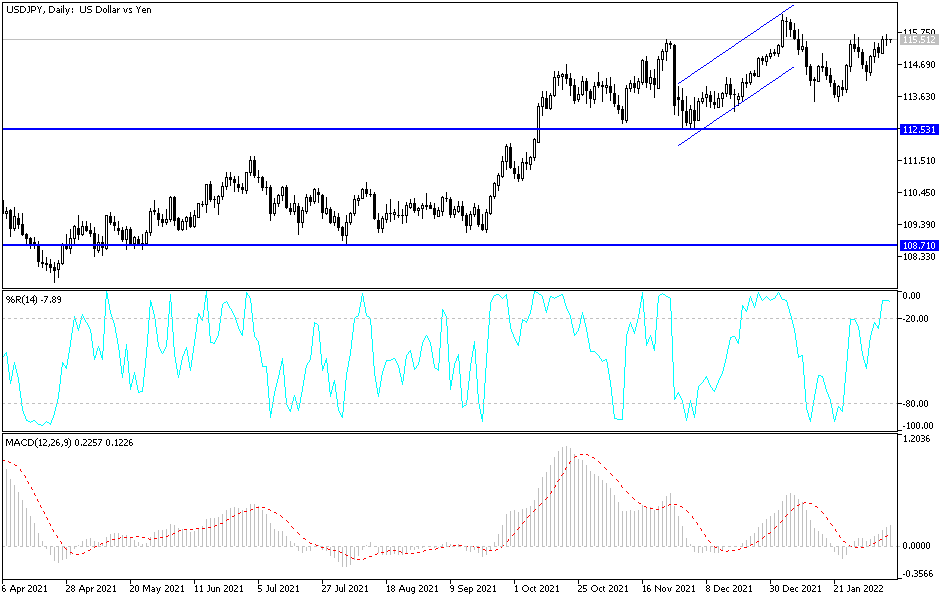

The bulls of the USD/JPY currency pair are still maintaining their gains, reaching the resistance level of 115.67. As I mentioned, the performance will remain unchanged until the US inflation figures are announced, which will determine the fate of the closings of the US dollar pairs for this week. Markets will get another update on the price hike Thursday when the Labor Department releases its report on US inflation for January. Economists expect the report to show inflation rose to a four-decade high of 7.3%.

An unexpected rise in prices can be seen as a sign that inflation may ease and may support the markets, although a larger increase may affect stocks. And the ever-increasing inflation could increase pressure on the Federal Reserve to accelerate plans to raise US interest rates in order to combat inflation.

Investors expect the Fed to raise interest rates at least four times this year, starting next month. They remain concerned that the Fed may need to raise rates further if inflation pressures remain high. As a result, markets are becoming more volatile as investors shift funds to prepare for a higher interest rate investment environment after a prolonged period of ultra-low interest rate policy throughout the pandemic.

On the other hand, the Japanese economy is still suffering from the effects of the epidemic. In the latest development, a BOJ board member who used to be a manufacturing executive said the country's permanently slow wage growth is necessary before any rate increase, a condition that could be more difficult to achieve than the bank's 2% inflation target. Raising the interest rate before wage growth would eat up resources that firms could use to raise wages. This is wrong, board member Toyaki Nakamura told reporters on Wednesday. “We will continue monetary easing continuously until wage growth is sustainable.”

The former CEO of Hitachi Ltd.'s comments came as Japanese yields rose near the upper end of the Bank of Japan, as traders bet the bank may eventually have to take steps toward policy normalization amid a global wave of tightening.

Bank of Japan Governor Kuroda faces a difficult task to convince markets that he will not be pivotal

Nakamura's president, Governor Haruhiko Kuroda, has been struggling to stamp out speculation that a policy pivot is looming, insisting there are no adjustments in the near future given the persistent weakness in Japanese price growth. And while Nakamura is not known as the leading voice on the Bank of Japan's board, his comments suggest he sees an even bigger hurdle. Many analysts see rising oil costs and temporary factors causing Japan's inflation to touch the BoJ's 2% rate target this year, a fact that has fueled market speculation with some backtracking on stimulus. But few people expect the 3% wage growth that Kuroda said is necessary for sustainable inflation.

According to the technical analysis of the pair: There is no change in my technical view that the price of the USD/JPY currency pair will remain bullish and stability above the psychological resistance 115.00 is important for the trend. The closest resistance levels for the trend are represented at 115.85 and 116.60, respectively, which is the most prominent on the daily chart below. On the other hand, the support levels 114.75 and 113.65 will remain important levels to return the bears' control and change the current bullish outlook. I still prefer selling the currency pair from every bullish level.