This momentum reached the resistance level 1.1185 at the time of writing the analysis of the currency pair in a month. The euro's cautious gains came amid optimism from the latest round of negotiations between Russia and Ukraine. German inflation has jumped to the highest level since records began after reunification in the early 1990s, with rising energy costs weighing on households and businesses even before the government activated an emergency plan to manage limited supplies.

According to official figures, German consumer prices rose 7.6% from a year earlier in March - topping the average estimate of 6.8% in the Bloomberg European Union Harmonized Reading Survey. All but one of the 27 economists saw a smaller move. A national figure of 7.3%. Combined with a higher-than-expected reading from Spain of about 10% earlier on Wednesday, the data underscores the difficulty of predicting price developments in Europe amid the heightened uncertainty unleashed by Russia's invasion of Ukraine.

These numbers are likely to raise expectations of an interest rate hike by the European Central Bank, as investors are already placing their bets on the increases in the wake of Spain's overrun. German Bundesbank President Joachim Nagel said this month that the ECB should not delay raising borrowing costs from record lows if inflation requires and may be able to start doing so in 2022.

Even before the outbreak of war just over a month ago, Germany - Europe's largest economy - faced major setbacks from supply restrictions linked to the pandemic, a problem that is now getting worse. Before that, it took the first step in an emergency plan to deal with limited energy supplies, with growing fears that Russia could halt shipments of natural gas.

A report issued by the country's Council of Economic Experts on the same day warned that supply disruptions could lead to a recession and push inflation higher. Even without this scenario, they expect prices to rise by an average of 6.1% in 2022. To help consumers and businesses bear the burden of higher costs, the government last week announced a second support package of about 17 billion euros ($18.9 billion), including a temporary cut in Fuel prices, one-time payments to families, and public transportation subsidies.

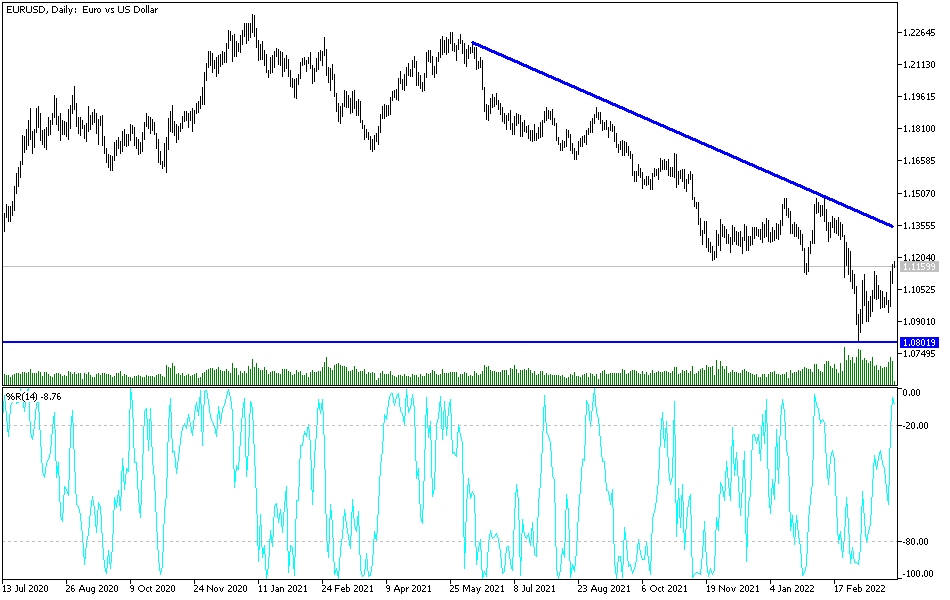

According to the technical analysis of the pair: The recent move has not exited the EUR/USD from its descending channel so far. It may need more momentum to breach the resistance levels 1.1240 and 1.1300, respectively, for the possibility of that happening. On the other hand, the return of the currency pair to the support area 1.1050 will support the return of the bears' control again. I still prefer to sell EURUSD from every bullish level. The currency pair will be affected today by the announcement of a package of US economic data, most notably the personal consumption expenditures price index, the Federal Reserve's preferred measure for measuring US inflation. Expectations of a US interest rate hike still support an upward trajectory for the US dollar against other major currencies.