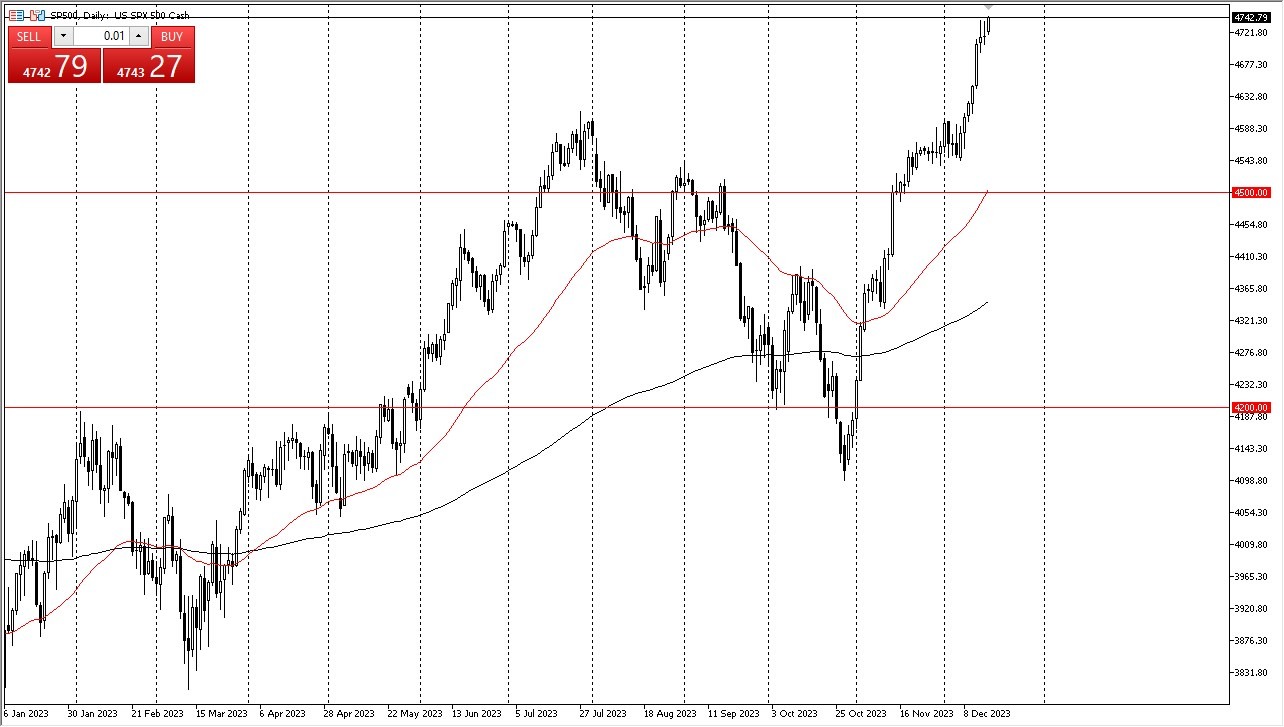

- On Monday, the S&P 500 experienced an early rally, indicating traders' willingness to drive the market higher.

- This trend aligns with the so-called "Santa Claus rally," a term often used to describe the end-of-year market uptick.

- Additionally, the Federal Reserve's recent adjustment to its dot plot, hinting at potential interest rate cuts in 2024, is fueling optimism for short-term stock growth.

However, this raises questions about the sudden shift in monetary policy, especially since just two weeks prior, there was no discussion of such changes. This abrupt change in strategy could signal the onset of more significant and potentially unsettling market shifts. If such a scenario unfolds, it could lead to a significant downturn in the stock market.

Short-term Performance Chasing in New York

In the short term, traders seem intent on pushing the market further up, primarily to improve year-end performance. This is a common occurrence as money managers often aim to report favorable gains or minimize losses to their clients by year's end. Despite the market being overbought, the influx of investors trying to capitalize on this trend means further bullish momentum is not surprising. In this environment, selling might not be a viable strategy, and buying seems to be the preferred approach. The real dilemma for investors is deciding whether to join the ongoing rally or wait for potential dips to buy at lower prices. However, it's uncertain if such dips will occur anytime soon.

Eventually, the market is expected to stabilize and retract, providing opportunities for swing traders to capitalize. Short-term day traders might already be engaging in buying activities, anticipating further gains. Nevertheless, there's an increasing possibility of an overextended market, which could lead to a significant correction. Such a correction, while daunting, may present a valuable chance for some investors to purchase stocks at more attractive, lower prices.

Overall, the current state of the S&P 500 reflects a blend of end-year trading strategies, reactions to changing Federal Reserve policies, and the inherent uncertainties of stock market dynamics. While the short-term outlook appears bullish, investors should remain vigilant and prepared for potential market adjustments, keeping in mind both the opportunities and risks these fluctuations present. However, there is a reckoning coming, so be aware that this rally can only go on for so long until profit-taking becomes the norm.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.