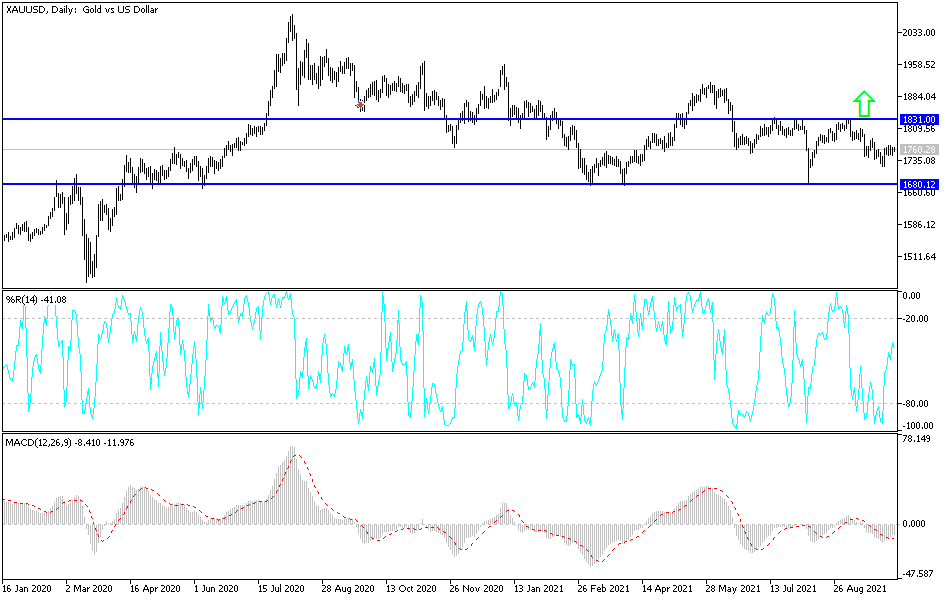

Gold markets fell significantly to kick off Wednesday, but just as we have seen all week, the $1750 level continues to offer support, as buyers come back in and push gold higher. Because of this, we have formed the third hammer in a row, which is a very bullish sign. That being said, we have not been able to take off quite yet, and that makes sense considering that the non-farm payroll number comes out on Friday, which will throw the markets all over the place.

This jobs report on Friday will be crucial, because it could be the last barrier for the Federal Reserve to start tapering and perhaps even tightening monetary policy. If that is the case, the market is likely to see a huge reaction to this jobs number, so because of this I think what we need to see is the Friday candlestick close before we put any real money to work. Obviously, you need to pay close attention to the US dollar, as it can also have a major input as to where gold markets go in the short term.

The 10-year yield is also something that we need to pay close attention to, because rising interest rates a lot of times will work against the value of gold. It does not have to; it just tends to do so over time. If we break above the highs of both the Monday and Tuesday candlesticks, then it allows this market to go looking towards the 50-day EMA. The 50-day EMA is currently sitting at the $1781 level and sloping a little bit lower, so I think that something worth watching. If we can clear that area, then it is likely that we could go looking towards the 200-day EMA which is just shy of the $1800 level.

To the downside, if we were to break down below the $1740 level, then it clears all of that support, and we would then go looking towards $1725 level, and then eventually down to the $1680 level after that. Obviously, that would be extraordinarily bearish for gold, and probably a situation where we would see the US dollar strengthened quite drastically. The next couple of days should give us a bit of a “heads up” as to where we go next.