The pair returned at the end of last week's trading to rebound higher with gains to the resistance level 110.35 before closing trading stable around the level of 110.08 dollar. The USD is still strong against the rest of the other major currencies because of the expectations of raising US interest rates and the distinguished US economic performance on the journey to recovery from the effects of the pandemic.

On the economic side, the BoJ kept the policy rate unchanged at -0.1% as expected. The bank kept bond purchases unchanged while expressing concerns about the impact of the pandemic on economic performance. Even BoJ Governor Kuroda stated that they would not hesitate to take additional easing steps if necessary.

In contrast, the US Federal Reserve also maintains a cautious stance, as Chairman Powell continues to play down the rise in inflation. This also puts the dollar in a weak position, although it looks like the Japanese economy may lag behind the US when it comes to recovery.

In addition, upbeat earnings numbers from US companies during this earnings season may be enough to keep the currency steady. The stronger than expected results may be enough to support the USD and prevent USDJPY from falling through the neckline of the head and shoulders. On the other hand, sharper declines may trigger more dollar bearishness and complete the dollar's reversal against the Japanese yen.

Data from the Commerce Department showed US retail sales rose 0.6% in June after falling by a revised 1.7% in May. The recovery surprised economists, who had expected retail sales to fall 0.4% compared to 1.3% originally reported in the previous month. Meanwhile, according to a preliminary report from the University of Michigan, he said that consumer confidence in the US unexpectedly deteriorated significantly in July.

The report showed the US consumer confidence index fell to 80.8 in July from 85.5 in June. The decline surprised economists who had expected the index to rise to a reading of 86.5.

U.S. President Joe Biden faces the troubling reality of soaring cases and deaths — and the constraints on his ability to combat the persistent vaccine frequency responsible for the summer's decline. Cases of COVID-19 have tripled in the past three weeks, and hospital admissions and deaths among unvaccinated people have increased. While rates are still sharply lower than their January highs, officials are concerned about reversal trendlines and what they see as needless disease and death. Cases are expected to continue to rise in the coming weeks.

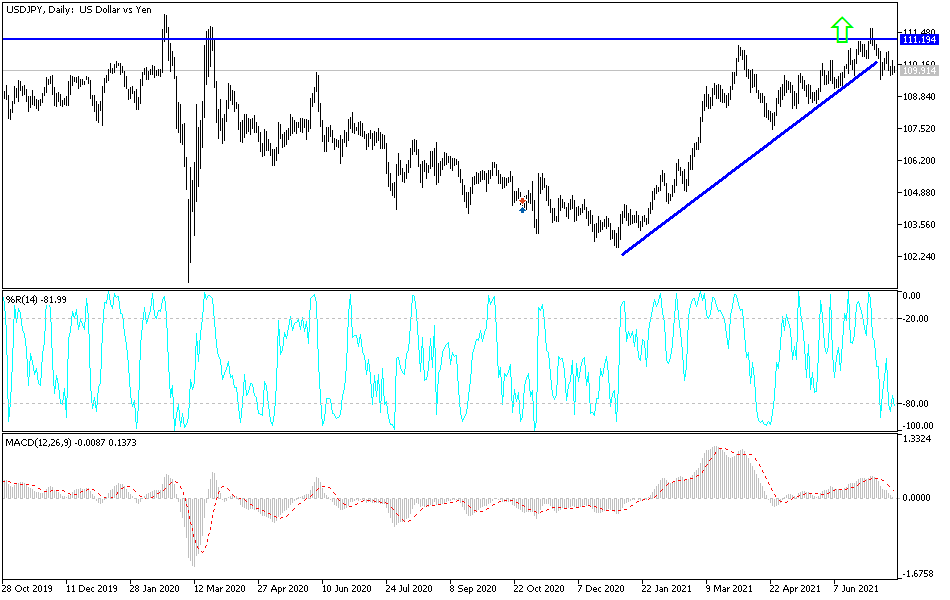

According to the technical analysis of the currency pair: In the near term and according to the performance on the hourly chart, it appears that the USD/JPY currency pair is trading within the formation of a descending channel. This indicates a significant short-term bearish momentum in market sentiment. Accordingly, the bulls will target potential rebound profits at around 110.23 or higher at 110.58. On the other hand, the bears will look to extend the decline towards 109.51 or lower to 109.17.

In the long term and according to the performance on the daily time frame, it appears that the USD/JPY currency pair is trading within the formation of a sharp ascending channel. This indicates a strong long-term bullish momentum in the market sentiment. As such, the bulls will look to ride the current uptrend by targeting profits at around 111.49 or higher at 112.88. On the other hand, the bears will target long-term pullbacks at 108,359 or lower at 106,915.

USDJPY has formed a head and shoulders reversal pattern and is currently testing neckline support around 109.75. A breakout below this could result in a slice as high as the chart pattern or 200 pips. The 100 SMA is still above the 200 SMA, so the trend is closer to the upside. In other words, the support is more likely to hold than to be broken. Then again, the gap between the indicators narrows to reflect weak upward pressure.