- Gold markets have spent most of the month of December being very volatile, but as we close out the year, it has become increasingly obvious that 2024 should be a very strong year for gold markets in general.

- After all, the Federal Reserve looks likely to step away from its monetary policy of tightening and has even started to move some of the “dot plot” dots toward listening to monetary policy for 2024.

- The market of course will try to get ahead of this, and therefore I think gold is going to continue to be a “buy on the dips” situation.

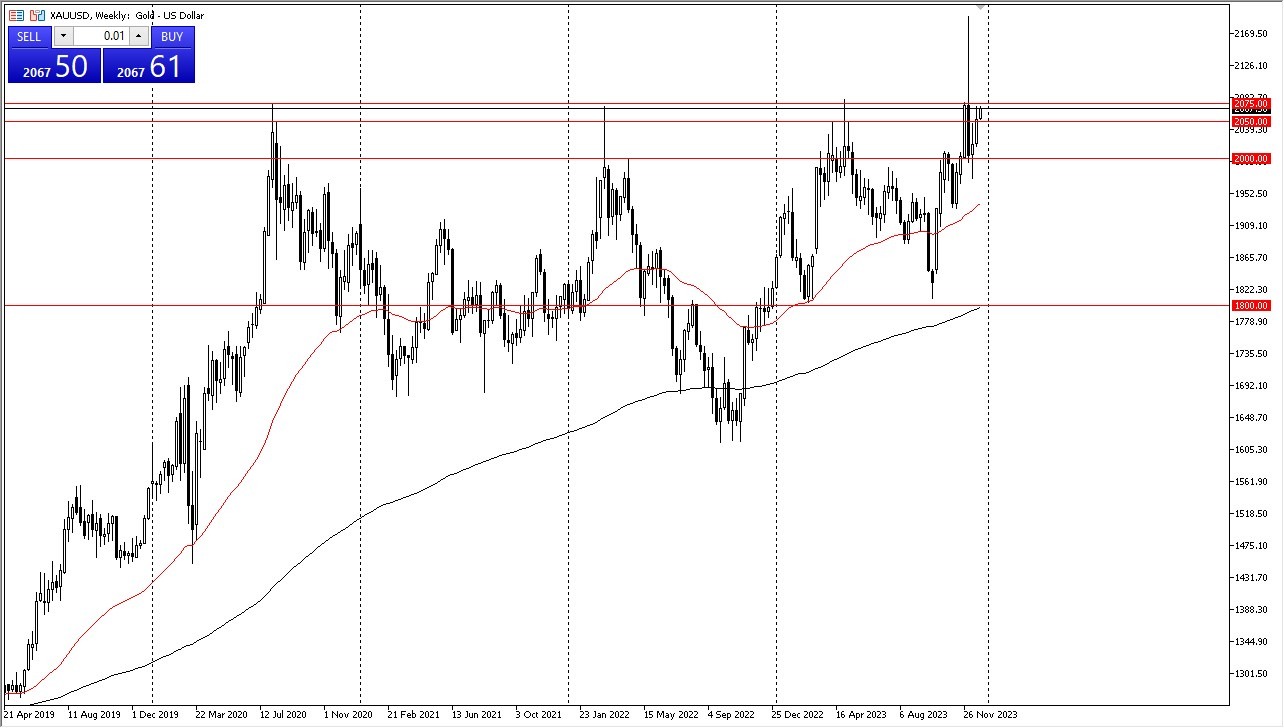

The $2000 barrier at this point is probably the floor in the market, so I’d be very surprised to see any type of breach below that level. If we were to see that happen, it could throw a lot of things into disarray, but right now that seems to be very unlikely. As I look at the chart it seems abundantly clear that we will eventually take out the $2075 level to the upside, allowing for the market to test that crazy wick that formed during December 4. There was a huge pocket of illiquidity above the $2075 level that was exploited, and now it’s probably only a matter of time before we reach the top of the candlestick. Can we do it in January? I don’t necessarily call for that, but I do think that sometime during the year we will test that high.

When Liquidity Returns

It will be especially interesting to see how gold behaves once the liquidity returns, which I assume is probably going to be after the jobs report at the end of the first week of January. There is no official “kickoff time” for the year, but typically it’s after the first jobs report. Unless inflation starts to pick up again in the United States, or barring some type of major geopolitical disaster, (And let’s be honest here, that’s the real danger.) I suspect the gold will continue to see a steadfast trajectory higher. That being said, we do see some type of geopolitical disaster, do not be surprised if gold struggles in US dollar terms, but takes off in other currencies such as the euro or the British pound. Either way, as things stand right now I’m very bullish on gold, and would not be surprised at all to see the market attempt to get to the $2125 level in January.

Ready to trade our Gold monthly forecast? Here’s a list of some of the best XAU/USD brokers to check out.