we continue to see the traders look at a strong job market as potential for growth and the coronavirus slowdown abating, but if the jobs number is horrible, then it will be only a matter of time before the narrative switches over to “more cheap money.” In other words, this market is going to continue to go much higher.