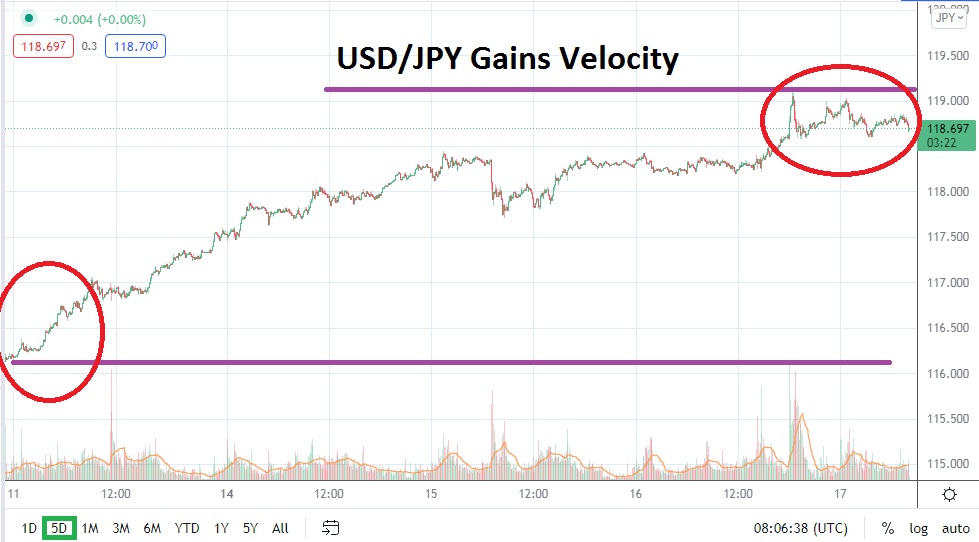

The solid bullish trend in the USD/JPY has continued to produce gains. In the wake of the interest rate hike from the U.S Federal Reserve yesterday the USD/JPY once again saw a rise in value and the forex pair momentarily climbed above the 119.000 level, which retested highs made the day before. Speculative forces are certainly being felt in the USD/JPY as it battles within an upper price range it has not sincerely traded since February of 2016.

Some fundamental traders may be questioning why the USD/JPY has gained when rather negative sentiment is being generated in the global financial markets. The Japanese Yen is historically considered a safe haven currency which has tended to get stronger when financial markets are nervous.

However, since the outbreak of the war in the Ukraine there has not been massive downward pressure in the USD/JPY, in fact it has been largely absent. The fact that Japanese equities have lost value and the Nikkei 225 is below its value which it was trading at this time last year, has not helped the Japanese Yen.

While some fundamental correlations may be absent for analysts the USD/JPY continues to technically move higher. Resistance levels have proven vulnerable and a look at a technical chart shows the USD/JPY having been at the 102.800 level at the end of November 2021. The trend in the forex pair has been significant, and one factor which may be having an effect is the shadow of potential interest rate hikes from the U.S Federal Reserve. The U.S central bank raise of a quarter of a point yesterday, and its stated intention to hike a handful of additional times this year may be creating strong support for the USD/JPY.

For day traders who have positions working on the buy side of the USD/JPY, rising stop losses may be appropriate if you do not want to cash out of the trade quite yet. There is certainly a chance the USD/JPY can trade higher. If the 118.950 is made vulnerable again and the 119.000 level is penetrated higher, traders may legitimately target the 119.250 juncture.

Sellers who believe the USD/JPY has been overbought should use tight stop loss ratios if they are inclined to bet against the existing trend. If the USD/JPY breaks through the 119.500 mark, the 120.000 may prove to be magnet near term. Traders should not be overly ambitious and be willing to cash in profits if they are happy with the winnings. Because if and when the USD/JPY reverses lower it could also produce sudden volatility if a sentiment shift occurs.

USD/JPY Short Term Outlook:

Current Resistance: 118.970

Current Support: 118.250

High Target: 119.530

Low Target: 116.910