Last Tuesday’s EUR/USD signals were not triggered, as there was no bearish price action when the price first reached the resistance level identified at 1.1893 that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trade Ideas

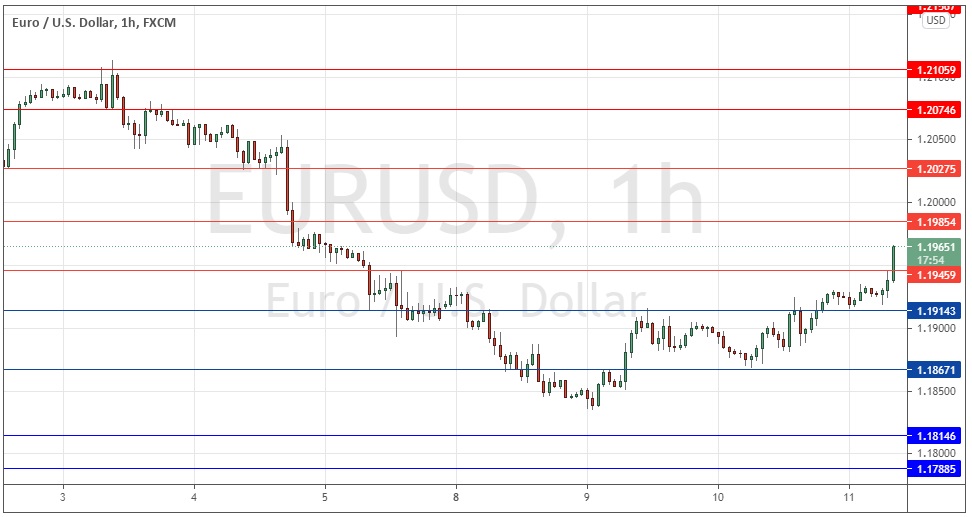

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1985, 1.2028, or 1.2075.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1914, 1.1867, or 1.1815.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Tuesday that this currency pair had finally broken down below the pivotal area at 1.1950 to get established at a new multi-month low price. When this happens in the EUR/USD currency pair, it is usually a signal that the trend is more likely than not to continue, so being short of this currency pair was I thought a good idea.

I was correct in theory but as it happened, the price only got to the 1.1850 before making quite a convincing bullish reversal – waiting for a bearish set-up at 1.1893 was at least enough to stay out of trouble.

This pair will be in the market’s focus today as the European Central Bank will be making its monthly policy release, which will be watched more keenly than usual by the market. We are already seeing some volatility in the price in the hours leading up to this release, with the price behaving very bullishly and breaking up beyond the former resistance level at 1.1946.

It seems clear that the line of least resistance is upwards so the price is poised to jump higher still, but much will depend upon the content of what the ECB says and does later today. If that supports a bullish euro, it is likely to be a strong up day.

I see the best approach today as waiting to see the impact of the ECB release and if it is pushing up the price, to trade this pair long on short time frames.

Regarding the EUR, the European Central Bank will be releasing its Monetary Policy Statement and Main Refinancing Rate at 12:45pm London time, followed 45 minutes later by the usual press conference. Concerning the USD, there will be a 30-year bond auction at 6:01pm.