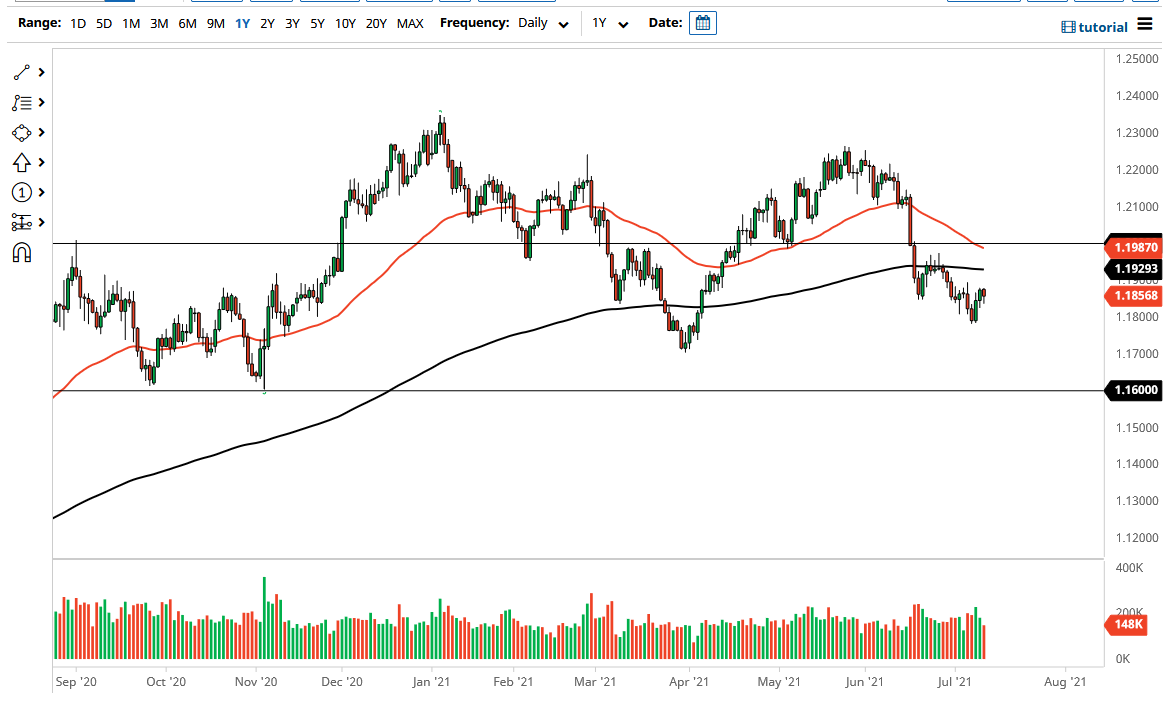

The euro fell a bit during the trading session on Monday, reaching down below the 1.1850 level. We turned around to rally a bit during the session but recovered a bit to hover right around that level. At this point, the market is trying to decide whether or not it is going to use the last couple of trading sessions as support, or if it is simply a reprieve to allow this market to go lower. Looking at the chart, the market is likely to see the 200-day EMA as a significant barrier, and it should be noted that the 50-day EMA is starting to dip towards the 200-day EMA. That is an area that a lot of people would pay close attention to because it would form the “death cross.”

To the downside, the 1.18 level would be the first support level, followed by the 1.17 level, and then the 1.16 level after that. Because of this, the market will remain very choppy even if we do break down unless there is some type of major “risk off event” in the markets that has people racing towards the greenback. That is very possible, and it certainly is worth noting that we ended up forming a bit of a “H pattern”, which is still very much valid. In fact, it measures for a move to right around the 1.16 or so.

There is always the other scenario in which the market would break above the 1.20 level eventually, and in that scenario I would become bullish of the euro. I do not necessarily think this will happen, but it is very likely to attract a lot of attention. That would obviously be in some type of major “anti-greenback” type of situation, but I do not see that happening quite yet. In fact, yields continue to see a little bit of a rise, but it is very slow, and it is worth noting that we did see a little bit of a pushback by bond bulls during the day, so I think it is only a matter of time before the 10-year yield comes into play. With this, I think that the market is going to continue to see a lot of noisy behavior, but that is normal for this pair.