- The USD/JPY has demonstrated resilience, experiencing a rally in the early hours of Wednesday.

- It is currently approaching the ¥145 level, with the 50-day Exponential Moving Average slightly above.

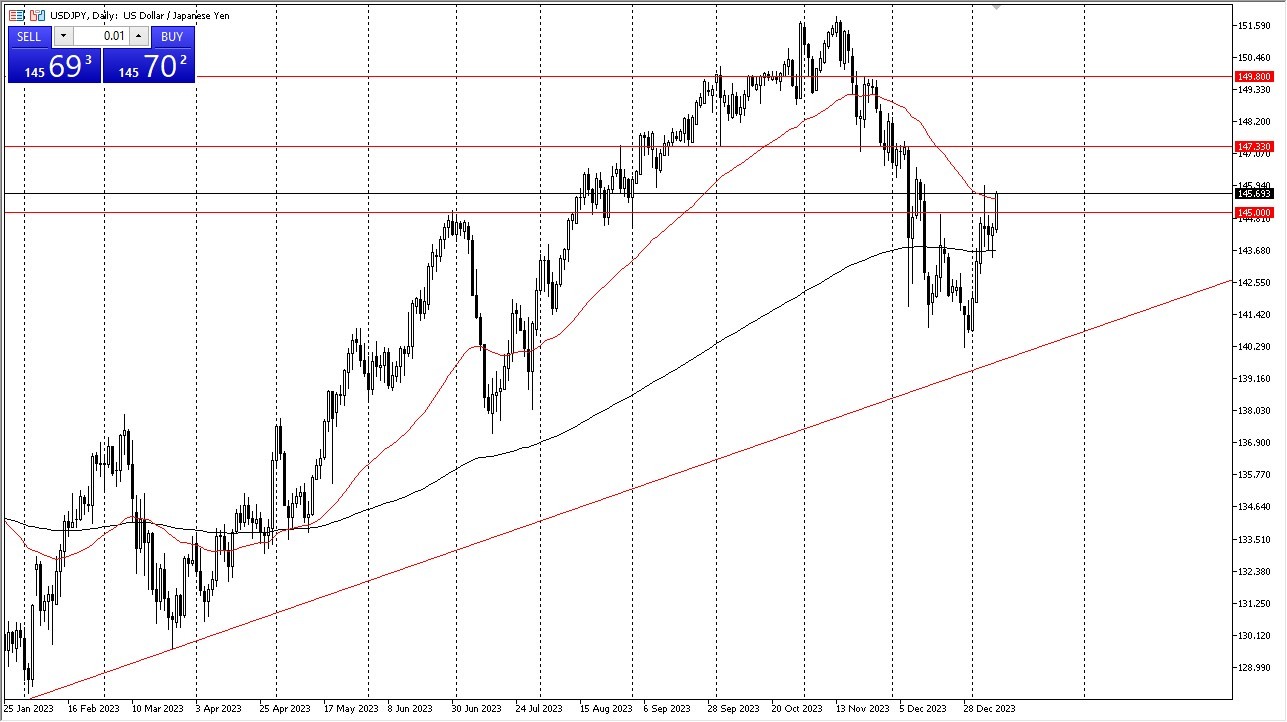

Turning our attention to the USD/JPY pair, it becomes evident that the US dollar has made substantial gains against the Japanese yen during the early hours of Wednesday, breaching the 145 yen threshold. However, it is crucial to acknowledge the presence of the 50-day EMA just above, acting as a potential resistance point. Vigilance is required in monitoring this level. A break above the 50-day EMA would also entail surpassing the shooting star observed during the previous Friday's session, signifying a bullish development.

Currently, the market operates within a range limited by the 50-day EMA and the 200-day EMA. Such a range typically engenders sideways and choppy price action. The upcoming release of the consumer price index (CPI) numbers on Thursday and the producer price index (PPI) numbers on Friday in the United States are poised to influence bond market yields. Consequently, these releases will impact the direction of the US dollar, contingent on the performance of yields. This ripple effect will extend to the USD/JPY market.

Bank of Japan

The Bank of Japan has remained relatively inactive in terms of raising or normalizing rates, despite sporadic hints in the past year. This inaction reflects the current state of the institution.

In general, the prevailing sentiment seems to favor a "buy on the dip" approach. However, a breakdown below the hammer formation observed during Tuesday's session could prompt a downward move, potentially leading the US dollar towards the 142 yen level. A more significant breach below the 140 yen level would have dire implications for the dollar against the yen. As things stand, trade appears to offer opportunities for profit accumulation, suggesting a gradual approach to building positions as opposed to immediate full-scale commitments.

In the end, the US dollar exhibited strength, rallying in the early hours on Wednesday as it nears the ¥145 level. The USD/JPY pair faces potential resistance at the 50-day EMA, with implications for the broader market. Upcoming CPI and PPI releases in the United States will influence bond market yields, subsequently impacting the US dollar's performance in the USD/JPY pair. The Bank of Japan's reticence on rate normalization remains notable. The prevailing market sentiment encourages a measured approach, and vigilance is essential to navigate potential price fluctuations.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.