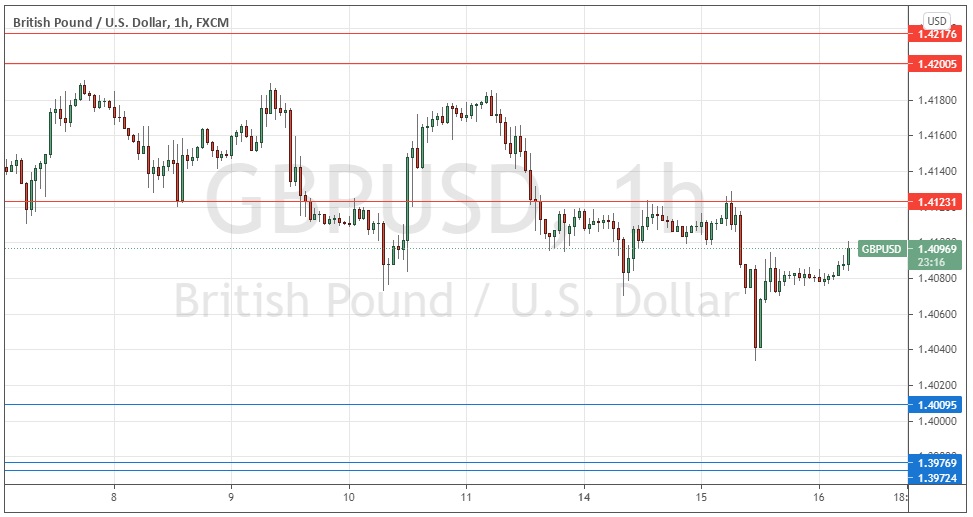

Last Monday’s GBP/USD signals would have produced a losing short trade from the bearish reversal at the resistance level identified at 1.4123, but I specifically stated not to go short from that level.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered before 5pm London time today.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4123 or 1.4200.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4010.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Monday that the 1.4100 area was under pressure again, and we saw this multi-week consolidation now starting to look heavy as the U.S. dollar seemed to be emerging as the strongest major currency. This suggested that we were becoming increasingly likely to see a strong bearish breakdown below the lower boundary of the recent consolidation pattern at 1.4100.

I was looking to go short following two consecutive lower hourly closes below 1.4087, and I think we will be likely to see a fast move down to the 1.4000 area, so I will take a bearish bias if that scenario sets up.

I did not want to go short from 1.4123 before that breakdown happened.

These were all good calls, as although the price did break down below the 1.4100 area, the action was not able to print two lower hourly closes below 1.4087 which was just as well as there was an immediate bullish rebound.

The price did continue to move down since Monday, reaching as low as 1.4040 at one point.

However, the price has rebounded strongly, driven in the last hour or so at the time of writing by higher-than-expected U.K. CPI (inflation) data, which was just released, coming in at an annualized increase of 2.1% compared to the expected 1.8%. This is not very dramatic, but it has pushed up the pound somewhat as we approach the London open.

There is no meaningful change to the technical picture, with the dominant feature near the current price being the resistance level at 1.4123, which is likely to be today’s pivotal point.

I would not want to take a short trade today from a reversal at that level. I will instead take a long bias if we get two consecutive hourly closes above that level during the first few hours of today’s London session.

Regarding the USD, there will be releases of the FOMC statement, federal funds rate, and projections at 7pm London time. There is nothing of high importance scheduled for today concerning the GBP.