Top Forex Brokers

The Crude Oil market has continued to exhibit volatile trading patterns as the year comes to a close, with Thursday being no exception.

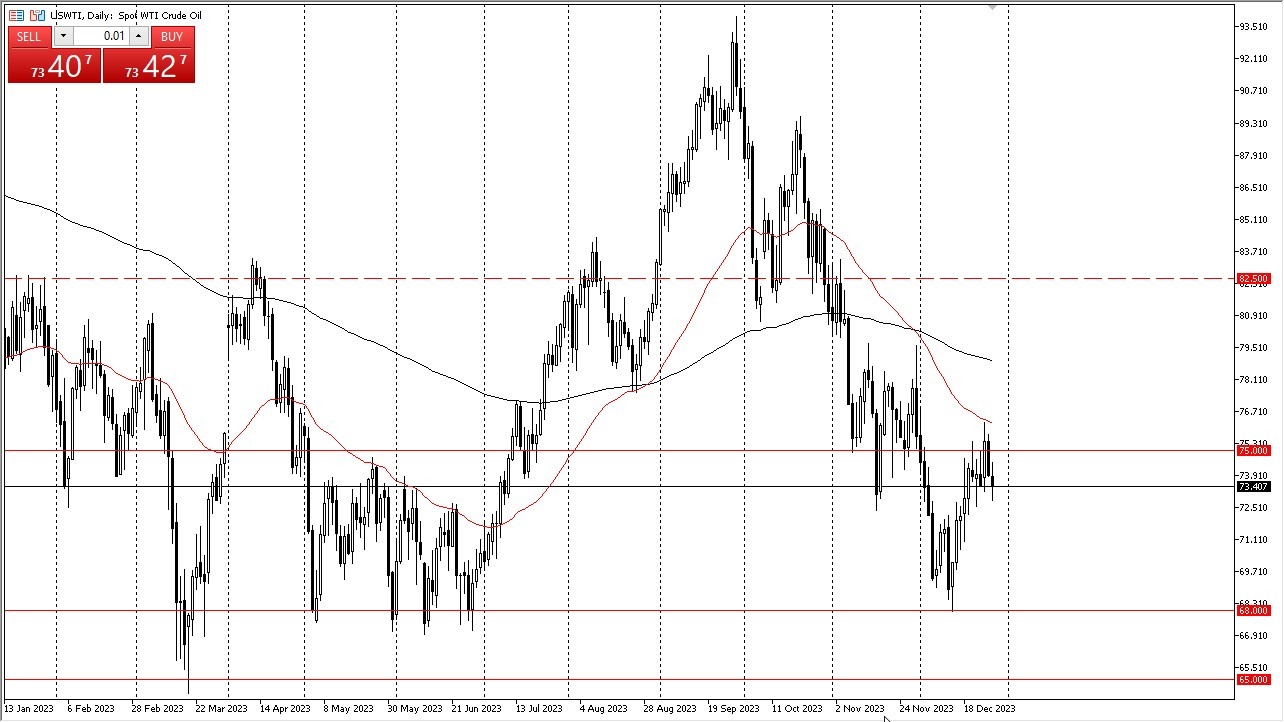

WTI Crude Oil

In the case of West Texas Intermediate (WTI) Crude Oil, an initial rally attempt on Tuesday was followed by a subsequent sell-off. The $75 level appears to serve as a significant resistance point, prompting the need to assess whether the bounce from the $68 level was driven by profit-taking or if it signals the beginning of a more substantial move. The significance of the $68 level as a major support level over several years adds weight to this bounce. In many instances, such rebounds at critical levels can be indicative of a bottoming process, implying continued interest from buyers during declines.

This potential bottoming process suggests a reluctance to initiate short positions in oil at this time. Despite various concerns surrounding oil prices, including the possibility of a global recession, there may be growing interest and buying support around the $72 level.

Brent Crude

In the Brent Crude market, a retreat from the pivotal $80 level has been observed. However, it is essential to note the presence of potential support at the $77 level. Small-scale positions in both types of oil are currently appealing, serving as a means to accumulate positions for the upcoming year. The underlying premise revolves around the expectation that central banks, particularly the Federal Reserve, will begin reducing interest rates, stimulating economic growth, and subsequently boosting oil demand.

Supply dynamics in the oil market warrant attention, although it is worth emphasizing that we are closer to the lower end of the price spectrum than the upper end. As such, a search for signs of support and short-term equilibrium is underway to engage in the market. Also, caution is warranted when determining position sizes during this period due to potential liquidity constraints associated with the holiday season.

At the end of the day, Crude Oil markets continue to experience tumultuous trading as the year draws to a close. WTI Crude Oil grapples with resistance at the $75 level, while Brent Crude has retreated from the $80 level, with potential support at $77. Small positions in both oil grades are currently attractive for long-term positioning. The anticipation of central bank rate cuts and economic growth are among the factors influencing this sentiment. While supply concerns persist, a cautious approach is recommended due to potential liquidity challenges during this time of year.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.