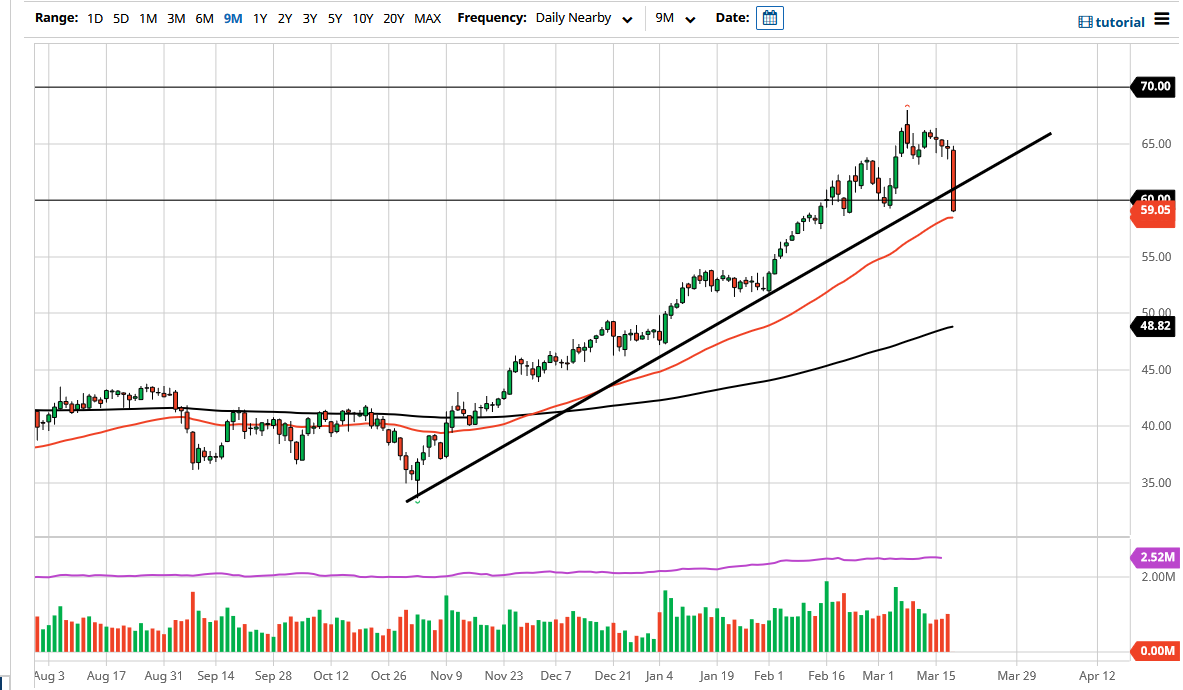

The West Texas Intermediate Crude Oil market lost almost 10% during the trading session on Thursday to slice through the $60 level. At this point, it looks very bearish, and the fact that we lost so much in a single session typically means big things for the future. After all, it is difficult to imagine a scenario where the market loses that much in one session and there is not some type of follow-through. This is a horrific looking candlestick, wiping out almost 2 months’ worth of gains, as oil traders suddenly have to worry about things like the bond market.

The bond market continues to sell off drastically in the United States, pushing up yields in a bid to attract money away from risk assets. It certainly looks as if it is working, and at this point in time I think what we are seeing is a massive turnaround that could cause some serious issues. For some time now, I have been saying that I thought the oil market was overbought and it looks like somebody decided to take profits today. Because of this, I would anticipate that the 50-day EMA could offer a little bit of support, but breaking the trendline I think was a much bigger problem, not to mention the fact that we just wiped out a couple of lows that should have in theory held the market up.

Looking at this chart, I think it is very likely we will go looking towards the $55 level, but we may bounce in the short term before actually making the move. However, if yields in America continue to rise the way they have, then it might be difficult for crude oil to really take off as the US dollar will gain strength. After all, the commodity is priced in US dollars, so that will take less of those greenbacks to buy a barrel of oil.

As the European Union continues to struggle with opening up, it has people worried about whether or not there is any true demand for crude oil at the moment. Yes, OPEC has cut some of its production, but at the end of the day there is more than enough out there to fill demand, as OPEC does not control as much of the market as it once did.