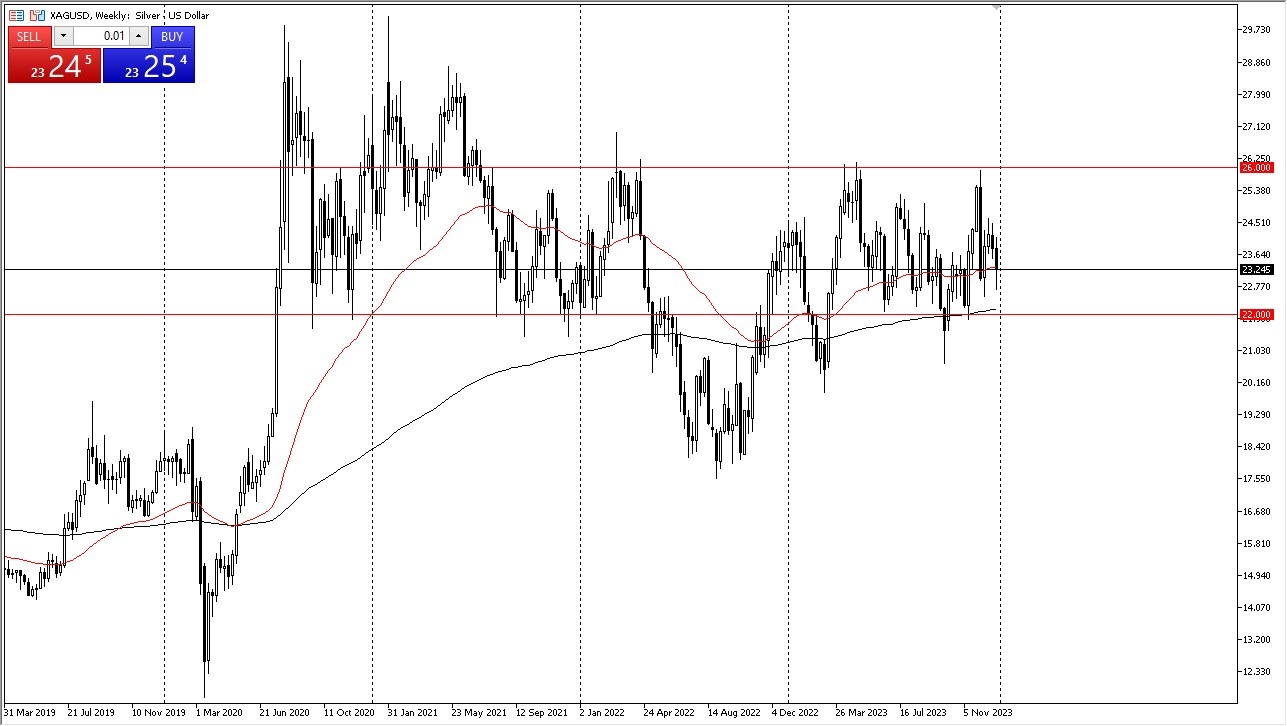

- Silver appears to be making an effort to defend the $23 level, which has held significance in the past, making it a notable area of interest.

- In line with its typical behavior, the silver market exhibits a tendency towards noise and choppiness.

- This volatility is something experienced traders have come to anticipate when dealing with silver, emphasizing the importance of maintaining a reasonable position size to mitigate potential risks.

The release of the jobs report on Friday injected an additional element of volatility into the market, as such reports often do. A break above the 200-day Exponential Moving Average is seen as a potential catalyst for increased buying momentum, potentially propelling silver towards higher levels, possibly around $24.50. The market experienced notable selling pressure over the past few days.

Maybe Thursday told us what we needed to know

The Thursday session offered a degree of stability, and now the focus shifts to whether Friday will follow through with any potential break above the 200-day EMA. Such a move would be indicative of a bullish signal and could pave the way for further gains. However, patience is advisable as we wait to see if this scenario materializes. In the event of a breakdown, the next major support level lies around $22. This level has historically served as significant support, attracting attention from market participants.

The $22 support level has played a prominent role in past market dynamics and remains an area of interest. Market participants appear inclined to take on risk, given expectations of potential rate cuts by the Federal Reserve next year. This sentiment has led many to consider buying assets such as silver, cryptocurrencies, stocks, among others.

Top Forex Brokers

Ultimately, silver is currently navigating a pivotal level at $23, which has historical significance. The market's inherent volatility and noise are characteristic, requiring traders to manage their positions wisely. The release of the jobs report added an extra layer of unpredictability to the situation. A break above the 200-day EMA could trigger increased buying momentum, while a breakdown might see support around $22 come into play. Overall, market participants are eager to capitalize on opportunities amid expectations of a dovish Federal Reserve stance in the coming year. As long as the Federal Reserve is expected to be loose with monetary policy, it’s likely that silver will at least find a certain amount of support .

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.