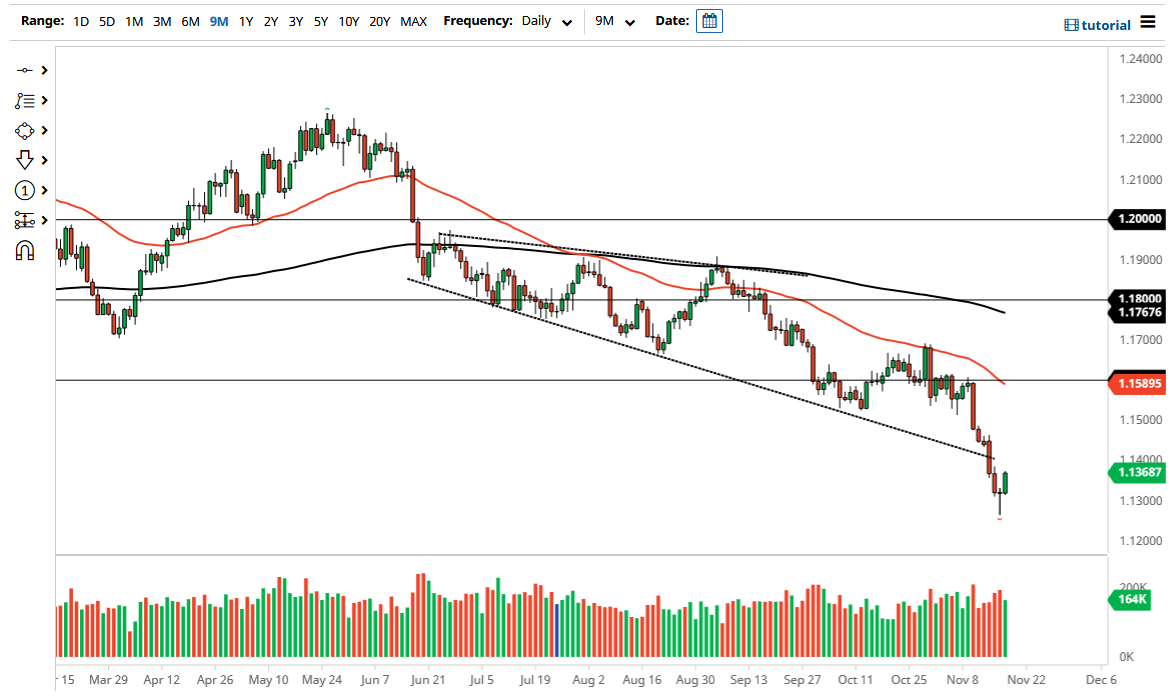

The Euro rallied a bit during the course of the trading session on Thursday to break above the top of the hammer from the previous session. This is a classic recovery signal, although I do not necessarily think that things turn around for very long amount of time. This market will eventually go looking for resistance above that we can start shorting into, and my first area of interest will be the 1.14 handle. Not only is that a large, round, psychological figure, but it is also where we had previously seen a downtrend line. Because of this, the market is likely to continue to see a lot of noisy behavior, with the possibility of an exhaustive candle that we can jump on.

I do not know if we are going to get it over the next 24 hours, so it is more likely than not going to be a scenario where I short this pair sometime early next week. The 50 day EMA currently sits at the 1.16 handle and is falling from here, so that is also an indicator that you will need to be paying attention to on any type of longer-term bounce. In fact, it is not until we can break above the 1.16 level that I would be interested in trying to buy this market due to the fact that the structure would only change at that point in time. The selloff was rather brutal, so now I will be paying close attention to the bond differential between Germany and United States, as it tends to be one of the main drivers of this pair. The market probably got a bit ahead of itself to the downside, so I think this recovery is going to be a nice selling opportunity given enough time, and therefore the market will more than likely give us an opportunity going forward. The market is more likely than not going to eventually break down below the 1.1250 level, an area that of course will continue to be worth paying attention to, as it could open up a move all the way down to the 1.10 level. That being said, I do not have any interest in trying to short until I get a decent set up.