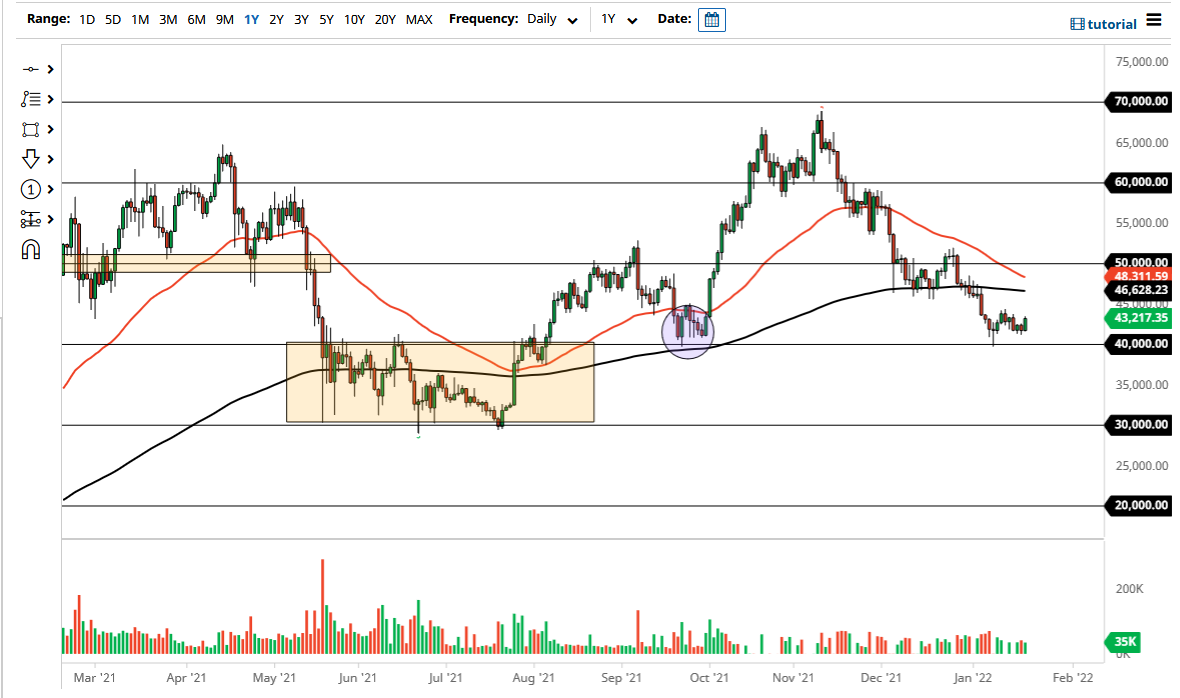

Bitcoin markets have bounced a bit during the trading session on Thursday to gain a little bit over 3%. By doing so, the market looks as if it is trying to continue this potential base, with a fairly significant amount of attention being paid to the $40,000 level. The $40,000 level has been supportive and of course is a large, round, psychologically significant figure that a lot of people will pay attention to. Because of this, you can expect a lot of noise in this general vicinity. Given enough time, we have to decide whether or not the $40,000 level is going to be the bottom?

To the upside, the $44,000 level has been somewhat difficult as of late, and if we can get above there it would most certainly be a victory for the bulls. Breaking above that level could open up a move towards the 200 day EMA rather quickly, which currently sits at $46,626. After that, then we could be looking at a move towards $50,000. All of that being said, I do recognize that the 50 day EMA is trying to break down below the 200 day EMA in order to form the so-called “death cross”, but that is an indicator that I do not put too much merit into, as it typically is late. Because of this, I think some longer-term traders may get this wrong and had defined themselves short covering yet again.

Bitcoin of course has been bullish for quite some time, and I think that will continue to be the case despite the fact that the last couple of months have been a bit rough. We have had a significant pullback to an area that has been supportive in the past, so it does make a certain amount of sense that there would be a lot of position building in this general vicinity. I think this could be very noisy, that I have no interest in shorting Bitcoin, and I think it is probably only a matter of time before longer-term trader step into the action and continue to build their position. All things being equal, this is a market that I think has much further to go and therefore you could do quite well by showing a certain amount of patient, just simply understand that the crypto markets tend to be very volatile so leverage is a necessary.