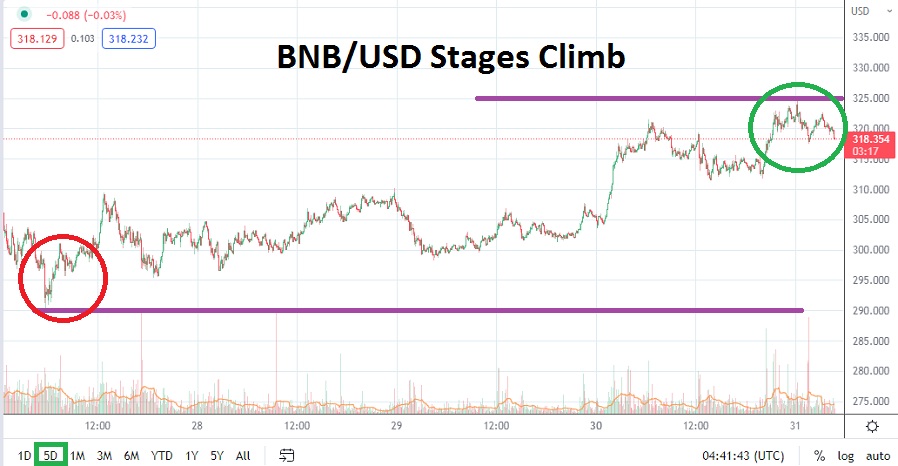

As of this writing, BNB/USD is trading below the 320.0000 mark, but it has traded near the 324.0000 juncture earlier this morning. On the 27th of May BNB/USD was trading near the 290.0000 ratio and its incremental climb upwards is intriguing technically. Having touched a low of nearly 225.0000 on the 12th of May during a frenzy of selling across the broad cryptocurrency market, Binance Coin has recovered rather well.

However, the long term bearish trend which has been shadowing digital assets has certainly continued to have an effect on BNB/USD. As a cryptocurrency which needs to be used within the Binance ecosystem to transact trading of other digital assets, BNB/USD enjoys a solid amount of volume, but it also remains a highly speculative cryptocurrency.

On the 25th of May BNB/USD did trade near the 338.0000 but then began to face headwinds and slumped. The result of strong selling after this high was made quickly produced the lows written about above on the 27th of May. Technical traders who are optimistic buyers do not have much evidence yet that a sudden burst of strong buying is going to puncture the highs seen on the 25th of May. Until the higher short term resistance levels are brushed aside and significant price velocity is seen in the broad cryptocurrency market, it is likely choppy conditions will prevail in BNB/USD.

Day traders may want to view the 324.0000 to 326.0000 values as rather solid resistance in the short term. If BNB/USD has trouble sustaining a price above the 320.0000 level in the short term, this may be a sign that some selling will gain momentum for BNB/USD and that support near the 313.0000 to 311.0000 ratios may be challenged. Market sentiment remains fragile and the incremental gains made since the 29th of May are good, but perhaps they are not enough to convince speculators that a strong bullish run is about to ignite.

Quick hitting trades are advised for cautious traders while using take-profit orders and conservative leverage. The use of momentum while seeking short term trends may prove worthwhile, and traders need to acknowledge that choppy results are likely to be demonstrated near term in BNB/USD.

Binance Coin Short-Term Outlook

Current Resistance: 322.4000

Current Support: 313.1000

High Target: 334.9000

Low Target: 306.0000