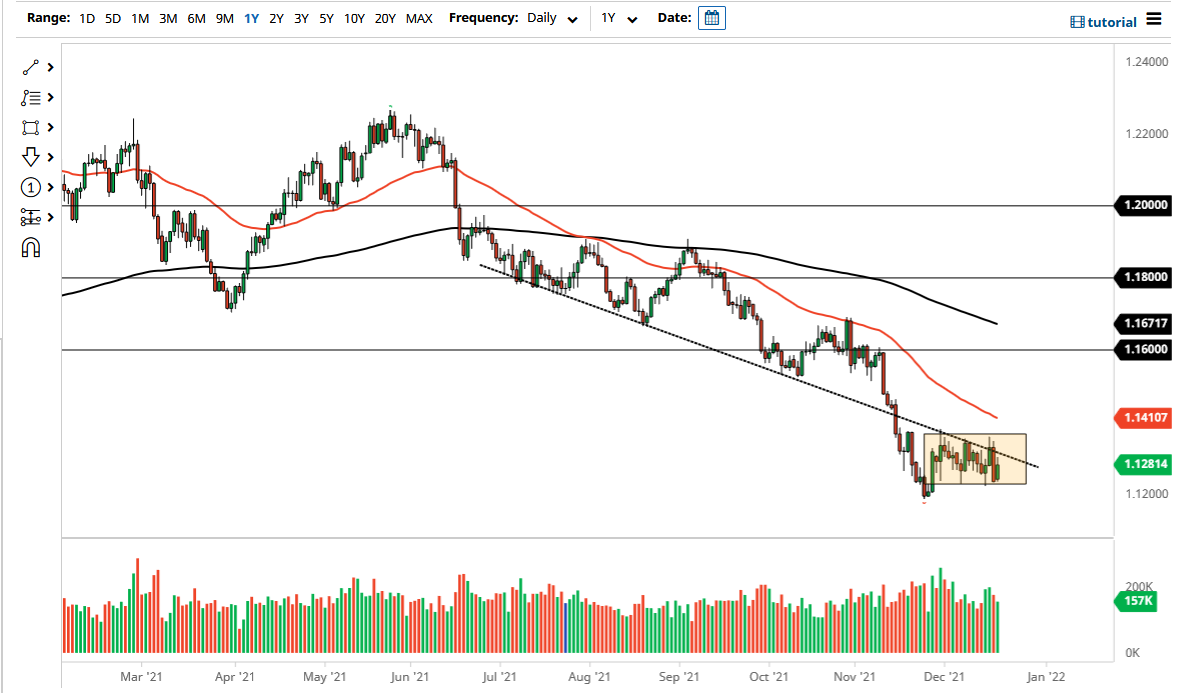

The euro rallied a bit on Monday, bouncing from the 1.1250 level yet again. It looks like we are going to continue to go sideways in general, as we do not have any reason to think that anything is going to change anytime soon. The reason I say this is that a lot of traders will not want to put a ton of risk on heading into the new year, as the liquidity issues are well-known. I think that we are hanging about the same area for the next two weeks, with the 1.1250 level being significant support, and the 1.14 level above being significant resistance.

It is worth noting that the 50 day EMA is starting to reach down towards the range, so I think technical traders will pay close attention to it. Ultimately, I think this is a market that you need to be very cautious with, but I believe that it is probably only a matter of time before we visit both sides of this consolidation, so I am looking at this as a market that you have to play back and forth like this. However, I would not put anything close to a huge position on right now, because if we get some kind of headline that crosses the wires in a very illiquid market, the pair can shoot straight up in the air or fall through the floor on you.

If we were to break down below the 1.12 level, then it is likely that the euro would go looking towards 1.10 level. The US dollar certainly looks as if it is trying to strengthen in general, so I believe it is probably much more likely to be a “fade the rallies” type of situation that we find ourselves in. The Federal Reserve and the European Central Bank are both starting to talk about inflation, but only the Federal Reserve is actually doing anything about it. This being the case, I think longer term we probably have more US dollar strength than anything else. In the short term though, we may be ready to tread a bit of water, simply “running out the clock” between now and the beginning of next year.