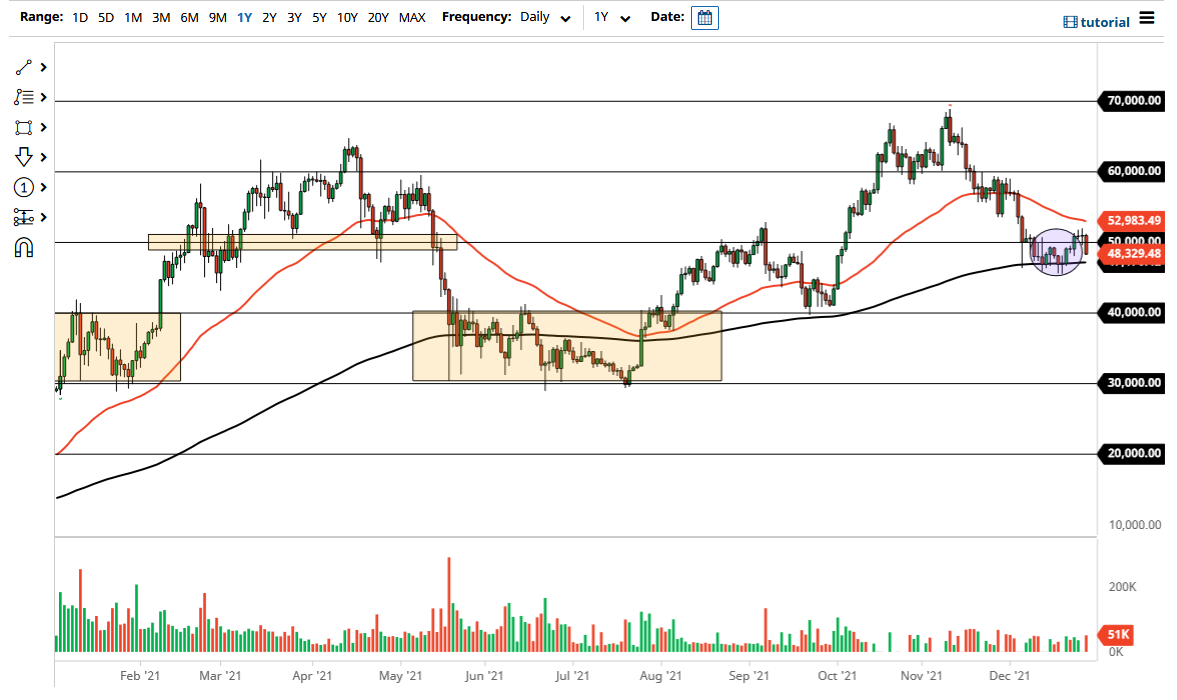

Bitcoin fell a bit on Tuesday, pulling back from the $51,000 level. This is the same type of choppy behavior that we have seen for a while, and I think we are basically just killing time as we head into the new year. We are essentially stuck between the 50 day EMA above and the 200 day EMA below. This is pretty common as far as consolidation is concerned, as we are trying to build some type of base in order to go higher. The $46,000 level continues to be a bit of a hard floor in this market, so I do not think we will break down below there. That being said, it does seem like it is going to take some effort to get above the crucial $51,000 level.

At this point, I buy on dips and simply add to my position in very small increments. I am not trying to get too cute, and not trying to short this market, and I certainly am not trying to time the whole thing. The most important thing on this chart is that we are in an uptrend and that is still very much true despite the fact that we are so sluggish at the moment. Remember, Bitcoin can also make the rest of the crypto markets move, so if this one takes off it is possible that we may see runs in other currencies as well.

The size of the candlestick is of course a little bit negative, but it is nothing that am overly worried about. I do not use leverage on Bitcoin, I think that is a very dangerous thing to do. In fact, it is one of the best things about Bitcoin: you do not need to use leverage because it moves so quickly.

If we do break down below the most recent lows, then we could drop down to the $40,000 level, where I think there is even more support. Not necessarily calling on this happening, but I do recognize it is a possibility. Between now and New Year’s Day, I anticipate that we are to simply going to grind back and forth and make a lot of noise while essentially going nowhere. You can say that about most markets, not just Bitcoin this time of year.