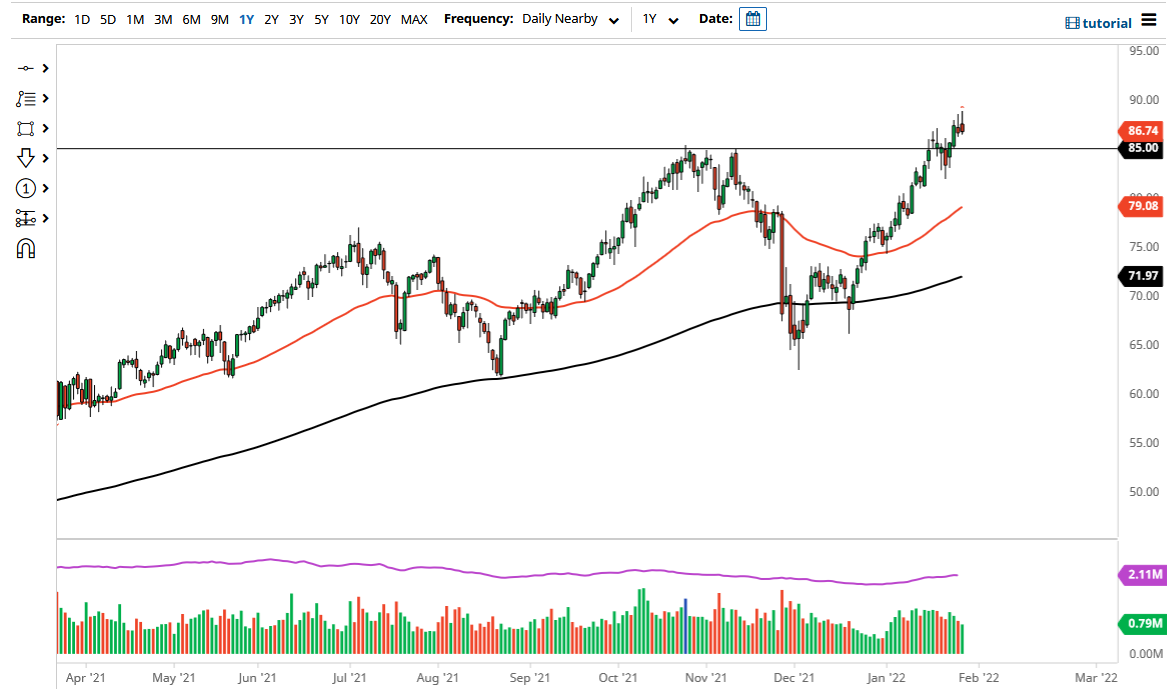

The West Texas Intermediate Crude Oil market rallied for the second day in a row on Friday, but also saw selling pressure at the highs like we did for the second day in a row. That being said, the market is likely to go looking towards the $85 level, which is a large, round, psychologically significant figure and where we had seen a lot of resistance previously. With that being said, the crude oil markets will continue to be bullish of the longer-term, we might get an opportunity to pick up a little bit of value.

Underneath, we not only have the $85 level to pay attention to, but we also have the $82.50 level that we could go looking for in order to start picking up momentum as well. That being said, I do believe that it is only a matter of trying to pick up oil when it pulls back in order to get long again. On the other hand, we could break above the top of these two shooting stars and go higher, which would be a very impulsive and bullish sign. The markets will continue to be noisy regardless, and it certainly makes a certain amount of sense that we would see volatility. We have gone straight up in the air for quite a while, and we may need to build up a little momentum to finally take off to the upside.

Keep in mind that there is still a lot of concern when it comes to the US economy slowing down, especially as we have the Federal Reserve looking to tighten, but at the end of the day OPEC has not been able to produce as much as they said they will. Also, with the reopening economies around the world, demand will continue to pick up. This is a market that I think needs to calm down just a bit, perhaps even pull back, in order to build up the necessary pressure to continue going higher. After all, this is a market that is very bullish, but nothing goes in one direction forever. I think that is essentially what you are seeing here, and that is what we need to pay attention to. Crude oil will continue to be one of the better trades for the next several weeks.