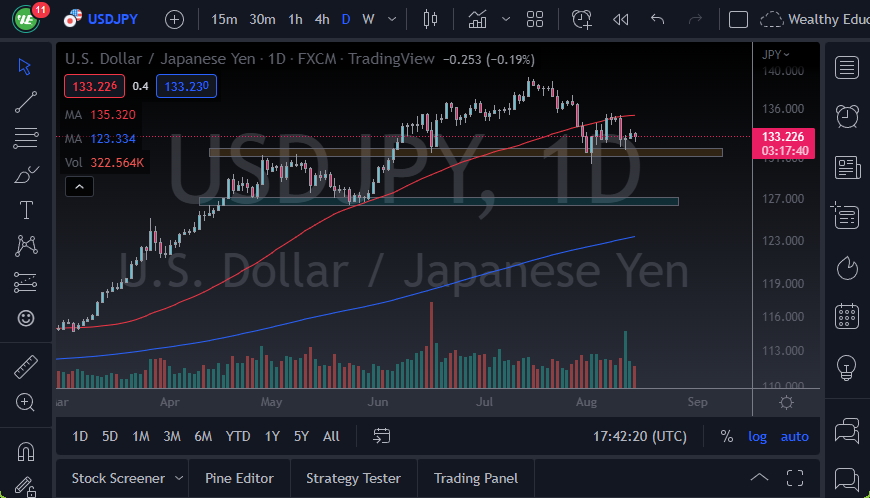

- The US dollar pulled back a bit against the Japanese yen in early Monday morning trading only to turn around and show signs of support.

- By doing so, the USD/JPY currency pair looks very likely to continue going back and forth, with the ¥133 area offering a bit of support.

- In fact, the ¥132.50 level seems to be even more remarkable when it comes to buying pressure, so I think we are essentially “stuck in this area” for the time being.

USD/JPY Technical Analysis

Ultimately, the 50-day EMA sits above the crucial ¥135.50 level, and I think will continue to offer a little bit of a technical barrier. Because of this, I will be looking at that as a gateway to much higher pricing, and if the US dollar can climb above that level, it’s very likely that this market would continue to see quite a bit of bullish pressure. Ultimately, the dollar could go looking toward the ¥140 level, which is an area that I think offers psychological and structural resistance based on historical charts.

On the other side of the equation, if we were to break down below the ¥132.50 level, we could go looking all the way down to the ¥127 level for support. I would also anticipate that the ¥130 level will at least be of psychological importance, so we could see noise in that vicinity as well. I do believe that given enough time, this is a market that continues to be very noisy to say the least, so you have to be cautious about your position sizing, but it’s obvious that it’s going to be much easier to go to the uptside than to the down, as it is with the longer timeframe trend.

The interest rate differential in the United States continues to favor the greenback over the yen, but if it appears that the Federal Reserve will have to be a little bit looser with its monetary policy than once anticipated, that could put downward pressure on this market. As a general rule, lower interest rates tend to favor the Japanese yen, which is what we are seeing as of late. In other words, the old correlations still remain, and it makes a certain amount of sense that we would see this play out in the same way.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.