Last Thursday’s AUD/USD signal was not triggered as there was no bearish price action when the price zone at 0.7218/23 was first reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken before 5pm Tokyo time Wednesday.

Short Trade Idea

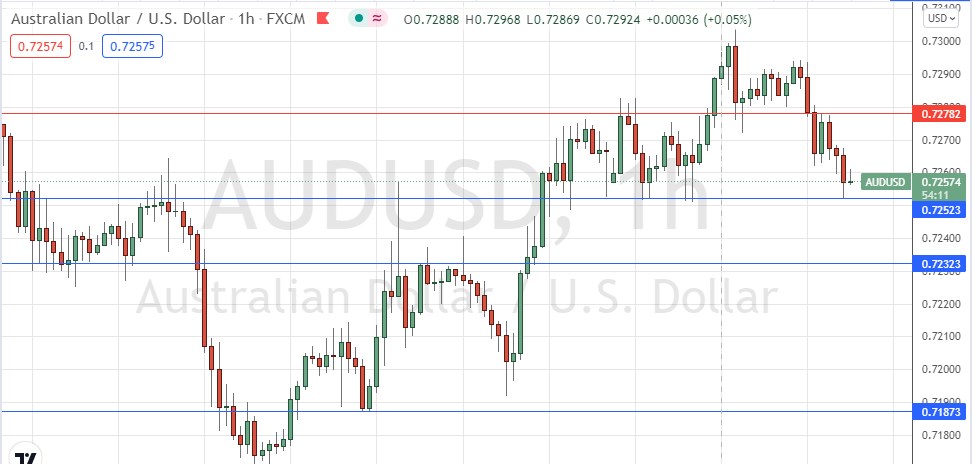

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7278.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7252 or 0.7232.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that there seemed to be a very pivotal price zone not far above the current price, from 0.7218 to 0.7223. I was looking to take a short trade from a bearish reversal off this zone or trade a bullish a weak rise after two consecutive hourly closes above 0.7225. This bullish set up did occur, and although it was initially followed by a bearish fall, over the next few days it would have been a profitable trade if taken.

We are now seeing a firm bearish pullback after a multi-day rise and this fits in with the broadly strong US dollar’s advance right now. The AUD has recently been weak but has recovered some strength yesterday so short trades here are no longer as attractive as they were.

The price is moving quite smoothly in its short-term swings, but medium-term direction looks very unclear here. The only feature that jumps out at me from the price chart below is the support level at 0.7252 which obviously is confluent with the big psychological quarter-number at 0.7250, so it may be strong. It has held as support many times when tested repeatedly over recent days.

Therefore, I see the best potential trade here today as a long entry from a bullish bounce at 0.7252 especially if the rejection also touches 0.7250.

Concerning the USD, there will be a release of ISM Services PMI data at 3pm London time. There is nothing of high importance due today regarding the AUD.