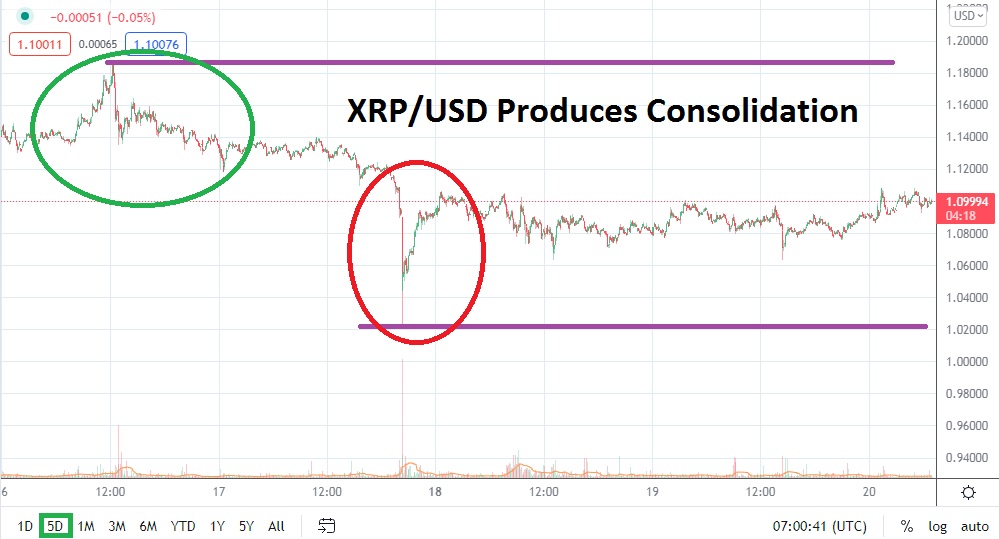

XRP/USD is hovering near the 1.10000 mark in early trading today. Ripple has produced a rather solid sideways trend the past few days. What is intriguing about this viewpoint is the notion that XRP/USD has continued to trade in the shadows of its major counterparts, and looks like it may build on broad market optimism which seems to be surging short term. The ability of XRP/USD to sustain its value largely between 1.06500 and 1.09500 the past few days and display some buying early today is also a positive development.

On the 10th of October, XRP/USD was trading near a high of 1.230000 and then did suffer a reversal lower which saw a low of nearly 1.02100 demonstrated on the 17th. However, the move to this lower boundary was a flash crash in many respects and the 1.06000 vicinity was quickly recaptured. Volatility remains a constant threat in cryptocurrencies and this does not exclude XRP/USD. Yet, Ripple often does offer the ability to trade in incremental steps which are not overly violent as long as conservative amounts of leverage are being used to trade.

If current support ratios hold their value near the 1.09200 level and a serious attack on the 1.08500 mark below is not demonstrated in the near term, it may signal that XRP/USD has the capability to move higher in the short term. If the 1.10000 is surpassed and values are sustained above this mark, it could be another dose of evidence that traders contemplating buying positions with a target between 1.11000 and 1.14000 may legitimately be appropriate.

The last time XRP/USD traded above the 1.140000 level substantially was on the 16th of October, but this was less than a week ago. While XRP/USD is certainly not like Ethereum and Bitcoin which can move in large chunks of value, Ripple has the ability to create sudden quick surges. Because XRP/USD moves in smaller increments, stop loss and take profit prices can be used which limit the odds of being devastated by volatility.

XRP/USD may be ready to move higher based on its ability to recently consolidate and traverse within sight of the 1.10000 ratio. Speculative bullish positions may prove to be a legitimate wager in the short term and traders looking for quick hitting trades that target nearby resistance may be rewarded.

Ripple Short-Term Outlook

Current Resistance: 1.10800

Current Support: 1.08500

High Target: 1.14400

Low Target: 1.06400