The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are very strong trends in the market right now, which can be easy to exploit profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 2nd October that the best trades for the week were likely to be:

- Short of the NZD/USD currency pair. The price rose by 0.17%, producing a small loss.

- Long of the USD/JPY currency pair. The price rose by 0.45%, giving a small win.

These trades produced a small overall averaged win of 0.14%.

The news is dominated by a seeming emerging consensus at the US Federal Reserve around a hawkish path, following increased speculation earlier last week of a potential dovish pivot. Judging by recent comments from Fed members, it seems likely that the Fed is determined to act by continuing to raise rates to 4.50% and then holding them there while inflation is assessed further, then being prepared to hike higher if inflation remains persistent. This emerging consensus has boosted the US Dollar, pushed the 2-year treasury yield up to test its recent multi-year high, and sent stock markets strongly lower over the week, with a notable decline on Friday.

Another significant event was Friday’s strong US jobs data, which emphasized that the US economy is still quite hot, making it seems more likely that further rate hikes will be required soon, strengthening the bearish case in stock markets.

OPEC agreed to cut production by 2 million barrels per day, which sent the price of WTI Crude Oil higher.

Global attention has also turned back to the war in Ukraine as following Russian annexation and an aggressive speech by President Putin, Ukrainian forces seem to have successfully attacked a strategically important bridge linking Crimea to Russia. This may also help to strengthen risk-off sentiment, as will President Biden’s strong warning over implied Russian nuclear threats, and last week’s North Korean missile test.

The details of the important economic data releases last week can be summarised as follows:

- US Non-Farm Employment Change, Unemployment Rate, Average Hourly Earnings – a net 263k new jobs were created, higher than the 248k which had been expected, while the unemployment rate unexpectedly fell from 3.7% to 3.5%. Average hourly earnings increased by 0.3% month on month as had been expected.

- Swiss CPI (inflation) – this came in lower than expected, showing a month on month decline of 0.2% when an increase of 0.1% was forecasted, giving hope for lower inflation in Europe.

- US ISM Services PMI data – this came in very slightly higher than expected.

- US ISM Manufacturing PMI data – this came in somewhat lower than expected.

- RBA Cash Rate & Rate Statement – the RBA hiked rates by only 0.25% when a hike of 0.50% was widely expected, sending the Aussie lower over the week.

- RBNZ Official Cash Rate & Rate Statement – the RBNZ left rates alone as had been expected.

- US JOLTS Job Openings – this data came in worse than had been expected.

- OPEC Meetings – OPEC agreed to lower daily production by 2 million barrels, double what had been expected.

- Canadian Unemployment Rate & Employment Change – the data was considerably better than expected, with the unemployment rate falling from 3.7% to 3.5%.

The Forex market saw relative strength in the New Zealand, Canadian, and US Dollars last week. The weakest currency is the Australian Dollar.

Rates of coronavirus infection globally increased last week for the first time since July, but the increase and overall numbers are small. The only significant growths in new confirmed coronavirus cases overall right now are happening in Austria, Finland, Germany, Italy, Liechtenstein, Micronesia, Singapore, and Taiwan.

The Week Ahead: 10th October – 14th October 2022

The coming week in the markets is likely to see a higher of volatility, with the US CPI release having a great deal of dramatic potential. Releases due are, in order of likely importance:

- US CPI (inflation) data

- FOMC Meeting Minutes

- UK GDP

- US Producer Price Index data

- US Retail Sales data

- US Preliminary UoM Consumer Sentiment

It is a public holiday this Monday 10th October in the USA, Canada, and Japan.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish pin or hammer candlestick which closed up right near the high or its range. It also rejected what seems to be a new support level confluent with the very big round number at 110.00. These are bullish signs, and there is no question that the long-term trend is very bullish.

The Dollar was very mixed the week before last but has gained wide enough strength to be advancing now almost everywhere.

