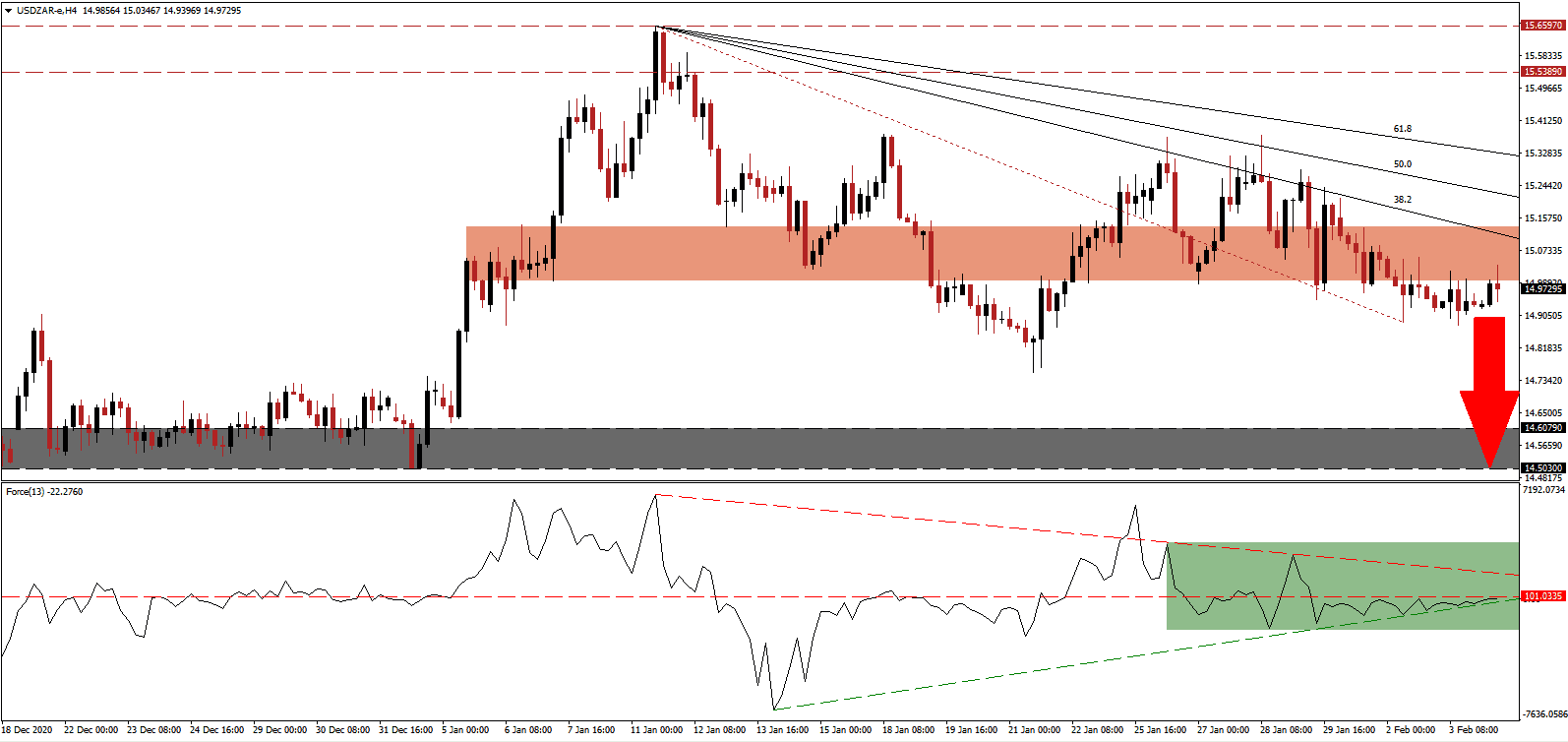

South Africa eased several lockdown restrictions despite the most recent COVID-19 mutation spreading. The country converted shipping containers to makeshift morgues as the death toll climbs. While President Cyril Ramaphosa's government struggles to revitalize the economy, one report suggests that the growth rate must come down. The USD/ZAR completed a breakdown below its short-term resistance zone with rising bearish pressures.

The Force Index, a next-generation technical indicator, created a series of lower highs, as marked by the green rectangle. After a move below its horizontal resistance level, the Force Index is now challenging its ascending support level. The descending resistance level adds to breakdown pressure. Bears remain in control of the USD/ZAR with this technical indicator in negative territory.

Traders continue to cling to hope that COVID-19 vaccines will deliver much-needed relief. Like most other countries, South Africa faces a logistics problem. Adding uncertainty is the ongoing mutations of COVID-19. The USD/ZAR moved below its short-term resistance zone, located between 14.9932 and 15.1349, as marked by the red rectangle, from where more downside is likely.

One bright spot for South Africa remains its vibrant tech sector. Adding to the prospects of a modernized post-COVID-19 economy is blockchain technology, renewable energy, and an efficient mobile workforce. The descending Fibonacci Retracement Fan sequence can guide the USD/ZAR into its horizontal support zone between 14.5030 and 14.6079, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 14.9700

Take Profit @ 14.5200

Stop Loss @ 15.0700

Downside Potential: 4,500 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 4.50

A breakout in the Force Index above its descending resistance level can pressure the USD/ZAR into a confined reversal. The upside potential remains limited to its resistance zone between 15.4002 and 15.4918. US debt and a rise in inflation expectations with a weak labor market add to downside pressure on price action.

USD/ZAR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 15.2200

Take Profit @ 15.4700

Stop Loss @ 15.0700

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67