Last Week’s Monday’s GBP/USD signals were not triggered, as there was no bullish price action at the key support level of 1.4139 when it was that were reached that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today only.

Short Trade Ideas

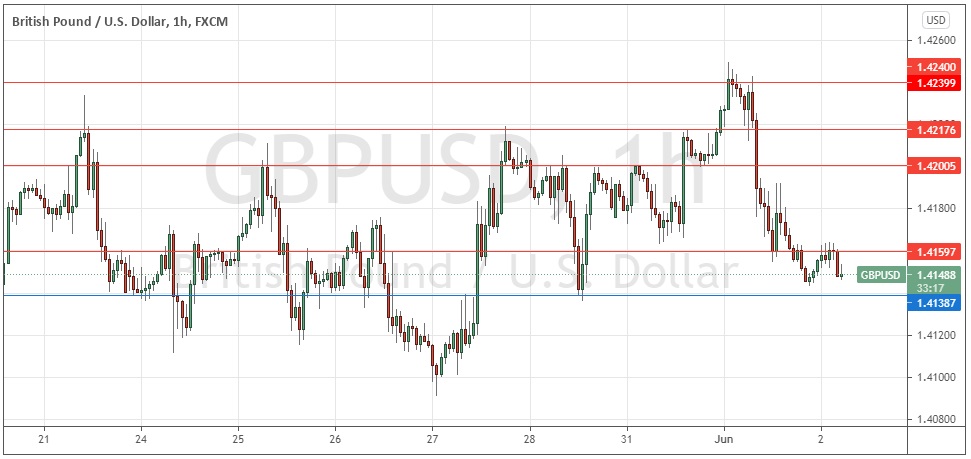

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4160, 1.4200, or 1.4218.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4139.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote on Monday last week that even though the price was not far from a new multi-year high price, there was only one support level holding up the price, at 1.4139, and if this broke down the technical situation would become bearish, so I saw that level as a definite pivotal point.

This was not a great call, as although we got a couple of hourly closes below 1.4139, this breakdown was not decisive, and the price came back up again quite quickly.

Yesterday the technical picture looked bullish, with the price hitting a new 2.5-year high price and looking ready to break above the very pivotal area of long-term resistance at about 1.4240. However, the breakout quickly failed, and the price fell quite sharply, printing as many as three new lower “stairstep” resistance levels – the daily candlestick was a large outside candlestick from a high which closed strongly down, and that is a bearish sign, despite the long-term bullish trend.

It looks like we have strong bearish momentum, which is likely to see some continuation today, but I would not want to be short of this currency pair above 1.4125 or ideally 1.4100. If the price gets established below 1.4100, it will be likely to fall further. I will take a bearish bias if that happens, and I will also be happy to enter a new short trade if we get a firm bearish price action reversal at any of the resistance levels identified at or above 1.4160.

There is nothing of high importance scheduled today regarding either the GBP or the USD.