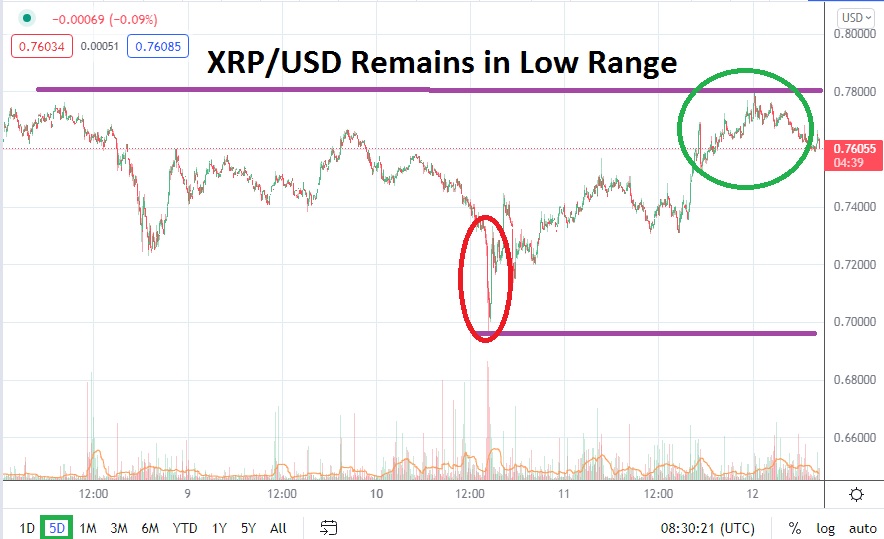

XRP/USD remains locked within a difficult bearish trend which has shown few signs of relenting. While XPR/USD was able to stage a rally higher yesterday, early headwinds this morning have Ripple trading once again below 76 cents. The dominant sentiment remains nervous as sellers continue to persist and support levels are being challenged. On the 10th of January, XRP/USD broke below the 70 cents ratio, but did bounce higher.

Optimistic traders who believe XRP/USD is oversold may continue to be testing the market with buying positions, but they are likely not catching a large amount of upside. Bullish traders who are going against the prevailing trend and wagering on reversals higher cannot be faulted, but they should make sure they are not overly ambitious when targeting goals.

The 78 cents barrier has proven quite tough and the goal of 79 cents in the short term may prove to be difficult to attain. It is certain reversals will continue to be seen in XRP/USD, but until Ripple topples the 80 cents juncture and proves it can sustain itself above, technical charts can be argued to be in a bearish mode.

Quick hitting trades may prove to be best and stop loss and take profit orders need to be practiced. If current support falters near the 0.075500 level and another dose of strong momentum downward is generated, traders cannot be faulted for believing XRP/USD could retest 74 to 73 cents and lower rather easily. The broad cryptocurrency market was able to produce gains yesterday, but in early trading today headwinds have been demonstrated.

The high for Ripple in the past month was a level of nearly 1.01000 on the 23rd of December, since then XRP/USD has resumed its downward trend. The question speculators may be considering is how far XRP/USD can decrease in value. If the 70 cents ratio is seriously challenged and Ripple sustains a price below this mark for a solid duration of time, this could be another poor signal. Until then, traders should be content to aim for support levels that are within a realistic reach. Selling XRP/USD on slight moves higher to pursue the downward trend may prove to be worthwhile near term as speculative wagers.

Ripple Short Term Outlook:

Current Resistance: 0.77020

Current Support: 0.75500

High Target: 0.79040

Low Target: 0.67800