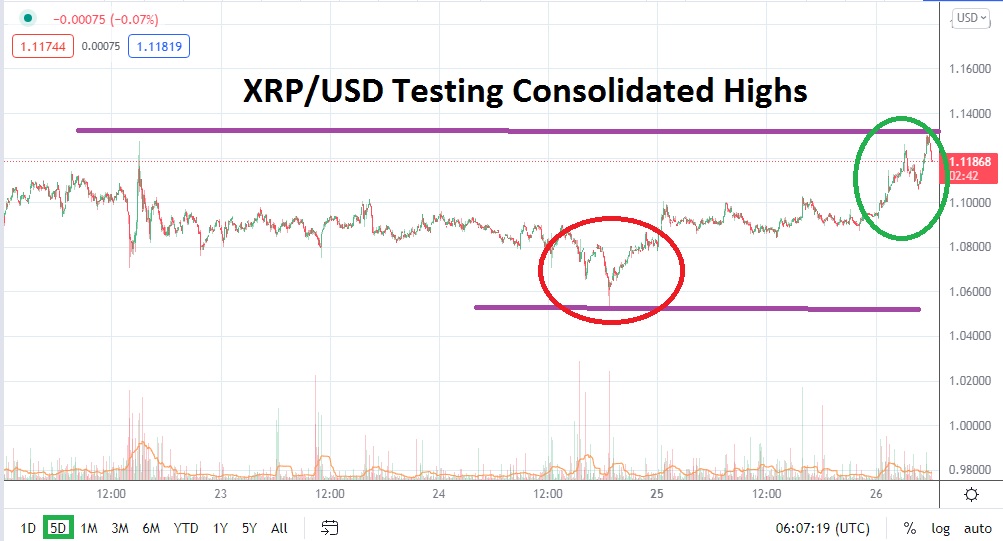

XRP/USD has demonstrated an abundance of consolidation the past handful of days. A look at a five day chart of Ripple shows the cryptocurrency has kept a tight price range, but intriguingly XRP/USD has begun to challenge short term highs in early trading today. The value of Ripple is lingering within sight of the 1.12300 mark and this is happening as the broad cryptocurrency market among its major counterparts is seeing a fresh wave of exuberance emerge.

Speculators of XRP/USD from a technical perspective are likely asking where the greatest amount of volatility can occur regarding direction in the short term. Behavioral sentiment appears to be generating power in the broad digital asset sector, and the combination of consolidation within XRP/USD within what could be considered within polite sight of its one month highs is notable. Traders could be tempted into believing if a big move were about to occur in XRP/USD it may be to the upside.

Current resistance appears to be rather vulnerable and if XRP/USD is able to penetrate the 1.12700 level and sustain prices above, the 1.13500 mark will certainly be a target. The rather comfortable trading within XRP/USD may not remain a luxury near term for Ripple and speculators should have carefully chosen entry, along with stop loss and take profit orders working to function it the market. On the 21st of October, XRP/USD was trading near a high of 1.17000. On the 10th of October XRP/USD was near the 1.23000 juncture.

While bearish speculators may say that XRP/USD has actually seen an incremental move lower the past week, it should be noted that this has taken place within the upper realms of its one month chart. Broad market conditions in cryptocurrencies remains near record values for some of the major counterparts of Ripple and speculators may be wondering if some of the exuberance can spill over into XRP/USD.

Buying Ripple on slight moves lower by cautious traders may prove to be a worthwhile speculative wager. XRP/USD has been in a consolidated mode the past several days, but it has shown signs of wanting to test short term highs. If current support levels near 1.11700 prove durable, going long XRP/USD could be a good trading stance.

Ripple Short Term Outlook:

Current Resistance: 1.13850

Current Support: 1.10600

High Target: 1.18500

Low Target: 1.07500