The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are some valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 18th December that the best trade opportunities for the week were likely to be a long trade in Silver against the US Dollar (XAG/USD) following a daily close above $24.15 and in the EUR/USD currency pair following a daily close higher than the two previous daily closes. The Silver trade did not set up, but the EUR/USD gave an entry at $1.0622, with the price ending the week 8 pips lower, a decline of less than 0.01%.

The news is currently dominated by the Bank of Japan’s upwards revision of its yield curve control policy, which gave a major boost to the Yen and put Yen futures shorts at their lowest level since August, and the higher-than-expected US Final GDP data which was released showing the US economy growing at an annualized rate of 3.2% compared to the 2.9% which had been expected. There was also a release of the Reserve Bank of Australia’s meeting minutes which showed the Bank had seriously considered a lower rate hike or no hike at all, and this was given a minor dovish interpretation by the market on the AUD.

The only other important data released last week was Canadian inflation data, which showed an annualized decline but which in fact came in just a fraction higher than expected, showing a month-on-month increase of 0.1%.

Global stock markets ended the week mostly unchanged, except the Japanese Nikkei 225 index which closed strongly lower due mostly to the new strength in the Japanese Yen. The Forex market saw most strength in the Japanese Yen last week, with the New Zealand Dollar the weakest major currency.

Rates of coronavirus infection worldwide fell slightly last week according to official data. However, there are credible reports suggesting millions of new infections in China’s “zero covid” measures have recently been scrapped. The most significant growths in new confirmed coronavirus cases overall right now are happening in China, Japan, New Zealand, and Taiwan.

The Week Ahead: 26th December – 30th December 2022

The coming week in the markets is likely to see a lower level of volatility, as there are no major data releases scheduled, and as it is the week of the Christmas / New Year holiday.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bearish inside candlestick which showed a small fall over the week. The former support level at 102.94 has again acted as effective resistance. The chart is clearly bearish.

The long-term bullish trend in the US Dollar is over technically, and we see a new long-term bearish trend established already with the price closing below its levels of both 3 and 6 months ago.

Short-term direction in the US Dollar looks likely to be bearish below 104.92. Therefore, it will likely be wise to only take trades short of the US Dollar over the coming week.

XAG/USD (Silver)

Last week saw Silver print a bullish engulfing candlestick which made the highest price seen since April this year. There is bullish momentum, but the resistance at $24.15 is also significant and a potential blow to bulls hoping for the price to reach the big round number at $25.

Although most commodities are not performing strongly in today’s market, precious metals such as Gold and Silver have been notable exceptions. Some other non-precious metals such as Copper have also done well.

I think that Silver will continue to rise, but I want to see a daily (New York) close above $24.15 before making any new long trade entries.

EUR/USD

Last week saw the EUR/USD currency pair rise and print an inside candlestick, but nothing that really looks solidly bullish. However, the Euro has held up in periods of US Dollar strength and retains some strength.

This pair is clearly showing a bullish long-term trend, with the highest weekly close seen since June. Such trends are usually statistically quite reliable in this currency pair, which is also usually the cheapest Forex pair to trade.

As the price has been consolidating within a retracement, I will not enter a long trade in this currency pair until we get a daily close higher than the previous two daily closes.

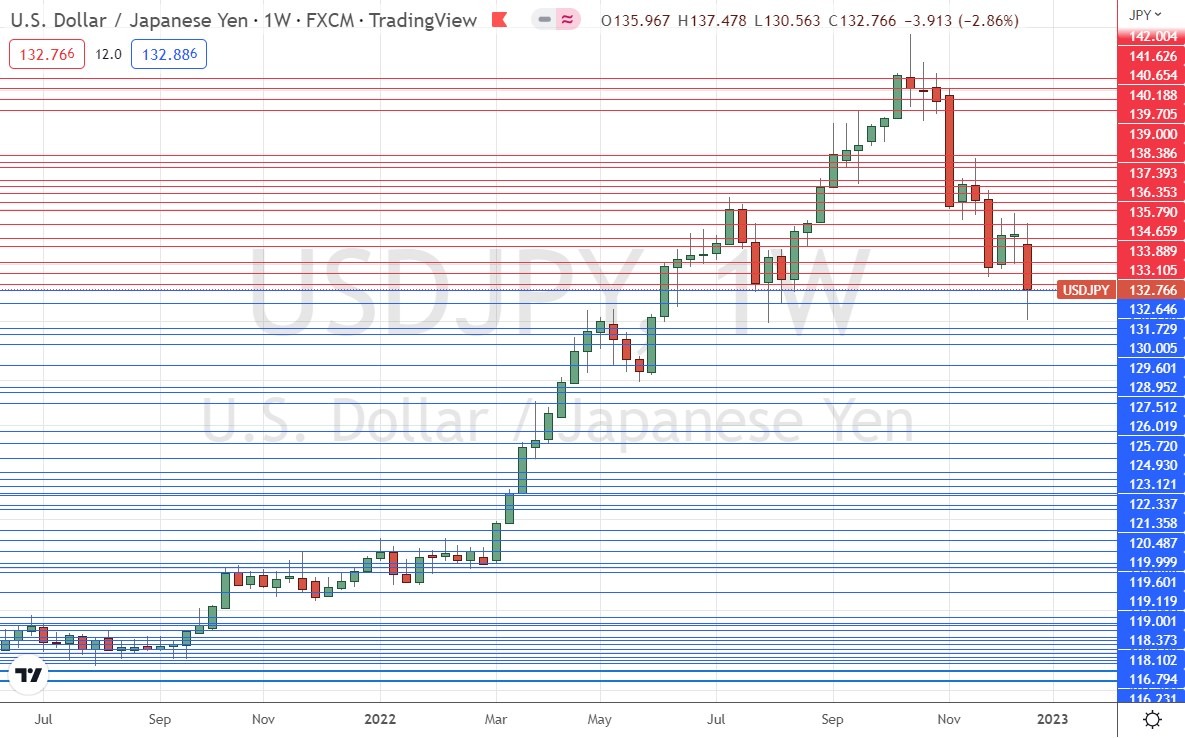

USD/JPY

Last week the USD/JPY currency pair printed a bearish engulfing candlestick with a healthy range, reaching a new 4-month low, although in the price chart below it is obvious that the weekly candlestick has a significant lower wick which calls the bearishness into some question.

We need to drill down deeper into what happened last week: the Bank of Japan made a policy change allowing its 10-year treasury yields to rise, and this made the Yen much more attractive to investors. The first day following the announcement, this currency pair fell by almost 700 pips, its biggest daily downwards movement in over 24 years. This happened in just one day, and the price has been mostly recovering since without retesting the 4-month low.

The Yen may not have much bearish momentum left in it right now, but it certainly is showing a long-term bearish trend and will be prone to more periods of strength. For this reason, I think a new short trade entry can make sense if we get a daily (New York) close below €131.56.

Bottom Line

I see the best opportunity in the financial markets this week as likely to be a long trade in Silver against the US Dollar (XAG/USD) following a daily close above $24.15 and in the EUR/USD currency pair following a daily close higher than the two previous daily closes. A short trade in the USD/JPY currency pair will also be attractive following a daily close below €131.56.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.