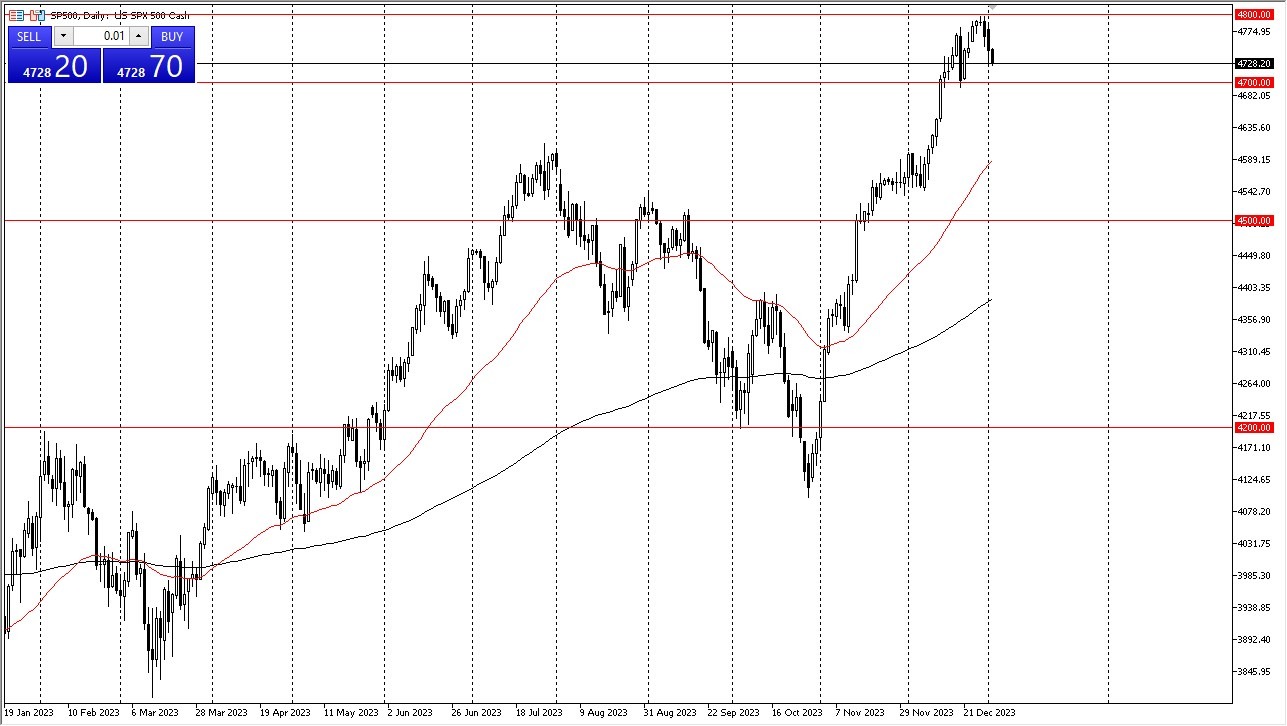

- The S&P 500 experienced a decline during Wednesday's trading session, hinting at a potential pullback towards the 4,700 level. This level had previously served as support just before New Year's, making it interesting to observe whether it can be held once more.

- If it does, it would allow the market to consolidate in the short term, setting the stage for a sideways movement before potentially resuming an upward trajectory.

- In contrast, a failure to hold the 4,700 level could lead to a descent towards the 50-day Exponential Moving Average, which currently resides near the 4,590 level. Further below, at the 4,500 level, an attractive buying opportunity may arise, assuming such a scenario materializes.

It's worth noting that the Federal Reserve has adjusted its dot plot, leading to expectations of multiple rate cuts this year. Lower interest rates often encourage investors to take on more risk, potentially spurring renewed interest in stock purchases. Additionally, the S&P 500 is heavily influenced by a select group of about seven to ten stocks, including well-known names like Tesla, Microsoft, and Nvidia.

Magnificent 7

The performance of these "Magnificent 7" stocks significantly impacts the S&P 500's overall performance. Many companies within the S&P 500 lagged in performance last year, leading to a situation where passive investors are funneling their investments into the same select companies. Consequently, market dynamics are influenced by this passive inflow, particularly through ETF markets.

In this context, dips in the S&P 500 are often viewed as buying opportunities, considering that the index's structure does not predispose it to prolonged declines due to its lack of equal weighting. As a result, the market remains susceptible to noise, driven by the influx of passive investments via ETFs and similar channels.

At the end of the day, the S&P 500 witnessed a decline in Wednesday's trading session, suggesting a potential retracement towards the 4,700 support level. The ability of this level to hold will be closely monitored, with potential consolidation before a potential upward move. Failure to maintain this support could lead to a descent towards the 50-day EMA at around 4,590, with the 4,500 level presenting an appealing buying opportunity if such a scenario unfolds. Anticipation of multiple rate cuts by the Federal Reserve has influenced investor sentiment, encouraging risk-taking. The S&P 500's performance is disproportionately affected by a select group of stocks, leading to passive investments concentrating in these companies and impacting market dynamics. Consequently, market fluctuations driven by passive inflows, notably through ETFs, continue to play a pivotal role.

Potential signal: If we test the 4600 level and bounce…. I am buying. I will have a stop loss at the 4525 level, with a target of 4700.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.