Bulls may have a small reason to be cautious, in that last week’s close was not a new high, and we did earlier see quite a strong sell-off from the 114.00 area.

It may be a good idea to only look for long trades in the US Dollar over the coming week. This is a very powerful, long-term bullish trend in the most important currency in the Forex market.

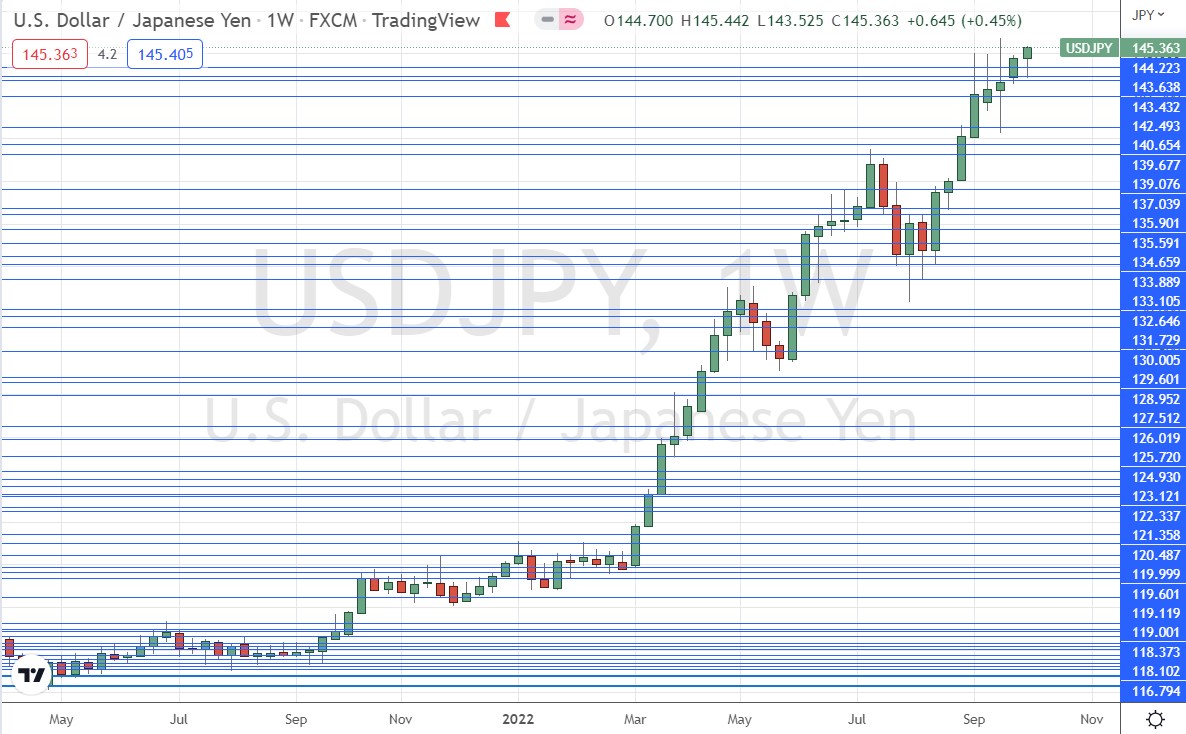

USD/JPY

Last week saw the USD/JPY currency pair print another bullish candlestick which again made the highest weekly close since 1998. The closing price was right at the high of the week. There have been 8 consecutive up weeks. These are bullish signs.

This currency pair is worth keeping an eye on this week, as the US Dollar has regained strength. A look at the price chart below shows that this pair is in a very strong long-term bullish trend. The problem for bulls was that the Bank of Japan did not want to see the price above the ¥145 handle, so had intervened at this area to stop any new advance beyond it. However, it looks like the price has successfully got established above that key round number at ¥145 so it may be that the Bank will draw a higher line in the sand at which to intervene.

If the Bank of Japan’s intervention fails, or if the Bank chooses not to intervene, the price could make a dramatic rise and even reach ¥150 rapidly.

