Top Forex Brokers

Bearish view

- Sell the EUR/USD pair and set a take-profit at 1.0500.

- Add a stop-loss at 1.0675.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 1.0600 and a take-profit at 1.0700.

- Add a stop-loss at 1.0500.

The EUR/USD exchange rate crawled back as last week’s dollar sell-off took a breather during the American session. The pair rose 1.0560 on Tuesday morning, a few points above last Friday’s low of 1.0498.

US retail sales and manufacturing data ahead

The financial market was upbeat on Monday even as the war in Israel continued and as the US dollar retreated. The Dow Jones and Nasdaq 100 indices jumped by more than 300 and 150 points, respectively.

This price action happened even as the war between Israel and Hamas continued. The market seems to believe that the war will not continue for a longer period because of the anticipated Israeli and Hamas death toll.

The EUR/USD pair also rose slightly even as the US published strong consumer expectation data. Consumers believe that inflation will continue rising in 2024 as the war continues and the price of crude oil soars.

The next key catalyst for the pair will be the upcoming US retail sales data. Economists expect the data to show that the headline retail sales rose by 0.3% while core sales jumped by 0.2%. If analysts are accurate, these numbers will mean that the health of the consumer remained high in September.

The pair will also react to the latest industrial and manufacturing production data. Economists expect the data to reveal that manufacturing production rose by 0.2% in September while industrial production jumped by 0.1%. These are important economic indicators in the US.

Several Federal Reserve officials will talk and express their view about the state of the economy and what to expect in the coming meetings. The two officials to watch will be Tom Barkin and Michele Bowman.

EUR/USD technical analysis

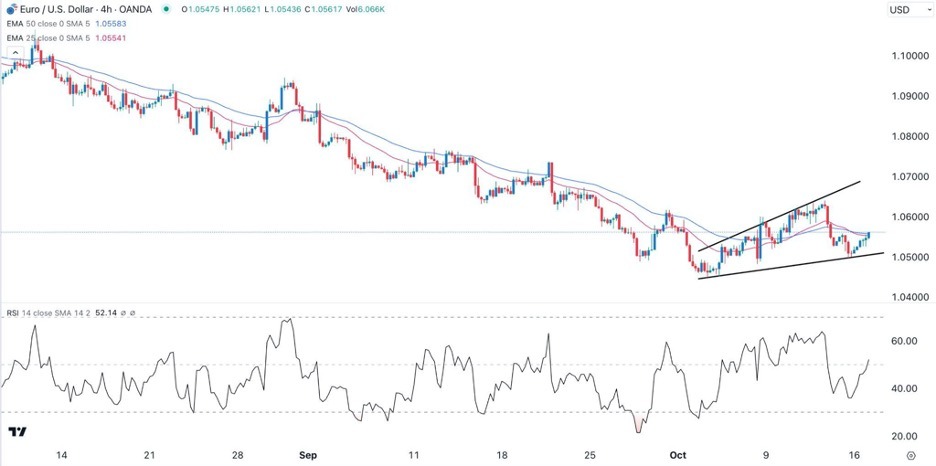

The EUR/USD exchange rate pulled back during the overnight session. On the 4H chart, the pair is consolidating at the 25-period moving average while the Relative Strength Index (RSI) has drifted upwards and moved slightly above the neutral point.

Most importantly, the pair has formed a rising broadening wedge pattern. In most cases, this pattern is one of the most popular bearish signs in the market. Therefore, the pair will likely have a bearish breakout as sellers target the psychological level at 1.0500.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.