- The EUR/USD exhibited a back-and-forth pattern during Friday's trading session, reflecting the persistently turbulent market conditions.

- This market is currently characterized by significant volatility, and in the coming days, we will be closely monitoring whether the prevailing uptrend can sustain itself.

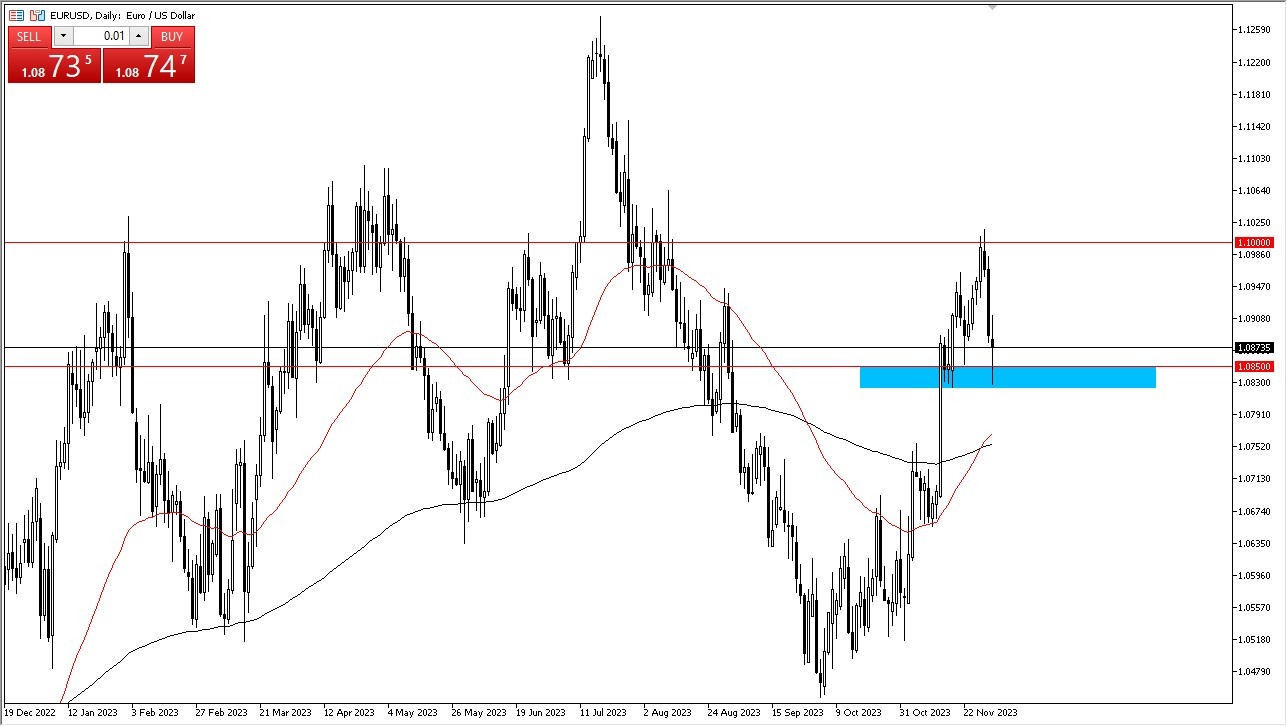

- An essential level to watch for potential bullish momentum is the high point of the Friday session, as a breakthrough there would likely set the stage for an upward move toward the 1.10 level.

Top Forex Brokers

Speaking of the 1.10 level, it has recently served as a formidable resistance barrier, and this is quite logical considering its status as a substantial, round, and psychologically significant price point. A successful breach of this level would undoubtedly signal an overwhelmingly bullish sentiment, potentially propelling the market toward the 1.1250 level. This particular level has historical significance, representing a point where a significant swing high was observed, aligning with my current analysis.

So, What About the Current Range?

However, a decline below the 1.0850 level could introduce the possibility of a substantial downward shift. The course of the euro will be heavily influenced by the United States' interest rate situation, a key determinant that has garnered substantial attention in recent weeks. Notably, the Thursday session was marked by considerable turbulence, but the subsequent stabilization on Friday suggests potential support for the prevailing bullish sentiment that has been prevalent. Consequently, market participants should prepare for continued volatility and assess whether the support just below can be maintained. In the coming days, a clearer market direction should emerge, and exercising patience is advisable.

In the end, the euro's performance remains dynamic, characterized by ongoing market fluctuations. The ability to sustain the existing uptrend hinges on multiple factors, with particular attention paid to the key resistance at the 1.10 level. A successful breach of this level could set the stage for further gains, with the 1.1250 level as the next target. Conversely, a drop below the 1.0850 level could introduce bearish pressures. The trajectory of the euro will be heavily influenced by developments in the United States' interest rates, making it crucial for traders to exercise caution, monitor key levels, and adjust their positions accordingly in this volatile environment. The markets will continue to shake everyone out if you are not careful, so make sure to be ok with this environment as December continues to offer decreasing liquidity.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.