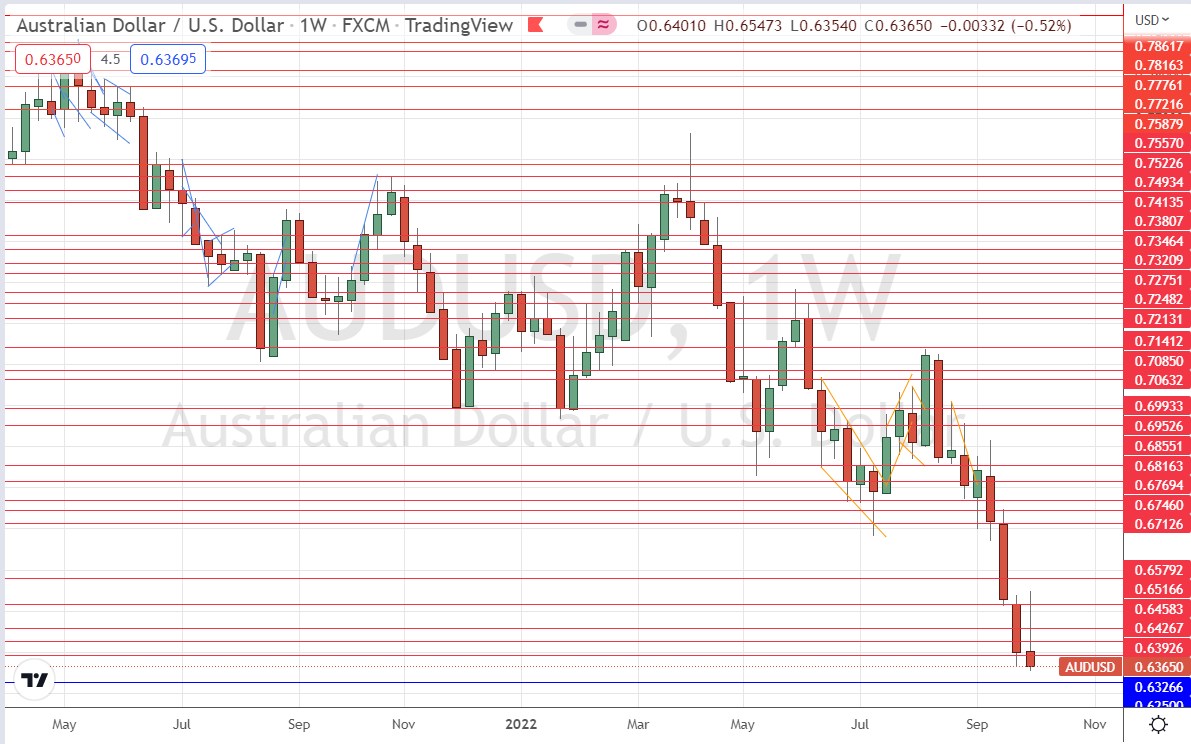

AUD/USD

Last week saw the AUD/USD currency pair print a fairly large bearish hammer candlestick which saw the currency pair again reach its lowest price since the coronavirus panic of May 2020, and make its lowest weekly close in more than a decade. The candlestick closed very near its low. These are bearish signs.

The bearishness is supported fundamentally as the Australian Dollar was already weak when the Reserve Bank of Australia announced a lower-than-expected rate hike last week, which helped to trigger a further fall in the currency’s value. This is a bearish tailwind.

Despite the bearish picture, there is one significant resistance level which is not far away which could trouble bears, at $0.6327. If the price can get established below that level, it will be a very bearish sign.

The Australian Dollar is currently the weakest major currency in the Forex market after the Japanese Yen, but unlike the Yen is extremely unlikely to get any supportive intervention from its central bank.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short of the AUD/USD currency pair and cautiously long of the USD/JPY currency pair which remains prone to intervention from the Bank of Japan.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.