The USD/JPY hit a new low as it retreated to the 107.97 support level today, the lowest for the currency pair in over a month-and-a-half. Despite risk appetite, the weak US dollar keeps the currency pair under pressure. The Japanese yen got some support from the announcement of an improvement in the country's trade and industry sectors, which recorded improved figures in February. But with the resurgence of COVID-19 cases in Japan, will the world's third largest economy fail to meet its economic forecast?

According to the Ministry of Economy, Trade and Industry (METI), Japanese industrial production fell 1.3% in February, down from 3.1% in January. But the reading exceeded the median estimate of -2.1%. The Japanese industry recorded a decline in cars, electrical machinery, transportation equipment, and petroleum products. On an annualized basis, Japanese industrial output declined 2%, up from 5.3% in January.

Capacity utilization came in at 93 in February, down from 95.7 in the previous month. However, it marks the fifth month in a row that capacity utilization has exceeded 90 points.

On the trade front, the country's trade surplus widened to $61.39 billion in March, beating market expectations. Accordingly, exports rose at an annual rate of 16.1%, to its highest level in three years, while imports jumped by 5.7% to its highest level in 14 months. In the first quarter of 2021, Tokyo reversed its trade deficit since January.

The Bank of Japan (BoJ) has thrown its weight on the growing popularity of central bank digital currencies (CBDCs) in the wake of the rise of the digital yuan. The BoJ recently announced that it had started a CBDC experiment to learn the technical feasibility of the digital yen. Last fall, the Bank of Japan published a document outlining three stages of testing for the digital yen. The main concern, according to Bank of Japan Governor Haruhiko Kuroda, is the ability to complete cash transactions or offline payments in the event of an emergency.

The public health crisis of COVID-19 continues to weigh on Japan, as local reports confirm that infections have reached their highest level in four months. The new cases and the seven-day average exceeded 4,000 again, bringing the total cases in the country to 535,000. The death toll exceeded 9,600 people.

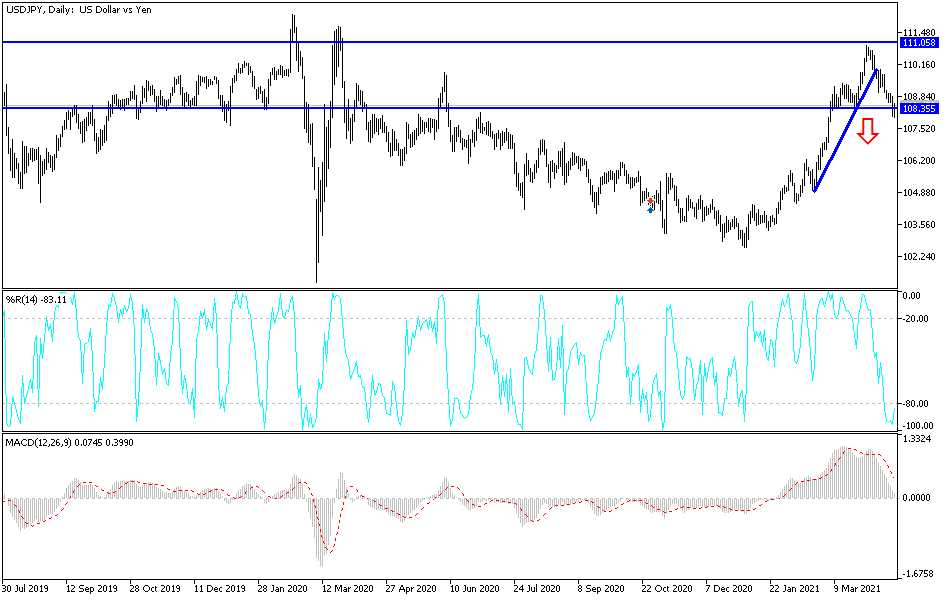

Technical analysis of the pair:

On the daily chart, the USD/JPY is still in the range of its descending channel, and stability below the 108.00 psychological support will support the bears. The pair would then be ready to test stronger support levels, the closest of which are currently 107.85, 107.00 and 106.65. Bearing in mind that these levels will move the technical indicators to strong oversold levels, a retracement to the correction is expected at any time. Despite the recent performance, I would prefer to buy the currency pair from those mentioned levels. On the upside, the bulls will not control the general trend again without breaching the 110.00 psychological resistance.

The currency pair is not anticipating any important Japanese or American economic data, so risk sentiment will have the strongest impact on the pair's trend.