The GBP/USD exchange rate rose by more than a percentage yesterday to 1.2277 after US CPI inflation rose 8.5% in the year to July, coming in below 9.1% in June and consensus forecast for a reading of 8.7%. Core US CPI rose 5.9% in the year to July, unchanged in June, but less than the 6.1% consensus was looking for. As a result, the US dollar fell as investors bet that peak inflation might be over, thus reducing the need for the Federal Reserve to pursue a strict policy of raising interest rates.

The GBP/USD pair is stable around the 1.2230 level at the time of writing the analysis.

The US did not actually register any inflation last month with a monthly reading of 0%, which is lower than the +0.2% reading the market had been expecting. The US dollar has been bid through 2022, in part because the Fed has led its global peers in pushing interest rates higher. Thus, exceeding the Fed's "peak" forecast may indicate that the "peak dollar" has arrived. “Powell might have been right to switch a few weeks ago. The pressure on the Fed to be aggressive is sure to come in September. Long-term trades will rise strongly.

James Knightley, chief economist at ING Bank, said: “Low inflation in the US has shifted the odds in favor of a 50 basis point Fed rate hike in September instead of 75 basis points, but there is a lot of data that She will come every now and then.” "Finally some good news about inflation," says Justin Wolfers, professor of public policy and economics at the University of Michigan. We may have seen peak inflation.” However, some economists warn that it is too simplistic to assume that inflation is about to drop sharply back to the Fed's target of 2.0%.

“But the stabilization of core inflation highlights the challenges of easing inflation in parts of the slowly shifting CPI basket,” says Hussain Mahdi, macro investment strategist at HSBC Asset Management. He says services inflation will prove to be a thorn in the Fed's side as consumers rebalance consumption away from goods to services, and amid rising shelter costs.

Moreover, he noted that spending is backed by a very strong labor market.

HSBC Asset Management maintains a defensive and selective investment strategy with investors potentially overestimating 2023 earnings performance and the Fed's ability to enact pivotal policy. And if true, this will be consistent with the continued strength of the dollar. Christoph Bales, chief economist at Commerzbank, also cautioned against betting that inflation is "over", which he says is the decline in US headline inflation driven by falling gasoline prices, in response to lower global oil prices. "It is therefore likely that the further decline in the inflation rate will be slow," he added. "Although we can breathe a little easier after today's data, the inflation problem is likely to be very persistent."

Commerzbank expects US inflation to remain above 3% over the next year, despite the recession.

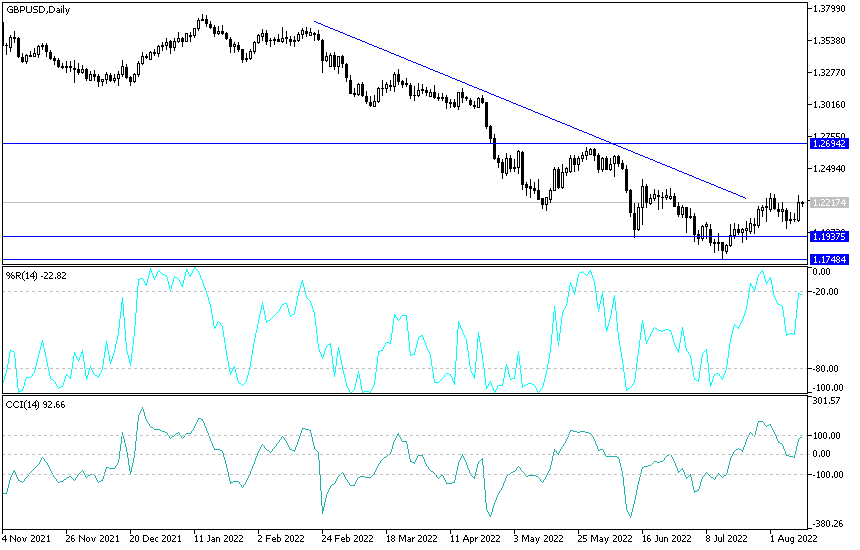

Sterling dollar forecast:

- The recent gains of the GBP/USD pair are beginning to break the downside trend, and it will need to move towards the 1.2330 and 1.2400 resistance levels to confirm its strength so far.

- Stability will remain below the 1.2200 support that supports the bears to stick to the general trend.

- We prefer selling sterling dollars from every bullish level.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.